Write something

👊That's How Lawtino Solutions WORKS👊

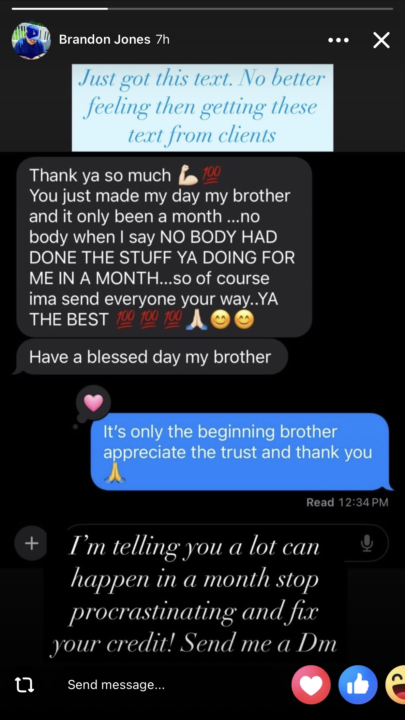

💫 We’re truly grateful to our valued client for trusting Lawtino Solutions with their credit restoration journey. Taking the first step toward fixing your credit is not always easy, and we’re honored that you chose our team to guide you through the process. 🔥 At Lawtino Solutions, we believe everyone deserves a second chance at financial freedom. 💡Thank you for allowing us to be part of your journey toward a stronger credit profile and better opportunities ahead. 💫 Your trust motivates us to continue helping more people rebuild their credit and create a brighter financial future.

0

0

Will you be in the same place next month, or will you be one step closer to financial freedom?🤔

🚨A lot can happen in a month.🚨 💡Every day you wait is another day you’re paying higher interest rates, getting denied for opportunities, or settling for less than you deserve. 💡Your credit affects more than just loans, it impacts where you live, what you drive, the interest you pay, even certain job opportunities. 💪One month from now will come whether you take action or not. 🔥Fix your credit. Bet on yourself.🔥

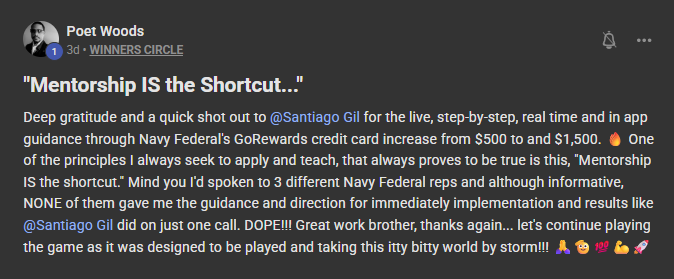

🚀 Join Our Mentorship Program Now!🚀

👊 Are you ready to grow, gain clarity, and move confidently toward your goals? 🔥Our mentorship program is designed to support, guide, and empower you every step of the way. 💡Whether you're looking to build skills, strengthen your mindset, or take your next big leap, we’re here for you. 🚨If you’re serious about your goals, this is your sign.🚨 🚀 Learn 🚀 Grow 🚀 Achieve 💪Join our mentorship now and let’s make it happen!💪

0

0

Secured Card Power

https://www.youtube.com/live/-pZ6FpAwEhs?si=39x_4u77ud1AbFCC

NAVY FED FLAGSHIP ACCOUNT

Anybody else get money taken from their Flagship Checking account recently over $1500

1-30 of 796

skool.com/myfreecreditskool-1499

CREDIT HACKS AND GROWTH FOR FREE!!! EDUCATE YOURSELF ON CREDIT AND GET ANYTHING YOU WANT HOUSE< CAR< HIGH LIMIT CREDIT CARDS

Powered by