Pinned

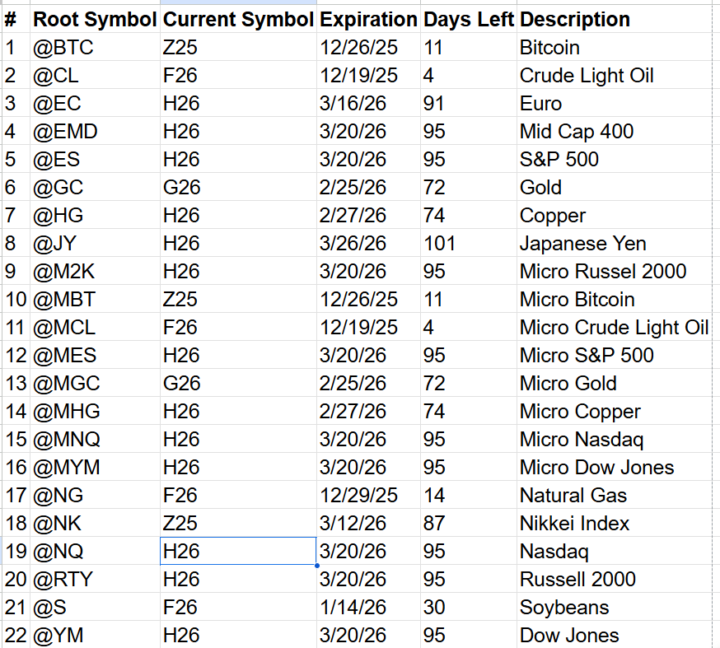

12/15/26: Contract Rollover Quad Witching

If you're running your own VPS, be sure to roll all charts ASAP Cheat Sheet: https://docs.google.com/spreadsheets/d/1AGPB2fiu1PbFHUOivOeQRi7yHNUC7IJmzBT8CrDDf5Y/template/preview

3

0

Pinned

A Case Study of 3 Successful Traders From 5-Minute Futures

🥇Best PNL YTD: FireKing 🥈 Best PNL/DD YTD: M-ray 🥉 Best PNL Last 3 Mo: SlyFox Congratulations to @Adam King @M-Ray Basar @Steve Reich! Please share in the comments any tips or tricks that helped you achieve the top results so far this year!

Pinned

Algo Trading Vs Manual Trading

I was having a long conversation yesterday about my trading journey, and it really made me reflect on how I got here. I started out spending tens of thousands of dollars on different programs and courses. One program alone cost $10k. I funded a $20k account alongside it, and that account was effectively gone within three months. After that, I moved into futures. The courses were cheaper, but I was still funding similarly sized cash accounts and blowing them shortly after. Then came prop firms, which honestly felt like a casino—buying accounts, blowing most of them, passing a few, and then eventually blowing those too. I’m curious if others here have had similar experiences, or if you’re willing to share your own journey. Since finding Kevin, I’ve taken almost no manual trades over the past 12+ months. For those of you who are live with Kevin—are you still trading manually at all, or are you letting the system do the work?

Poll

2 members have voted

12/13/25 8+ hour backtesting session

Usually I'd use BA, but this particular strategy required a non-standard profit target (RR multiple of Low at entry price). Will share conclusions in a shorter loom video later. No talking, just screenshare of me backtesting EMA + hammer candelstick pattern.

Nasdaq is moving to 23hr a day, 5 day a week trading

This is excellent news for futures algotraders! Low liquidity outside of NY session on NQ has made a lot of algorithms unable to scale past a few million bucks in capital. Now, our algorithms will be even more powerful because slippage on overnight edge will go down. "Nasdaq is moving to 23hr a day, 5 day a week trading & will file with the SEC on Monday to get it approved The plan is for a day session from 4am to 8pm ET & a night session from 9pm to 4am, with the trading week running Sunday 9pm to Friday 8pm and a launch targeted for 2H'26" Source: Reuters

1-30 of 486

skool.com/futures

A simple path to automated futures trading. Try 45+ algos for 30 days.

Powered by