Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Owned by Hassan

Offer-Engineering for elite careers (Corporate Law • IB • PE). Gate-by-gate templates + weekly live drills. Evidence on file for all outcomes.

Learn the frameworks that win offers: PEAL-X™ • PEAL-3™ • STAR-3® (Law) and IB fundamentals (e.g., DCF). Lessons, drills, and replays.

Memberships

393 contributions to Elite Careers Strategy Gateway

An Oxford Degree Won't Guarantee You a Training Contract

It’s a hard truth, but one that too many students learn the hard way. I’ve worked with Oxford PPE graduates, all with strong academic backgrounds and solid legal experience, who still faced rejection from Magic Circle and top US firms. Despite the prestigious name, they struggled to make the cut. 𝐇𝐞𝐫𝐞’𝐬 𝐰𝐡𝐲 Top firms aren’t looking for a famous university name or a flawless academic record. They want commercially fluent, evidence-driven applications that clearly prove your value. A generic "hard-working" claim won’t cut it. They want line-by-line proof — that’s where frameworks like PEAL-3™ and STAR-3™ come in. These frameworks ensure you show exactly how your experience aligns with their needs, whether it’s handling complex client issues or leading cross-border deals. In fact, the acceptance rates at elite firms are brutal — only about 2% at Magic Circle firms and under 1% at top US firms. Prestige might help get your foot in the door, but precision is what gets you through. The firms want candidates who have not just worked hard but can demonstrate their impact in a way that directly aligns with the firm’s goals. 𝐒𝐭𝐫𝐚𝐭𝐞𝐠𝐢𝐜 𝐓𝐚𝐤𝐞𝐚𝐰𝐚𝐲 If you're relying on the prestige of your degree alone, you're missing the mark. It’s time to shift focus and prove your value with structured, firm-specific answers. Which career myth do you think misleads the most students?

1

0

Why “Prestige” Isn’t Enough: What Elite Firms Actually Want

In my years as a recruiter guiding candidates through corporate law recruitment, I’ve seen many assume that a prestigious degree or the right connections will guarantee an offer. But the truth is far more strategic. 𝐇𝐞𝐫𝐞’𝐬 𝐰𝐡𝐚𝐭 𝐭𝐨𝐩 𝐟𝐢𝐫𝐦𝐬 𝐚𝐫𝐞 𝐚𝐜𝐭𝐮𝐚𝐥𝐥𝐲 𝐥𝐨𝐨𝐤𝐢𝐧𝐠 𝐟𝐨𝐫: 1⃣ 𝐈𝐧𝐭𝐞𝐥𝐥𝐞𝐜𝐭𝐮𝐚𝐥 𝐀𝐠𝐢𝐥𝐢𝐭𝐲 𝐚𝐧𝐝 𝐂𝐫𝐞𝐚𝐭𝐢𝐯𝐢𝐭𝐲 Elite firms want candidates who can think critically and solve problems under pressure. It’s not just about what you know, but how you apply that knowledge. 2⃣ 𝐂𝐨𝐦𝐦𝐞𝐫𝐜𝐢𝐚𝐥 𝐀𝐜𝐮𝐦𝐞𝐧 Firms like Clifford Chance, White & Case, and Sidley Austin value candidates who demonstrate a strong understanding of how business works. Your application must connect your skills to their mandates, deals, and clients. 3⃣ 𝐂𝐮𝐥𝐭𝐮𝐫𝐚𝐥 𝐅𝐢𝐭 𝐚𝐧𝐝 𝐓𝐞𝐚𝐦𝐰𝐨𝐫𝐤 While academic excellence is important, firms like Ropes & Gray and Ashurst emphasize the ability to work collaboratively and maintain resilience under stress. 4⃣ 𝐀 𝐏𝐞𝐫𝐬𝐨𝐧𝐚𝐥 𝐓𝐨𝐮𝐜𝐡 𝐢𝐧 𝐘𝐨𝐮𝐫 𝐀𝐩𝐩𝐥𝐢𝐜𝐚𝐭𝐢𝐨𝐧 A generic cover letter? A red flag. Tailor every sentence to reflect why the firm specifically excites you. To land that coveted training contract, start by thinking like a future associate — focus on the strategy, the execution, and the specific value you bring to the firm. 𝐒𝐭𝐫𝐚𝐭𝐞𝐠𝐢𝐜 𝐓𝐚𝐤𝐞𝐚𝐰𝐚𝐲 Treat your application as a transaction — it’s not about getting in, it’s about proving why you belong there. What do you think is the most overlooked factor in securing a role at top firms?

0

0

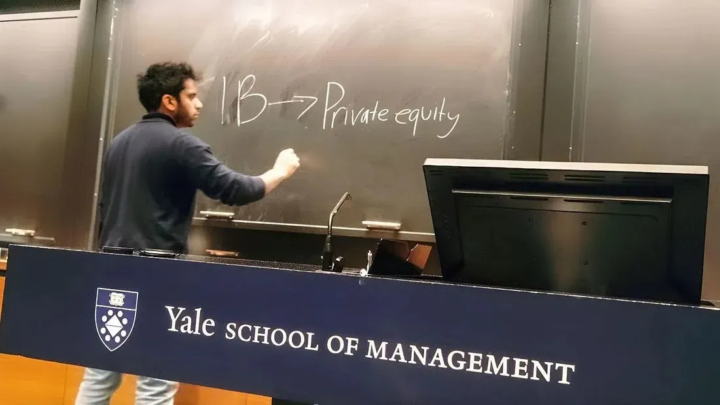

𝐏𝐫𝐨𝐝𝐮𝐜𝐭 𝐯𝐬. 𝐂𝐨𝐯𝐞𝐫𝐚𝐠𝐞 𝐆𝐫𝐨𝐮𝐩𝐬 𝐢𝐧 𝐈𝐧𝐯𝐞𝐬𝐭𝐦𝐞𝐧𝐭 𝐁𝐚𝐧𝐤𝐢𝐧𝐠: 𝐖𝐡𝐢𝐜𝐡 𝐢𝐬 𝐁𝐞𝐭𝐭𝐞𝐫 𝐟𝐨𝐫 𝐘𝐨𝐮𝐫 𝐂𝐚𝐫𝐞𝐞𝐫?

Choosing between product groups (M&A, ECM, DCM) and coverage groups (industry-focused teams) as a junior banker at Goldman Sachs or JPMorgan profoundly shapes your career. 𝐏𝐫𝐨𝐝𝐮𝐜𝐭 𝐆𝐫𝐨𝐮𝐩𝐬 (𝐃𝐞𝐚𝐥 𝐄𝐱𝐩𝐞𝐫𝐭𝐬) Specialise deeply in one deal type (e.g., mergers or IPOs), across multiple industries. • Pros: Technical excellence, intense financial modelling, deal structuring mastery. Ideal for roles at buy-side firms (private equity, hedge funds) demanding rigorous analytics. • Typical Day: Execute detailed financial models, valuation analyses, and deal negotiations. You become a technical expert (e.g., complex LBO modelling in LevFin). • Exit Opportunities: Highly favoured by mega-funds like KKR or Blackstone due to heavy transaction and modelling experience. 𝐂𝐨𝐯𝐞𝐫𝐚𝐠𝐞 𝐆𝐫𝐨𝐮𝐩𝐬 (𝐈𝐧𝐝𝐮𝐬𝐭𝐫𝐲 𝐄𝐱𝐩𝐞𝐫𝐭𝐬) Focus deeply on one industry (e.g., TMT, Healthcare), across multiple deal types. • Pros: Deep sector expertise, earlier client interaction, broader strategic understanding. Excellent for sector-focused investing or corporate roles. • Typical Day: Industry research, operating models, client relationship management. You'll cover equity raises, debt financings, and M&A—all for one industry. • Exit Opportunities: Ideal for roles valuing industry expertise, such as sector-specific hedge funds, VC, or corporate strategy. 𝐊𝐞𝐲 𝐃𝐢𝐟𝐟𝐞𝐫𝐞𝐧𝐜𝐞𝐬 𝐭𝐨 𝐂𝐨𝐧𝐬𝐢𝐝𝐞𝐫: 1️⃣ Technical Skill Development: • Product: Intensive, specialised financial modelling (e.g., M&A valuations, LBO structures). • Coverage: Broader industry and strategic business insight, holistic financial analyses. 2️⃣ Client Interaction & Network Building: • Product: Intermittent, deal-specific interactions, technical specialist role. • Coverage: Frequent, ongoing client relationships, strong early network development. 3️⃣ Exit Opportunities: • Product: Clear path to PE (especially from M&A, LevFin). ECM/DCM is more challenging for PE but suitable for credit roles or hedge funds. • Coverage: Excellent for sector-focused funds (VC, growth equity, hedge funds), corporate roles, or industry-specific strategy positions.

0

0

𝐈𝐧𝐬𝐢𝐝𝐞 𝐚 𝐁𝐢𝐥𝐥𝐢𝐨𝐧-𝐏𝐨𝐮𝐧𝐝 𝐃𝐞𝐚𝐥: 𝐓𝐡𝐞 𝐂𝐨𝐫𝐩𝐨𝐫𝐚𝐭𝐞 𝐋𝐚𝐰𝐲𝐞𝐫’𝐬 𝐑𝐨𝐥𝐞 𝐚𝐭 𝐄𝐯𝐞𝐫𝐲 𝐒𝐭𝐚𝐠𝐞

Most people assume deals happen when signatures hit paper. In reality, by the time ink meets contract, the real work has been done — and by corporate lawyers at every stage. 𝐇𝐞𝐫𝐞’𝐬 𝐰𝐡𝐚𝐭 𝐭𝐫𝐮𝐥𝐲 𝐡𝐚𝐩𝐩𝐞𝐧𝐬 𝐛𝐞𝐡𝐢𝐧𝐝 𝐭𝐡𝐞 𝐬𝐜𝐞𝐧𝐞𝐬: 1. 𝐏𝐫𝐞-𝐝𝐞𝐚𝐥 𝐬𝐭𝐫𝐚𝐭𝐞𝐠𝐲 Before a single clause is drafted, lawyers assess viability: Which structure maximises value? Which jurisdictions apply? Where are potential legal and commercial obstacles? Early guidance shapes the deal itself. 2. 𝐃𝐮𝐞 𝐝𝐢𝐥𝐢𝐠𝐞𝐧𝐜𝐞 This is investigative, forensic work. Contracts, IP, employment terms, regulatory compliance — every element is examined to uncover hidden risks that could erode value or derail the transaction. 3. 𝐍𝐞𝐠𝐨𝐭𝐢𝐚𝐭𝐢𝐨𝐧 Lawyers balance ambition and protection. They translate complex commercial aims into legally enforceable terms, making sure clients get what they need, not just what they ask for. 4. 𝐃𝐫𝐚𝐟𝐭𝐢𝐧𝐠 𝐚𝐧𝐝 𝐫𝐞𝐯𝐢𝐬𝐢𝐧𝐠 Drafting isn’t clerical. It’s about structuring deals, defining timelines, allocating responsibilities, and embedding protections for risk. Precision here prevents multi-million-pound disputes. 5. 𝐑𝐞𝐠𝐮𝐥𝐚𝐭𝐨𝐫𝐲 𝐜𝐥𝐞𝐚𝐫𝐚𝐧𝐜𝐞 Competition law, market regulations, cross-border approvals, data privacy — missing one detail can kill the deal. Lawyers coordinate with authorities and advisers to ensure smooth compliance. 6. Signing & closing All moving parts — people, documents, funds — must align perfectly. Lawyers orchestrate the handover, ensuring risk is mitigated and obligations are clear. In short: the legal work isn’t paperwork. It’s orchestration, foresight, and strategic alignment — turning complex, high-stakes transactions into reality. 𝐒𝐭𝐫𝐚𝐭𝐞𝐠𝐢𝐜 𝐓𝐚𝐤𝐞𝐚𝐰𝐚𝐲 In major deals, corporate lawyers are not mere scribes. They are engineers, navigators, and architects — shaping billion-pound transactions at every turn. Next time you read a deal announcement, ask yourself: Which stages did the lawyers influence — and how did they actually create value behind the scenes?

0

0

2,500+ Members from McKinsey, Oxford, Stanford, and LSE! [Introduce Yourself]

Welcome all! You’re now part of a global community with students from the world’s most elite universities. We're in beta stage, and already have members here from These include the University of Oxford, the London School of Economics, and Stanford Business School 💪 This community has been up for only 4 months and we've passed 1000 members Reply to this post with a brief intro to you Who are you? Where are you studying? What career would you like to pursue? And also what content would you like to see added?? (as we're still in beta at the moment) To re-introduce myself I'm Hassan, an ex-corporate recruiter, I'm here to help you enter elite careers like Investment Banking, Corporate Law, Venture Capital, Private Equity amongst many others. Any questions? Please make a post here and ask! If you'd like to enquire about the 1-1 waiting list please DM me or one of our admins and they'll provide you with the details 😁

![2,500+ Members from McKinsey, Oxford, Stanford, and LSE! [Introduce Yourself]](https://assets.skool.com/f/1ee54dc8e72e49c5ba2306da5924981a/9a6764a3f9cd49728415a23fea297a2686a16292a1a44fcbba161a520e96c725)

1-10 of 393

@hassan-akram-7877

Founder, Elite Careers Strategy – offer-engineering for elite law & front-office finance. Ex-IB/PE & corp-law recruiter; Harvard/MIT/Yale; TOI.

Online now

Joined Mar 7, 2024

London