Write something

Pinned

Welcome to the Community! 🎉

You’ve just taken the first step toward unlocking Money & Time Freedom through property investment – congrats! 🚀 This community is here to help you go from the daily grind of a 9-5 to earning a full-time income through property – all with part-time effort. Whether you’re just getting started or already have a few deals under your belt, you’re in the right place. 💡 Why 2024 is the Best Time to Start in UK Property If you’ve been thinking about jumping into property investment, 2024 is THE year to take action. Here’s why: 1. Property Prices are Cooling – After years of rapid growth, the UK market is stabilising, making it prime time to find deals. The competition is down, but opportunities are still strong – meaning you can grab properties at great prices before the next boom! 2. High Rental Demand – With rising interest rates, more people are renting rather than buying. This creates a massive opportunity for property investors to secure strong, reliable rental income. 3. Government Incentives – There are still favourable tax incentives and government schemes to support first-time buyers and investors. This lowers your entry costs, giving you a leg up on getting started! 4. Wealth Transfer Opportunities – 2024 is the year of property shifts. Baby Boomers are selling, and there’s a wealth transfer happening. You can step in, secure properties, and benefit from long-term growth. This is the perfect time to make moves, and we’ve got your back every step of the way. Dive into the discussions, ask questions, and get ready to learn the exact strategies that built our business to £30k+ recurring monthly revenue! Let’s make 2024/25 your breakthrough year in property! 💥

🎓 A Small Win I Wanted to Share With You All

This Monday was special for me — I finally graduated with my MSc in Real Estate (with commendation). But the photos don’t show the reality behind it. Running HNFC Stays full-time. Studying full-time. And trying to stay sane in a year that honestly tested me more than any before. There were mornings I was on site at 7am dealing with leaks… then in a lecture by 10… replying to guests on the metro home… and writing coursework half-asleep at 1 or 2am. I submitted one assignment from the car between viewings. Read valuation notes at 5am because that was the only quiet hour I had. None of it was pretty — but it made me sharper. And it made me fall even deeper in love with this industry. The best part? Everything I studied went straight into the business: - Valuation → landlord reports - Planning → our development pipeline - Property law → negotiations - Asset management → better systems - Investment → scaling with confidence And somehow, through all that chaos, we still grew: 📈 Sales up nearly 30% 📦 Doubled our managed listings 🏢 Took on bigger, more complex buildings I’m honestly just grateful that now I can share this knowledge with all of you for FREE here in the community —so you don’t have to pay £18,000 in tuition fees to learn the same things. This degree didn’t just give me theory. It made me a better operator, a clearer thinker, and more confident about where we’re going next. 👉 What’s something you took on that felt impossible at first… but proved to yourself you could handle it?

My Quick Thought on REITs — And Why I Wish I Knew About Them Earlier

When I started in property, I thought the only way to “be an investor” was to save for a deposit, get a mortgage, pray the boiler didn’t explode… and basically stress my way into the portfolio. No one ever told me there was a simpler starting point. A way to invest in real estate without buying actual property. That’s where REITs (Real Estate Investment Trusts) come in. I ignored them for years — big mistake. A REIT basically lets you own a small piece of huge property portfolios: hotels, offices, apartments, logistics buildings… all the stuff we talk about here. And the best part? You don’t deal with tenants, cleaners, repairs, voids — none of it. Why I like them now: - They pay steady dividends (passive income without stress) - You can start with £50 instead of £50,000 - You stay liquid — buy in, sell out anytime - And you get exposure to dozens of buildings, not just one If someone explained REITs to me when I was 18, I probably would’ve started my investing journey much earlier — and with a lot less fear. So, if you’re just getting into property or want a low-risk way to learn the market, REITs are honestly a great stepping stone. 👉 Has anyone here tried investing in REITs? Or thinking about it?

1

0

I didn’t choose Rent-to-Rent because it was trendy. I chose it because it was the ONLY thing I could actually afford.

When I first looked at Buy-to-Let, everyone around me made it sound like the “proper” path. Save a big deposit, buy a house, pray the rent covers everything. But when I ran the numbers… reality hit me. A BTL in the North East usually needs £25k–£35k upfront, and the cashflow is around £250–£400/month (approx figures) At that time, I didn’t have £25k spare. I barely had £3k. Literally. My first ever 1-bed deal — fully set up, furnished, supplies, TV, deposit, everything — cost me £3,000 in total (I'm still amazed how I pulled this off) That one deal changed my entire direction. And when I compared it to the cashflow… again, it shocked me: £350–£550/month from a Rent-to-Rent SA that cost a fraction of a BTL deposit. Same cashflow. 7–10x less capital. (I don't enjoy the appreciation though) For someone starting with almost nothing, that was life-changing. I still respect Buy-to-Let. I still buy when the deal makes sense. But the truth is… Rent-to-Rent is what gave me a shot. It’s what allowed me to learn fast, make mistakes cheaply, and build momentum without waiting years to save a deposit. Both strategies work. But for me, R2R wasn’t a “business model.” It was a lifeline. A doorway into property when everything else felt out of reach. 👉 What did you start with — BTL, R2R, or something completely different? P.S. *In this picture, I had to walk for 2 miles like that, and do 2 more trips. All because I couldn't afford to pay for a taxi and wanted my set-up costs to be as low as possible x

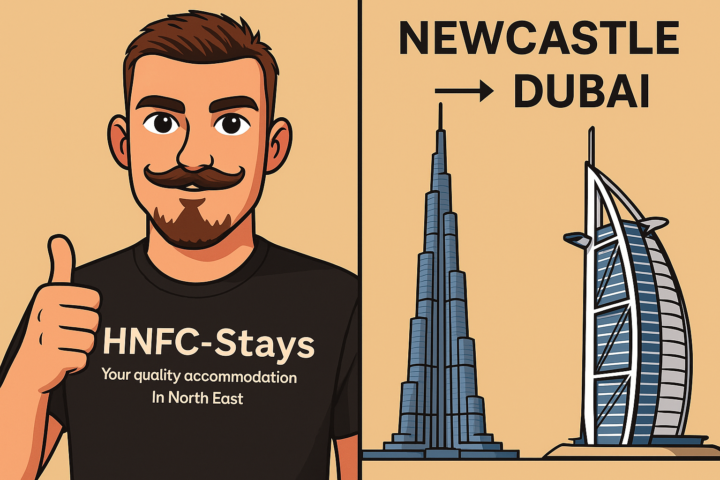

🌍 A Small Update From Me

I wasn’t sure if I should share this… but this community deserves honesty. After 10 years of living, studying, and building my whole life in the UK, my ILR application was rejected. One email — and suddenly everything I built felt uncertain. I won’t pretend it didn’t hit me hard. But life has a strange way of redirecting you. While that door closed, another one opened almost immediately. This year, we started something I never imagined:HNFC Stays Dubai. 🇦🇪 The market there is booming, and somehow it feels like the right next step — even if it came from a tough place. And through all this, we kept growing here too: 🎓 Finished my Master’s with Commendation 💰 On track for £500k+ guest revenue 🏘️ More properties than ever under management Honestly, none of this feels “big”. It just feels like the result of not giving up when things got difficult. I’m sharing this here because I want everyone in this group to remember: Sometimes the things that shake your life the most push you exactly where you need to go. Thanks for being here — it means a lot. 👉 What’s one challenge that pushed you into a better chapter, even if it didn’t feel like it at first?

1

0

1-30 of 33

skool.com/vv-properties-uk

Hi, I'm Vee Venski and I want to show you how to build wealth via property.

Holiday lets, buy to lets, BRRR and many more.

Powered by