Recap of My Trade Idea from Yesterday’s LIT Market Talk

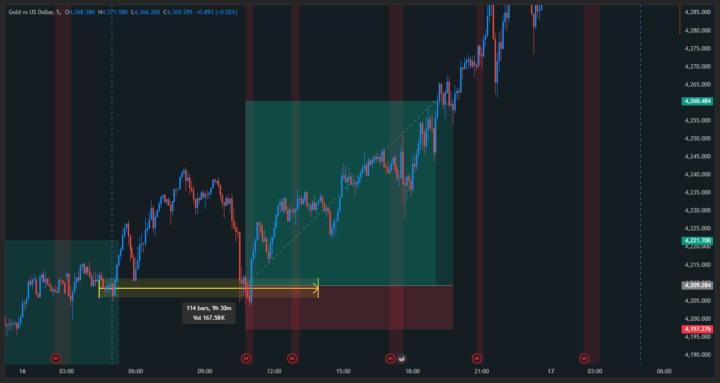

Hi everyone! Here is a short explanation of my trade proposal from yesterday’s LIT Daytrading Market Talk. Yesterday, Robert had to leave early because he had a webinar in Bookmap’s Learning Center. He asked me spontaneously if I could share my screen. I actually don’t have a microphone set up on my trading desk, and normally I don’t trade on Mondays. Additionally, yesterday’s trading day was quite difficult because we had a holiday last week, and on Friday the CME data feed collapsed. Under these circumstances, you have to be more careful than usual. In general, on Mondays the market also needs to find its direction. Anyway … Here is a short breakdown of my technical analysis for those who may have watched my screen and followed my drawings, with some additional context: - The overall context was clear: be careful and wait to see what happens during the market opening at 3:30 PM (CET).The market opened below Friday’s lows, which is a sign of strong bearish sentiment. - Additionally, I had marked a selling imbalance in the pre-session of the day and a high-volume node in the prior week’s volume profile (30-minute timeframe). - The market opened very bullish. I waited to see how market participants would react after the news release at 4:00 PM (CET). - When the market pushed into the selling imbalance, I switched to a smaller timeframe (3-minute) to see whether aggressive sellers would enter the market again in that price area. After the first white candle (in my chart; normally this would be a red candle) with a rejection wick to the downside, I would have entered the trade with a stop loss above the top of the move. - My first target was the session VWAP, with the idea that the market might retest the pre-session value area and the volume point of control before higher prices would be accepted. Everyone who followed my analysis saw live that the idea finally played out. This is my explanation in advance since I didn’t have a microphone to comment on the trade live 😅

2

0

INTRO

Invest for the long haul. Don't get too greedy and don't get too scared✅

HL & LL Market Structure Strategy.

Hit my another TP yesterday it take 8 hours to hit my TP.

hello traders

its great to trade and make passive results, never back down on an opportunity to trade even when risks are involved

“The only way to do great work is to love what you do.”

(Don’t want to read? Scroll to the bottom to watch my video on this) That is a quote from Steve Jobs. And it is very true. I myself believe of you do not have love or passion for the work you do, really you can only fuel yourself by discipline and the desire to get materialistic stuff, you can go no more than 6/10 of your true work potential. But on the other hand of we couple discipline with work you love and are passionate for, now we are talking, that is more like it now you can work to your true 10/10 capacity and get you were discipline can't. And me and you both know… Whatever you can work hardest on and persevere the longest on, that Is the business you will win at. So working on what you love not only is good for your happiness, life satisfaction and etc, it also makes more success… So now that you know the truth why waste your life grinding on some business you hate, that makes you depressed? The point of your business was true freedom in every realm of your life don’t ever forget that bro…

1-30 of 153

skool.com/traders-mindset

Learn how to make 10K+ per month day trading

Powered by