Sep '25 • 💸 Money Moves

🚨 The Fed Just Cut Interest Rates — What It Means for You

The Federal Reserve just lowered interest rates for the first time in a while. That means it’s now cheaper to borrow money (for things like mortgages, car loans, or business loans), but it also means your savings accounts and CDs may pay you less.

The Fed made this move because the job market is slowing down, and they want to give the economy a boost. They’re walking a tightrope: lowering rates too much could cause prices (inflation) to rise again, but leaving rates too high could push more people out of work.

For you, this is a moment to be strategic. Lower rates can be an opportunity — or a trap — depending on how you move. Here are some money moves to consider right now:

- ✅ Shop around for better loan terms: If you have a car loan, student loan, or credit card debt, see if refinancing or transferring to a lower-rate option saves you money.

- ✅ Check your mortgage: If you’re a homeowner, it may be worth running the numbers on refinancing — even a small drop in your rate can save thousands over time.

- ✅ Be careful with new debt: Just because borrowing is cheaper doesn’t mean you should load up on credit cards or unnecessary loans.

- ✅ Revisit your savings plan: If your bank lowers your interest rate, consider moving money into high-yield accounts, money market funds, or even starting to invest.

- ✅ Think like an investor: Lower rates can push stocks and real estate up. This might be the right time to look at putting more into your long-term investment plan, but stick to what fits your SSI framework — don’t chase trends.

2

0 comments

skool.com/think-outside-the-cell-comm

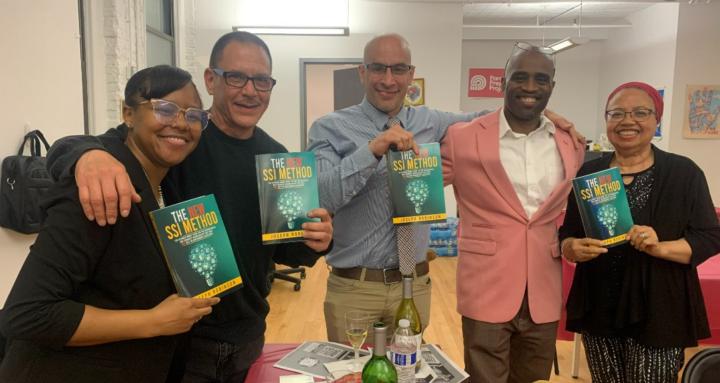

A global community for and by justice-impacted people (and allies) to transform mindsets, build wealth, and reclaim our futures—together.

Powered by