Pinned

Bookmap Live Trading Today at 9 AM EST / 3 PM CET

Join me for real-time market analysis and trading insights using Bookmap. https://www.youtube.com/watch?v=CErz-m7VgZg New to prop firm trading or want to learn my approach? Join our LIT Academy: https://www.skool.com/lit-academy/about Perfect for sharpening your order flow skills! Ready to Start Your Prop Firm Journey? 📈 Apex: https://apex.robertrother.com (Use code: SAVE90) 📈 Bulenox: https://bulenox.robertrother.com (Use code: DPDY7) Want personalized guidance? Book a free consultation: https://contact.robertrother.com See you live! 💪 https://www.youtube.com/watch?v=CErz-m7VgZg #PropFirmTrading #Bookmap #LiveTrading #TradingEducation

2

0

Pinned

Bookmap Live Stream - 3 PM CET / 9 AM EST

Join me for real-time market analysis and trading insights using Bookmap. https://www.youtube.com/watch?v=kobBJkOjePE New to prop firm trading or want to learn my approach? Join our LIT Academy: https://www.skool.com/lit-academy/about Perfect for sharpening your order flow skills! Ready to Start Your Prop Firm Journey? 📈 Apex: https://apex.robertrother.com (Use code: SAVE90) 📈 Bulenox: https://bulenox.robertrother.com (Use code: DPDY7) Want personalized guidance? Book a free consultation: https://contact.robertrother.com See you live! 💪 https://www.youtube.com/watch?v=XquwlLBCpyw #PropFirmTrading #Bookmap #LiveTrading #TradingEducation

2

0

Pinned

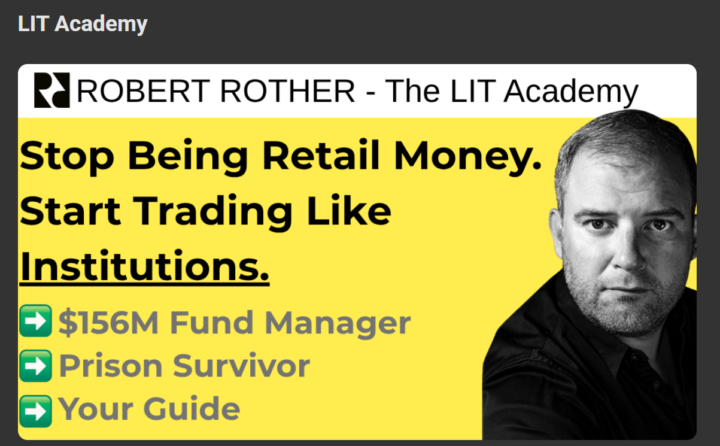

🚀 4 Days. Complete Prop Firm Mastery.

I just uploaded my most comprehensive prop firm course I've ever created. What makes this different? - Recorded over 4 intensive days - Includes actual live trading sessions - Zero fluff, 100% actionable content - My personal strategies that work TODAY Inside LIT Academy, you'll discover: 🎯 How to pass prop firm challenges consistently 🎯 My scaling strategy for growing accounts 🎯 Risk management that keeps you profitable 🎯 Live examples of real trades 🎯 The psychology behind successful prop trading Limited Time: $49 / month (increases to $199 soon) This isn't just another course. It's 4 days of concentrated knowledge that could transform your prop firm journey. Ready to join the LIT Academy? 👇 Get instant access now https://www.skool.com/lit-academy/about

🚀 Real Talk Moment

Success looks great on the outside, but behind the scenes there’s usually a struggle. What’s the one thing holding you back right now? Could be mindset, money, time, discipline, or just not knowing the next move. Share openly below this community grows stronger when we’re honest with each other. 💬

0

0

Community question 💡

What’s the one challenge you keep running into on your journey right now? Be honest. Be real. Be human. This space is built for growth, not perfection. Comment below someone here may have the exact insight you need 👇

1-30 of 472

skool.com/traders-mindset

Learn how to make 10K+ per month day trading

Powered by