Activity

Mon

Wed

Fri

Sun

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

What is this?

Less

More

Owned by Alaysha

This Skool helps people with bad credit regain control first — then earn access to funding.

DFY Funding for Entrepreneurs to Accelerate their credit scores to 700+, Structure their LLC for maximum funding, & secure $50K+ in Business Credit!

Memberships

Skoolers

189.6k members • Free

$100K Funding Challenge (FREE)

10.5k members • Free

Legacy Builders Free🏅

7k members • Free

40 contributions to Slab City Funding DFY

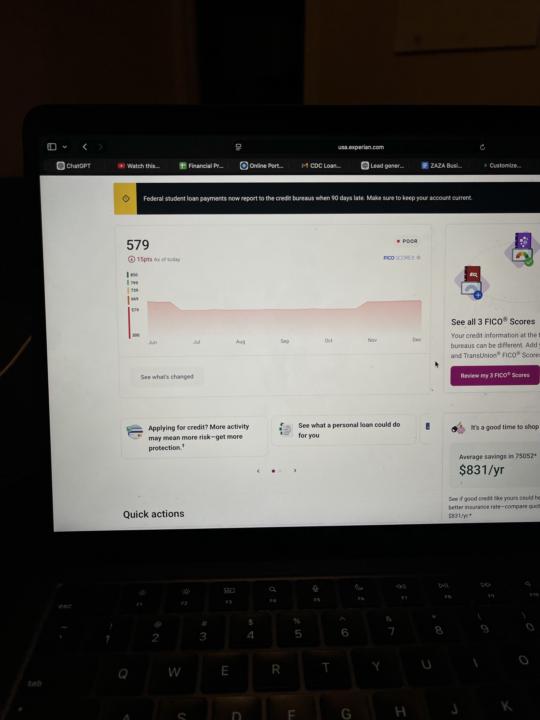

🏆Another REPAIRED win”🏆

🚘 From stalled to street-ready 🚘 Congratulations to @Gerald Ukonu One of our members pulled into the Skool garage and within 6 days: 🔧 Collections wiped 🔧 Inquiries removed 🔧 Eviction deleted Now we’re: ⚙️ Registering the business ⚙️ Clearing student loans ⚙️ Lining up funding If your credit or business setup needs a full tune-up, this is where it happens. Join our Skool community and within 72 hours we’ll optimize your personal & business profile so you’re positioned for approvals — not denials. 🏁 DM me “GARAGE” to get started

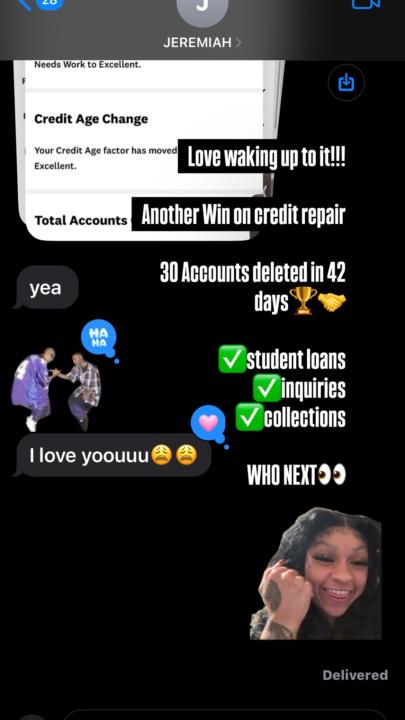

Another MASSIVE client win this week 🚀

Student loans? Deleted. Inquiries? Gone. Collections? Wiped. 30 accounts cleaned in just 42 days. And this is EXACTLY what happens when you’re inside my Skool community. If you’re ready to… 🧼 Repair your credit 📈 Run up your personal + business profile 💰 Get fully funded within 30 days

0

0

🏆7 Day Credit Repaired🏆

Congratulations @Gabriel Harrison Credit repair results in 7days and still going ✅collections removed ✅charge offs removed ✅late payments removed Contact @Alaysha Shepard to start your credit repair process if you haven’t already 🤠🤝

1

0

What Is an APY Savings Account?

An APY (Annual Percentage Yield) savings account is a type of bank account that earns interest on your deposits over time. - APY accounts compound interest, meaning your money grows faster than a regular savings account. - The higher the APY, the more your savings earn automatically.

1

0

What Is a Tradeline? (Personal Credit Side)

A tradeline is any credit account that shows up on your personal credit report.This includes things like: - Credit cards - Auto loans - Student loans - Personal loans - Mortgages - Authorized user accounts Each tradeline reports your payment history, credit limit, balance, age, and status, which lenders use to judge how you handle credit.

0

0

1-10 of 40

@alaysha-shepard-9840

SLAB CITY

Automotive Funding Company

Partnering & Coaching Car Enthusiasts Sponsorship & Event Hosting to build their Car & Community FULL THROTTLE

Active 1d ago

Joined Aug 23, 2025