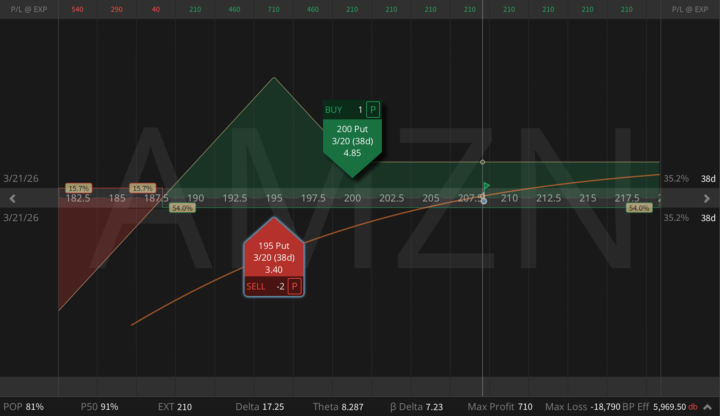

Amazon After Earnings: When Ratio Risk Beats Naked Risk

Last week we skipped trading AMZN earnings. Options were pricing 7.5%, reality was -14%, so short gamma was not the place to be. In my personal view it was only a repricing of capex and FCF timing, nothing more. AWS re-accelerated, ads keep growing >20%, NA retail margins are improving, but the market suddenly realized buybacks and FCF are pushed out by heavy AI capex. Post-earnings, the setup changed. The shock is out, downside skew is still rich, and fundamental downside convexity is much lower than before the print. That's why ratio risk now beats naked risk, so today I'm expressing this via a March put ratio:

2

0

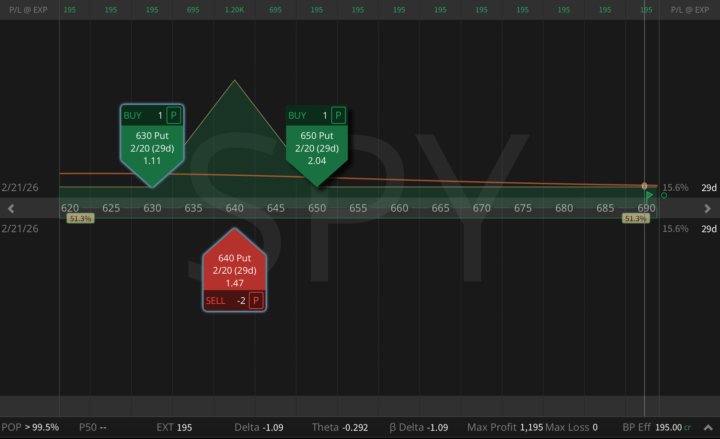

Converting a SPY Put Ratio Into a Risk-Free Butterfly 🦋 (Again)

Hey, on Tuesday I published a new trade idea: a SPY 650/640 put ratio spread (1x2), 31 DTE, opened for a $306 credit right as volatility spiked. The objective was simple: get paid for the panic. Today I've pulled a super-strategic move: just bought the 630 put for $1.11, and that single adjustment transformed the entire position into a risk-free butterfly 🦋 (!) with: - Zero downside risk - Zero upside risk - Max profit: $1,200 - Min profit: $195 - Probability of Profit (PoP): 100% This is what most traders miss in high-volatility regimes: you're not predicting direction; you're engineering a distribution. When fear is overpriced, you can sometimes lock structures where the market pays you first, then sells you the wing cheap enough to remove the tail. I do this setup on SPY all the time, but the framework works on any liquid ticker with tight markets: QQQ, IWM, and even selected single names.

1

0

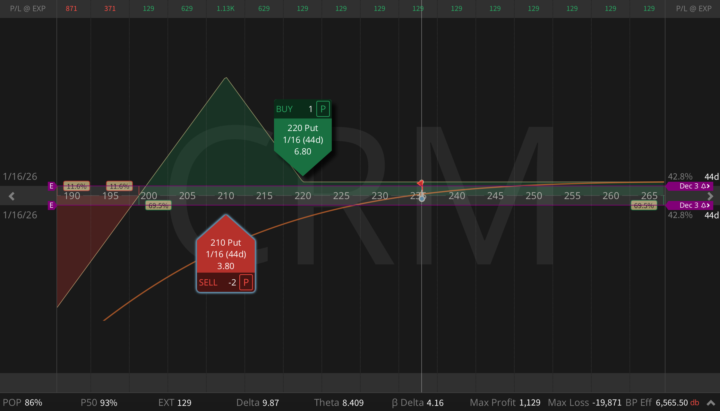

CRM Earnings Put Ratio Into Agentforce Test

CRM reports after the bell, and the setup is actually fascinating. The stock sits around $235, down 36% from highs and 30% YTD. Growth has slowed, but fundamentals aren't broken. They're just… less sexy. IV is pricing a 7-8% move, skew is modest, and this is exactly the type of environment where I want to be slightly long CRM and short rich downside vol, with a wide cushion if we get a controlled pullback. Let's see what Marc Benioff brings us tonight!

2

0

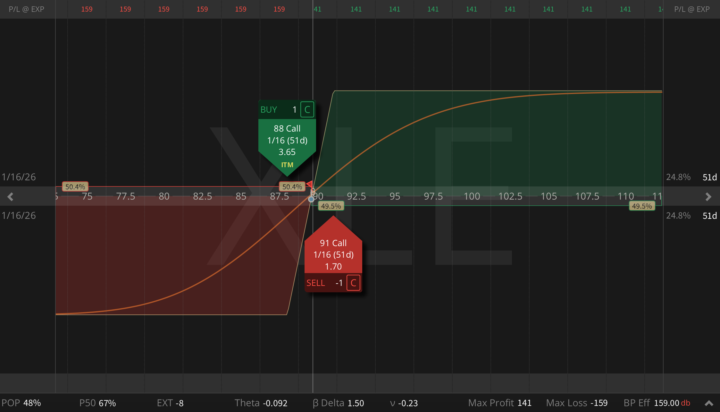

A Sector Spread With Teeth: XLV-XLE Pair Trade

Hey, in the previous posts, I shared that rotation charts are finally giving us clean signals: XLV (Healthcare) keeps gaining relative strength, while XLE (Energy) is recovering after weeks of underperformance. Both sectors moved into a decision zone, and today I'm showing the exact structure I'm using to trade that divergence in the hedge fund. Part 1: XLE Call Debit Spread (Defined-Risk Snapback Play) - Buy 88C / Sell 91C Jan 16 (51 DTE), Debit: $1.59, Max Profit: $141 - A clean, defined-risk way to play the standard Energy bounce inside a choppy, low-volatility range. If XLE mean-reverts toward 90–92, this structure pays quickly Part 2: XLV Call Ratio Spread (Harvesting Exhaustion) - Buy 160C / Sell 2× 163C Jan 16 (51 DTE), Max Profit: $357, Max Risk is undefined (but extremely manageable in XLV). - XLV is extended, overbought, and showing early fatigue. Elevated IV makes upper-strike calls expensive, perfect for a ratio spread that benefits from slowing momentum or shallow consolidation. Why it works as a pairs trade? These aren't two isolated ideas, they're one combined expression: - XLE - defined-risk long delta where bounce probability is high - XLV - premium capture where trend exhaustion is visible - Combined - smooth Greeks, positive theta, and exposure to sector divergence rather than index direction. This is how you express rotation and sector behavior without guessing the market's next move. A clean, elegant pairs structure built for this macro regime.

2

0

Skip the NVDA circus?

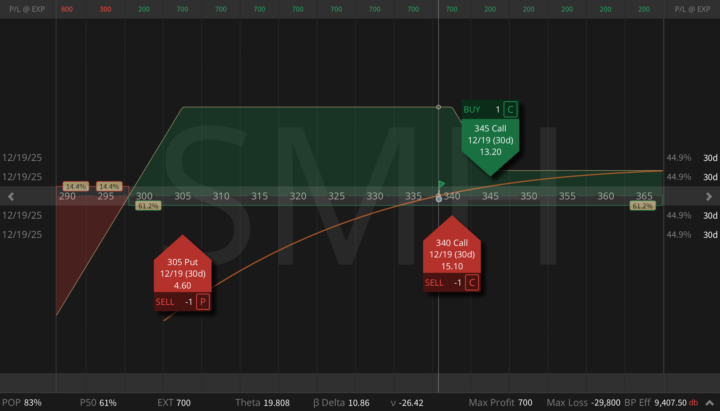

Hey, NVDA reports today after the close, and this is one of those earnings where the reaction can tell you more about the entire AI cycle than the numbers themselves. IV Rank is high (37), implied move is around 6-7%. Historically, NVDA often moves less than implied, and post-earnings IV drops fast. Everyone tonight is obsessed with one thing: "How are you trading NVDA earnings?" My honest answer: most people shouldn't. It's a crowded, binary event with sky-high expectations already priced in. Yes, IV is juicy, but one wrong line in the guidance and you're fighting a 10-15% gap in a single name. I'd rather attack the same theme, AI and semiconductors, in a calmer, higher-probability way: through SMH, the semiconductor ETF. So why SMH gives more edge than straight NVDA? SMH still benefits from the whole AI chip story, but: - You're diversified across the basket, not hostage to one conference call. - Earnings noise in any single name is diluted. - IV is elevated, but moves are usually much more reasonable than NVDA's all or nothing gaps. That's exactly the environment where short premium, and high probability of profit shines. So, my main play today is not NVDA itself, but a Jade Lizard in SMH:

2

0

1-6 of 6

powered by

skool.com/jcow-capital-6336

Define Risk - Manage Risk - Take Risk

Join for growth

- Strategic Updates

- Market Outlook

- Daily Reviews

Suggested communities

Powered by