Lets JV

I’ve got buyers ready and hungry for their next project in Ohio and Kentucky. If you’re sitting on deals, struggling to dispo, or just want to JV and move inventory faster, let’s connect. I’m actively working with investors looking for their next flip, rental, land, or value-add opportunity. If you bring real deals, I bring real buyers and clean communication. Let’s stop letting good opportunities sit. JV up, move deals, and make sure everyone eats. Drop your market below or DM me what you’re working with.

DFW

Anybody got buy boxes for dfw builders? I’ll trade for my list of off market infills in the area

1

0

Connecting with Like-Minded 👋🏻

Hi, I’m a real estate investor and wholesaler. Let’s connect and see how we can work together!

1

0

Find Preforeclosure leads on your own for free!

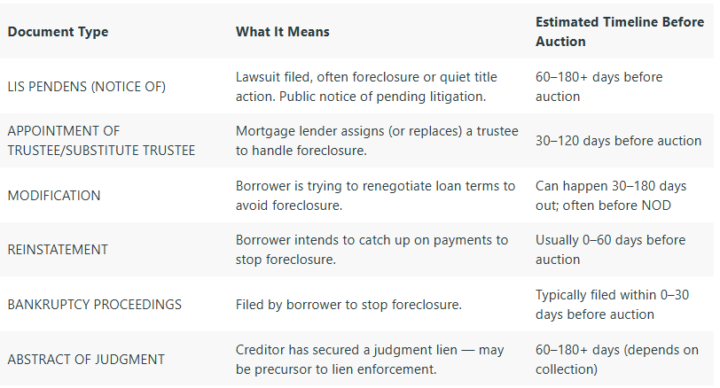

This post focuses on my experience in the fastest way of using your local county clerk documents to find real-estate leads, specially pre-foreclosures. I mean the fastest because even your commercial data reseller vendors won't be as fast as your local counties, trust me I run a real-estate data company ;) Here's a bit of background: The county clerk's office is responsible for recording and maintaining public records (related to property and legal matters) It tracks documents like deeds of trust, mortgages, liens, Lis Pendens, probates, and related foreclosures docs, etc. These records help verify ownership, track legal claims related to real estate and legal transactions. Below is a table I've put together on these Document types (or some counties call them instruments) which get recorded daily. I've also added a simple explanation of what they mean, and estimated time before they go into a foreclosure or auction state. I know some of you who are truly experienced in real-estate go directly to the foreclosure pages on your local county which get published daily; however, these document types below often occur much earlier. The point of these is to get hold of a property owner and work something out to help them deal with their situation (i.e. creative financing, subject to, etc..) Take a look at the screenshot which is a table of the documents that i'm referring to, what they mean, and the time period that you'll have to reach out. County clerk documents like lis pendens, mortgage loan modifications, and similar filings can reveal signs of financial distress in a property. A lis pendens indicates that a foreclosure lawsuit has been filed, marking the property as legally contested and likely in preforeclosure. Mortgage loan modifications suggest the homeowner is struggling to keep up with payments and is attempting to renegotiate terms to avoid foreclosure. Other filings, such as loan defaults, tax liens, or bankruptcy notices, can further signal financial hardship.

0

0

Skiptracing Probate Records

m going to start marketing to probate records, since the owner of the property is deceased do I skiptrace the personal representative along with the probate property or do I skiptrace the owner of the deceased property and call the relatives that come from the skiptrace results? Who are you guys using for skiptracing? Thanks

1-21 of 21

skool.com/recession-proof-wholesaling-1744

Learn how to wholesale real estate for 6-figure paydays with Willny Guifarro. Close your biggest deal yet with proven strategies.

Powered by