Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Memberships

Scale Systems

197 members • $899/month

Legacy Wealth Accelerator

17 members • Free

Founder OS+

231 members • Free

21 contributions to Legacy Wealth Accelerator

What’s one tax strategy that’s actually helped you keep more of your gains?

I used to think paying huge capital gains taxes was just part of being a high earner. Then I learned about tax-loss harvesting,and it changed everything. By strategically selling underperforming assets, I offset my gains and cut my effective tax rate by tens of thousands. Now I reinvest those savings into real estate that produces income and appreciation. It’s wild how many execs don’t know this exists. Curious if anyone here uses tax-loss harvesting regularly? What’s been your experience with it?

Is now the time to sell single family and scale into multifamily?

I’m seeing a pattern with tech leaders: tons of home equity, weak cash flow, and a desire for stability. Appreciation looks like it’s slowing, yet renter demand is strong and multifamily cash flow is steady. Syndications lower the barrier and pro teams handle the heavy lifting. Has anyone here sold appreciated single family homes and moved the equity into multifamily? what shifted for you, returns, time, or stress?

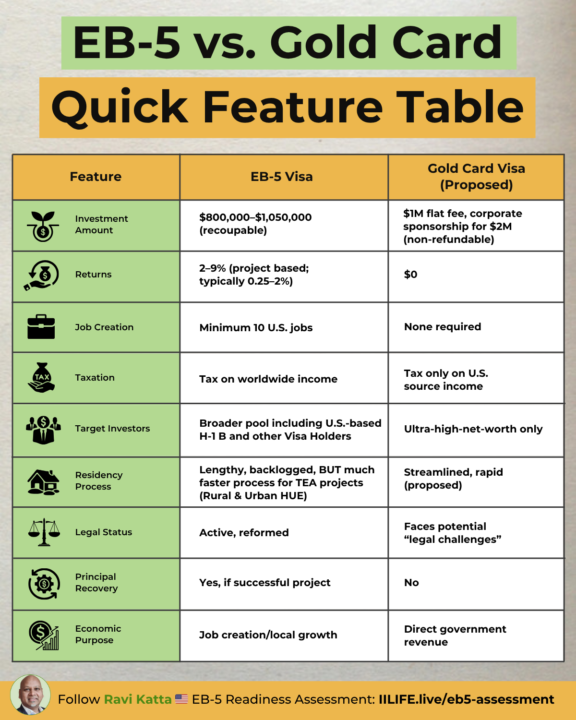

EB-5 vs. Trump’s Gold Card Quick Feature Table

Two residency paths. Two very different outcomes. One builds U.S. jobs and potential returns. The other buys speed and simplicity. Here’s a quick breakdown of how the EB-5 Investor Visa compares to Trump’s proposed Gold Card Visa, including returns, taxation, and who each program truly serves. Check out the cheat sheet to see the side-by-side comparison and discover which path aligns with your wealth strategy. Interested in EB-5? Take our Readiness Assessment in the Resources tab.

❤️🔥 The Ultimate Tax Playbook

If you’re earning big but still losing 30–40% of it to taxes… this is your wake-up call. The IILIFE Ultimate Tax Playbook breaks down how top tech professionals and entrepreneurs are legally saving $75K–$300K+ a year, and turning those savings into real estate-backed wealth. Inside, you’ll learn: ✅ How to use depreciation, 1031 exchanges, and REP status to slash taxable income ✅ How to leverage Opportunity Zones & self-directed accounts to eliminate capital gains ✅ How 100% bonus depreciation & the OBBBA can change your 2025 tax plan forever If you’re ready to keep more, invest smarter, and design your wealth strategy for 2025–2026, grab your FREE copy here 👇 IILIFE.live/tax-playbook

what hedge fund strategies can real estate investors actually learn from?

I used to think hedge funds were just billion-dollar bets on Wall Street. Turns out, their core strategies are actually lessons in discipline, timing, and risk management. I started studying how funds use long/short equity, macro timing, and even event-driven investing. The parallels in real estate are crazy. Holding cash-flowing rentals while cutting losers, watching rates like a hawk, spotting value gaps , these principles aren’t just theory. They’re playbooks for building long-term wealth. Curious , do you think real estate investors should study hedge fund strategies more closely, or are they overhyped?

1-10 of 21

@beth-smith-9931

I am a creative director, copywriter, strategist, and voice actor--I've helped 100+ brands drive business results through marketing and advertising.

Active 16d ago

Joined Aug 26, 2024

Powered by