Write something

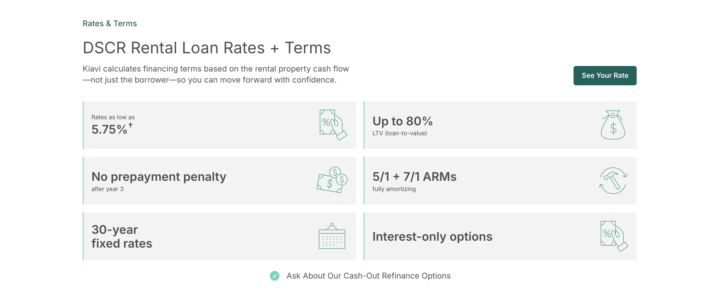

Straight From My Lenders: Rental Loan Rates in the 5%'s

Getting financing for a buy & hold anytime soon or refinancing out of a BRRRR deal? Rates just went down even further & we are in the 5's! Here's what my rep from Kiavi just sent me: - Rates as low as 5.75%* and LTV up to 80%* - Cash-out refinances after a property is owned for 90 days or is free and clear - Flexible DSCRs as low as 0.8X - No hard credit pulls Remember, they calculate your financing terms based on the property’s cash flow, not your personal income. That means no W2s, bank statements, or hard credit pulls. Want to get a quote for your next deal? Submit a request here: https://try.kiavi.com/sczxcel2n5pp I've used Kiavi to fund a couple of my deals & rates have never been this low (since pre-covid). Just remember to always shop around for the best rate if this aligns with your strategy.

START HERE: Welcome to Auction Property Academy

Welcome to Auction Property Academy. I'm excited to have you apart of this amazing community! That being said, I want to go over some community guidelines with you all and give you a chance to introduce yourself and get active in this community Step 1: IMPORTANT - First please introduce yourself in the Welcome tab using this copy-paste template 1. What's your name? 2. Where are you from/based? 3. What you wanna learn about from this community? Step 2: Head over to the modules and start going through the content Step 3: Answer the poll below Step 4: Comment on this post to let you know you've introduced yourself. Last thing, be respectful, add value and follow the rules. Welcome to the best Auction Property Academy in the world. Glad to have you. - Tiffany

Poll

38 members have voted

Confused Which Real Estate Strategy you Should Follow?

One of the biggest struggles I see with people at the start of their investing journey isn’t lack of motivation — it’s too many options. Tax deeds. Foreclosures. Wholesaling. Rentals. Airbnb. Development. And suddenly… you’re stuck. Not because you can’t do this — but because you’re trying to do everything at once. So let’s simplify this 👇 Step 1: Get Clear on Your Constraints (Not Your Dreams) Before choosing a strategy, answer these honestly: - How much capital do you realistically have access to? - Do you need something straightforward or are you okay with complexity? - Are you trying to flip, rent, or build long-term wealth? - How much time can you dedicate weekly? Step 2: Understand What Each Strategy Is Actually Good For 🏷️ Tax Deed Sales Best for: Low barrier to entry - Cash only - Mostly used for flipping - Can be a medium–long term play - Higher risk if you don’t understand liens & redemption rights 🔨 Auction Foreclosures (3rd-Party Sites) Best for: First-time investors who want options - Financeable (as low as ~10% down with hard money) - Works for long-term rentals, Airbnb, affordable housing, flips (multiple options) - More straightforward process - Lower risk when analyzed correctly 🏗️ Real Estate Development Best for: Advanced investors - Time-intensive - Higher profit potential - County approvals & zoning hurdles - Often requires buying land (sometimes via tax deed sales) - Financeable, but usually 20%+ down Step 3: Pick ONE Strategy for 90 Days The fastest investors I know didn’t try everything.They committed to one lane, learned it deeply, and executed. Drop a comment based on your answers: - 💰 “Cash + flipping” - 🏠 “Rental + financing” - 🏗️ “Long-term development” Not sure what direction is best for you? Book a call with me & lets have a chit chat bout which strategy might work best with your goals. 👉 Book a call through the link and let’s map out a clear plan for your first deal.

LIVE: How to Find High Profit Properties Event Tomorrow!

Happy Wednesday! Hope everyone’s week is moving strong 💪🏽 Quick reminder — our LIVE training is tomorrow and you do NOT want to miss this one. I’m breaking down exactly how I find high-profit real estate deals in today’s market — and I’ll be screen-sharing real platforms I actually use. Two of the resources we’ll be diving into: 🔥 Tax Deed Auctions – how to find properties starting below assessed value and what to look out for before bidding 🔥 Xome.com – an underrated platform with serious opportunities (and less competition than you think) I’ll also be walking through what separates profitable deals from money pits and how to avoid the beginner mistakes that cost people thousands. If your goal is to secure a deal in 2026, this training will give you clarity and direction. Make sure you’re registered, block your calendar, and come ready with questions. Let’s level up 🚀

0

0

LIVE Coffee Hour: Where to Find High- Profit Real Estate Deals

I’m hosting a live webinar inside the community on How to Find High-Profit Real Estate Deals — and I’ll be breaking down exactly where my deals come from. In this training, I’m pulling back the curtain on the top 5 platforms I personally use to find properties at up to 80% off. No theory, no fluff — just real places to look and how to actually use them to find profitable opportunities. We’ll cover: - Where to find deeply discounted deals - How to quickly identify which deals are worth your time - Common mistakes that cause investors to miss great opportunities - How to think like an investor when searching for deals Whether you’re brand new or already investing but struggling to find solid deals, this live will give you clarity and direction. 🗓️ Thursday 2/12 at 8pm EST - Save it in the calendar tab 💬 Come live and bring your questions — I’ll be answering them in real time. Let’s get it 🚀

1-30 of 41

powered by

skool.com/real-estate-investing-101-7860

Welcome to Auction Property Academy — a community of real estate investors mastering the art of finding, analyzing, and landing off-market deals.

Suggested communities

Powered by