Activity

Mon

Wed

Fri

Sun

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

What is this?

Less

More

Owned by Hassan

Offer-Engineering for elite careers (Corporate Law • IB • PE). Gate-by-gate templates + weekly live drills. Evidence on file for all outcomes.

Learn the frameworks that win offers: PEAL-X™ • PEAL-3™ • STAR-3® (Law) and IB fundamentals (e.g., DCF). Lessons, drills, and replays.

Memberships

398 contributions to Elite Careers Strategy Gateway

A&O Shearman First Year Programme Interview

Has anyone done the video interview or is able to give any tips on it? I think I will be asked to analyse a commercial case study- any advice?

Isnan, from a non-target, landed 3 Assessment Centres - Hassan has never me thim

See his story here

2

0

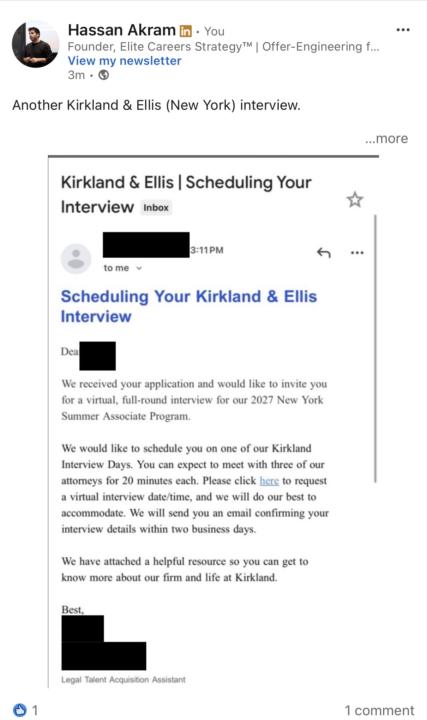

Kirkland & Ellis New York - Student Interview

Another Kirkland & Ellis (New York) interview. This time for the 2027 New York Summer Associate Program. One of my students just received this email. Here's what most candidates don't understand about US law firm applications: Kirkland & Ellis receives thousands of applications for a handful of spots. They're not looking for "good" candidates. They're looking for candidates who demonstrate: ↳ Commercial fluency — not textbook definitions, but real understanding of how Kirkland's private equity clients think about deals, risk, and value creation ↳ Clear data points — your CV must show a pattern of interest in corporate law and finance, not random experiences ↳ Precise answers — "Why Kirkland & Ellis?" cannot be generic. You need to articulate why Kirkland's full-service model for private equity sponsors matters to YOU This student built their application using our proprietary frameworks: → VTMR™ to structure their CV (Value, Transferability, Metrics, Relevance) → PEAL-X™ to answer "Why Kirkland & Ellis?" with specificity → Commercial Fluency™ to speak confidently about Kirkland's deals and clients The result? A virtual interview invite to meet with three Kirkland & Ellis attorneys. If you're applying to US law firms in London or New York — Kirkland & Ellis, White & Case, Sidley Austin, Ropes & Gray — your application must be engineered to stand out. We call this Offer-Engineering for Elite Careers™. — I'm Hassan Akram, founder of Elite Careers Strategy. I help candidates land training contracts, vacation schemes, and summer associate offers at Magic Circle law firms, US law firms, and top investment banks like Goldman Sachs and Morgan Stanley. DM me "KIRKLAND" if you want to learn how we prepare students for US law firm applications.

1

0

VIDEO EDITING INTERN

I'm looking for someone hungry who wants coaching but can't afford it. I'll coach you for free in exchange for 5 hours/10 hours a week of content admin — uploading videos, writing descriptions, scheduling posts, cutting clips. If that's you, message me.

1-10 of 398

@hassan-akram-7877

Founder, Elite Careers Strategy – offer-engineering for elite law & front-office finance. Ex-IB/PE & corp-law recruiter; Harvard/MIT/Yale; TOI.

Active 5h ago

Joined Mar 7, 2024

London