Understanding the Two-State Dynamic Playing Out in Kansas City Right Now

Kansas City operates as a single economic region, but it functions across two different state systems — each with its own tax structures, incentive tools, and development priorities. When those systems begin pulling in different directions, the effects don’t appear overnight. They show up through where employers commit, where capital flows, and how people reorganize their daily lives. That two-state dynamic is becoming relevant again. Why This Metro Behaves Differently In most cities, relocating a headquarters or major asset means crossing hundreds of miles and rebuilding a workforce. In Kansas City, it can mean crossing a street. That distinction matters. It allows: - Companies to reposition without disrupting their labor pool - Municipalities to compete aggressively without geographic friction - Employees to adapt incrementally rather than uprooting entirely As a result, movement inside this metro tends to be gradual, but durable. We’ve Seen This Before — and We’re Seeing It Again This isn’t hypothetical. Kansas City has already experienced meaningful internal repositioning. One of the most visible examples is Lockton, which committed to relocating its headquarters to the Kansas side. That decision wasn’t about leaving the metro — it was about optimizing within it. More recently, similar conversations are happening around large-scale anchor institutions, not just office users. There have been serious discussions around: - The Kansas City Royals potentially locating a new stadium and surrounding mixed-use development on the Kansas side, including sites tied to the Aspiria campus - The Kansas City Chiefs exploring the possibility of moving from Arrowhead Stadium to the Legends Outlets Kansas City area in Wyandotte County Whether or not every proposal materializes is less important than what these discussions signal. These are not fringe ideas — they are serious evaluations of incentives, infrastructure, and long-term alignment. What Happens When Incentives Start to Matter Again

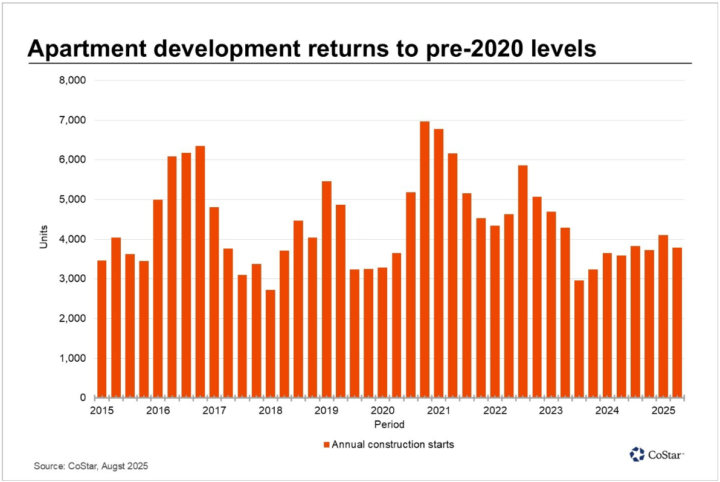

Multifamily Supply Overhang Begins to Ease

📊 Multifamily Update: The Supply Wave Is Finally Starting to Ease One of the biggest questions investors have been asking the past 18–24 months is: When does the supply pressure let up? We’re now starting to see the first real signs of that shift. According to new CoStar data, the national multifamily market is actively working through the historic wave of deliveries from 2022–2025. While vacancies remain elevated in newly delivered properties, the overhang itself is shrinking as absorption improves and new deliveries slow MultifamilyUnits. Key national takeaways: - Roughly 353,000 recently delivered units still need to lease up to reach equilibrium, but that number is declining MultifamilyUnits. - The drawdown of excess vacant inventory accelerated in Q4, with over 100,000 units absorbed year-to-date MultifamilyUnits. - Demand for higher-quality, stabilized assets remains strong, with properties built 2017–2021 operating below the national vacancy average MultifamilyUnits. - The challenge today is volume timing, not renter demand. In short: the market is digesting supply, not breaking under it. 📍 Kansas City Focus: A Faster Reset Than Most Markets Kansas City is actually ahead of many metros in this cycle. CoStar data shows that KC’s apartment construction pipeline has shrunk to its lowest level in nearly a decade, driven by higher borrowing costs, tighter equity requirements, and slower rent growth KCMultifamily. Kansas City highlights: - Only ~5,300 units currently under construction, representing just 2.9% of total inventory, the lowest level since 2018 KCMultifamily. - This is down sharply from the 2021 peak, when nearly 9,000 units were underway KCMultifamily. - 2026 deliveries are projected at ~2,900 units, the lowest annual total since 2019, aligning new supply much more closely with demand KCMultifamily. - Several submarkets, including parts of Cass County, now have zero units under construction. What this means: - KC is likely to see supply pressure ease sooner than many Sun Belt markets - Stabilized assets should benefit first - Rent growth doesn’t need to surge for fundamentals to improve — simply less competition helps

3

0

🚨 Multifamily Market Update — December 2025

📉 Rents & Vacancy - National rents continue to soften — 4th straight month of declines, now averaging $1,740. - Vacancy rates are hitting record highs across many metros due to heavy new supply. - Early 2025 showed a brief rent uptick, but momentum faded quickly. Sources: - Rent declines & vacancy spike:https://www.credaily.com/briefs/multifamily-rents-slide-as-demand-lags-supply-in-key-us-markets/?utm_source=chatgpt.com - Rent growth snapshot:https://www.multihousingnews.com/rent-growth-20/?utm_source=chatgpt.com - Vacancy hitting record highs:https://www.credaily.com/briefs/rent-decline-deepens-as-vacancy-rates-hit-record-high/?utm_source=chatgpt.com 🏗 Development Trends - Construction starts are down ~74% from 2021 peaks, signaling a major slowdown. - Developers shifting toward middle-income and affordable housing as luxury oversupply weighs on absorption. - Colorado issues its first Middle-Income Housing Tax Credit (MIHTC) — a sign of national policy direction. Sources: - Development slowdown (CBRE 2025 Outlook):https://www.cbre.com/insights/books/us-real-estate-market-outlook-2025/multifamily?utm_source=chatgpt.com - Supply snapshot (Arbor):https://arbor.com/blog/u-s-multifamily-market-snapshot-november-2025/?utm_source=chatgpt.com - MIHTC announcement:https://yieldpro.com/2025/12/mihtc/?utm_source=chatgpt.com 🏢 Investor Behavior - Investors are cautiously coming back as values begin to stabilize. - Sales volume fell 28% YoY, showing many are still hesitant to transact. - Sellers continue to chase 2021-style peak pricing despite softer fundamentals. - Toll Brothers is exiting multifamily, selling its portfolio to Kennedy Wilson for $347M.

2

0

Kansas City’s Development Slowdown Strengthens Existing Assets

Kansas City’s Development Slowdown Strengthens Existing Assets New CoStar data shows apartment construction in Kansas City has fallen back to pre-2020 levels — down nearly 46% from the market’s peak. While that may sound like a cooling market, it’s actually welcome news for current owners and investors. With borrowing costs high and new projects slowing, the city’s development pipeline has dropped to its lowest level since 2018. That means fewer new units competing for renters — especially important as vacancy rates have inched higher over the past few years. For existing properties, this environment can create real advantages: ✅ Reduced future supply pressure — fewer lease-ups competing for tenants ✅ Stabilizing vacancy rates — demand absorption catching up with new inventory ✅ Healthier rent growth outlook heading into 2026 Kansas City’s fundamentals remain steady — strong job growth, population inflow, and downtown expansion along the Main Street streetcar corridor continue to drive long-term housing demand. For well-operated assets, this is a market that rewards efficiency and staying power while new development takes a breather. 📊 Source: CoStar, August 2025

The Multifamily Construction Boom is Over — and That's Bullish for the Future.

📉 The Multifamily Construction Boom is Over — and That's Bullish for the Future. 2024 marked the tail end of a historic multifamily construction boom. New deliveries are hitting the market now, causing headlines about rent softening and oversupply in some metros. But here's what the headlines aren’t telling you: ➡️ New multifamily permits are down 27.1% from pandemic highs 🔗 GlobeSt, May 2025 https://www.globest.com/2025/05/06/multifamily-housing-permits-fall-to-lowest-levels-since-pandemic-in-most-us-cities/ ➡️ Completions have far outpaced new starts — by over 250,000 units in 2024 🔗 Jay Parsons, Feb 2025 https://www.linkedin.com/posts/jay-parsons-a7a6656_the-final-numbers-are-in-and-in-2024-multifamily-activity-7287454668761309184-wcGC/ ➡️ Most major U.S. metros are seeing construction pullbacks 🔗 Commercial Real Estate Daily, May 2025 https://www.credaily.com/briefs/multifamily-permits-drop-as-construction-slows-nationwide/ ➡️ State housing agencies are warning of a supply gap by 2026 🔗 Stateline, May 2025 https://stateline.org/2025/05/01/the-number-of-new-apartments-is-at-a-50-year-high-but-states-expect-a-slowdown/ ➡️ Even Redfin shows permits are now below pre-pandemic levels 🔗 Redfin, May 2025 https://www.redfin.com/news/multifamily-construction-permits-2025/ 🔁 What does this mean? While current supply may feel abundant, the pipeline is drying up fast. And because it takes 2–3 years to entitle and build, we’re heading toward a structural shortfall.

1-25 of 25

skool.com/multifamily

All things Multifamily, otherwise known as Apartment Buildings: investing, managing, owning, financing, raising capital, partnerships, legal, debt.

Powered by