Write something

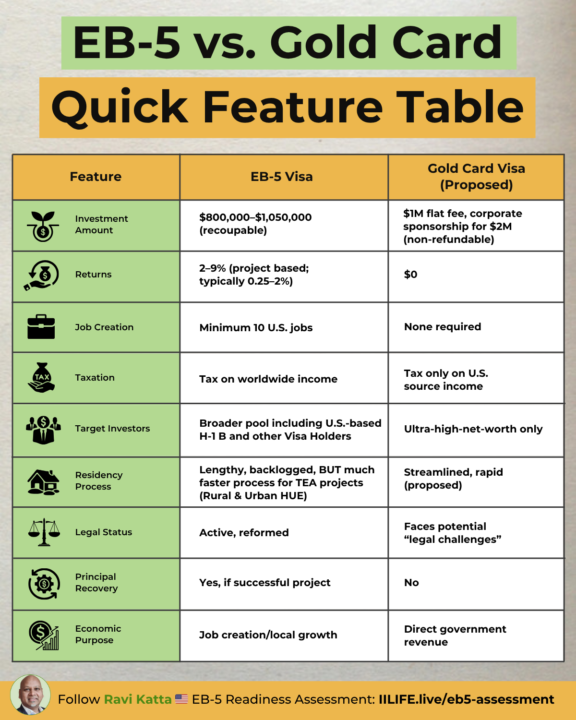

EB-5 vs. Trump’s Gold Card Quick Feature Table

Two residency paths. Two very different outcomes. One builds U.S. jobs and potential returns. The other buys speed and simplicity. Here’s a quick breakdown of how the EB-5 Investor Visa compares to Trump’s proposed Gold Card Visa, including returns, taxation, and who each program truly serves. Check out the cheat sheet to see the side-by-side comparison and discover which path aligns with your wealth strategy. Interested in EB-5? Take our Readiness Assessment in the Resources tab.

❤️🔥 The Ultimate Tax Playbook

If you’re earning big but still losing 30–40% of it to taxes… this is your wake-up call. The IILIFE Ultimate Tax Playbook breaks down how top tech professionals and entrepreneurs are legally saving $75K–$300K+ a year, and turning those savings into real estate-backed wealth. Inside, you’ll learn: ✅ How to use depreciation, 1031 exchanges, and REP status to slash taxable income ✅ How to leverage Opportunity Zones & self-directed accounts to eliminate capital gains ✅ How 100% bonus depreciation & the OBBBA can change your 2025 tax plan forever If you’re ready to keep more, invest smarter, and design your wealth strategy for 2025–2026, grab your FREE copy here 👇 IILIFE.live/tax-playbook

EB-5 Readiness Assessment

🇺🇸 Thinking about the EB-5 Visa? Don’t risk wasting time or money chasing the wrong path. Most EB-5 investors lose months navigating hidden fees, ineligible projects, or missed requirements. Our free EB-5 Readiness Assessment shows you exactly where you stand, before you apply. ✅ Instant self-check on USCIS thresholds & project criteria ✅ Tailored action plan based on your profile ✅ Zero risk, no commitment It takes less than 10 minutes and gives you the clarity you need to fast track your U.S. Green Card. 👉 Take the EB-5 Readiness Assessment now: https://iilife.live/eb5-assessment

Tax Savings Assessment

🚨 Stop Losing 40%+ of Your Hard-Earned Money to Taxes. If you’re tired of “wasting” $250K+ a year, it’s time to redirect those dollars into a $5M+ real estate portfolio. Take our Tax Savings Assessment: in just a few minutes you’ll see where you may be overpaying and how real-estate-backed strategies could lower your tax burden close to zero. No CPA jargon. Just clear, results-driven insights. 👉 Take the Tax Savings Assessment Now: https://iilife.live/tax-savingshttps://iilife.live/tax-savings

3

0

1-4 of 4

skool.com/iilife

Helping tech pros & entrepreneurs build Legacy Wealth through real estate & alternative investments, keeping 40% more by minimizing taxes.

Powered by