The Highest-Probability Way to Trade NVDA Earnings Tonight?

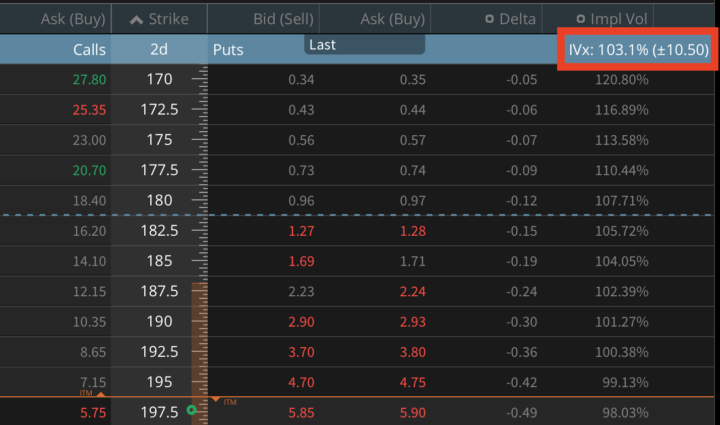

NVDA reports after the bell tonight, and this is the single most important event of the week for the entire technology complex, for AI capex sentiment, and potentially for sector rotation across the market! If NVDA re-prices the AI narrative, QQQ moves, growth vs value rotation shifts, even energy and cyclicals feel it through flows. Now here’s what’s interesting. Consensus is extreme: 65-66B revenue, +66% YoY. EPS up 70%, Data Center nearly the whole engine. The base case is already beat and strong guide. You'd expect options to price this like a bomb, but they aren't! The at-the-money straddle implies roughly a 5-6% move. Over the last 12 quarters, the average implied move was closer to 7.5%. By NVDA's own standards, this event is being priced smaller than usual. That's the first non-obvious signal. The second one is even more important. Historically, NVDA's implied earnings move trades at about 1.5x the tech sector (XLK). This quarter, that ratio is closer to 0.9x. Read that again: the market is pricing NVDA as less idiosyncratic than the sector, at a moment when AI capex concentration arguably makes it more idiosyncratic than ever. Yes, front-week IV is high (72% vs 55% baseline). Yes, there will likely be IV crush. But the lazy trade "short the rich IV" assumes the event premium itself is bloated. This time, the event premium is compressed relative to history and relative to tech. That changes the game, so we're not putting on calendar spreads today. The edge, in my view, sits in: - NVDA vs sector variance - Defined-risk or asymmetric volatility harvesting The market is not overpricing fear, it's compressing NVDA's uniqueness into sector volatility, and if that assumption breaks tonight, the move won't care about your straddle math. Because the event move is priced relatively small (5-6%) and the front-week premium is not unusually fat versus history, forcing a weekly Jade Lizard would mean selling compressed event variance with thin margin for error. So instead of playing the binary print, we step out to April (51 DTE) and build a safer Earnings Jade Lizard.

1

0

Your "safe" short strangles just lost 2x more than your stress test predicted?

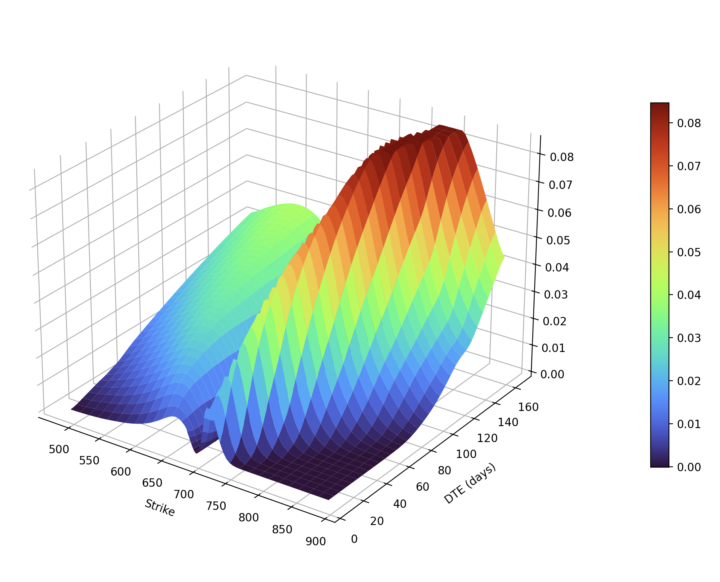

Hi, I just finished modeling the SPY Volga surface into the close (see attached). Now imagine this: you sold the OTM strangles, you stress-tested a 5-point volatility move, looked at the potential drawdown, and you accepted it. Then the spike actually hit, and you lost double. Why? Because your platform lied to you! Most retail brokers show you a static snapshot of your exposure RIGHT NOW. They don't show you what happens to that exposure when IV moves from 15 to 25. The reality is Vega isn't a constant. When volatility rips, the entire surface reprices, your short Vega becomes significantly more negative exactly when you need it to shrink. That's Volga (also known as Vomma). Think about it: if Delta has Gamma, Vega has Volga. It's the second-order Greek that measures how your Vega changes as volatility moves. If you're short the wings, you are Short Volga. My rule: don't size off today's Vega. Ask: What is my Vega if IV jumps 20-30 points? If you haven't modeled that, you don't know your true position size!

1

0

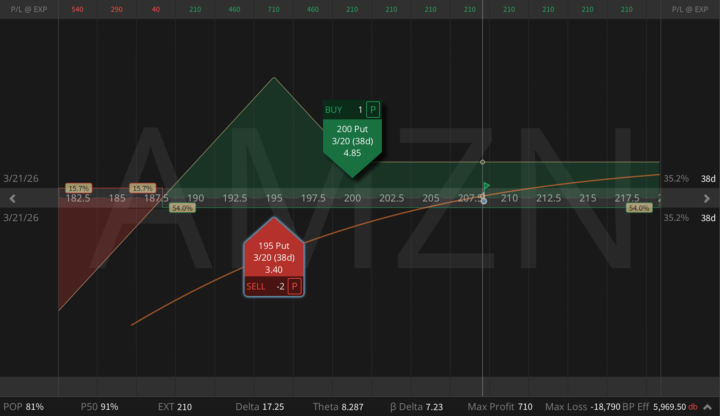

Amazon After Earnings: When Ratio Risk Beats Naked Risk

Last week we skipped trading AMZN earnings. Options were pricing 7.5%, reality was -14%, so short gamma was not the place to be. In my personal view it was only a repricing of capex and FCF timing, nothing more. AWS re-accelerated, ads keep growing >20%, NA retail margins are improving, but the market suddenly realized buybacks and FCF are pushed out by heavy AI capex. Post-earnings, the setup changed. The shock is out, downside skew is still rich, and fundamental downside convexity is much lower than before the print. That's why ratio risk now beats naked risk, so today I'm expressing this via a March put ratio:

2

0

Converting a SPY Put Ratio Into a Risk-Free Butterfly 🦋 (Again)

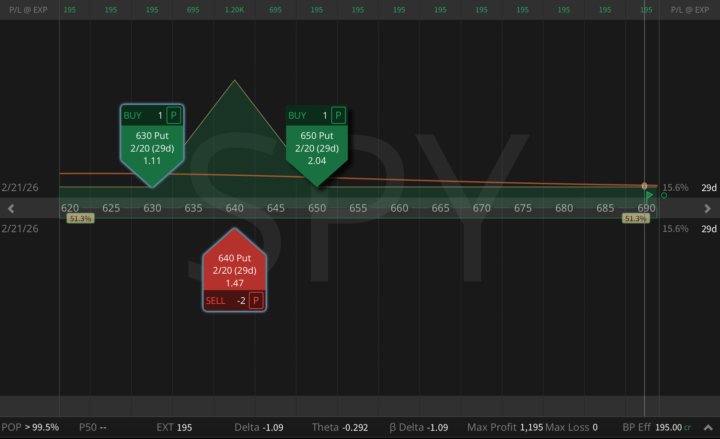

Hey, on Tuesday I published a new trade idea: a SPY 650/640 put ratio spread (1x2), 31 DTE, opened for a $306 credit right as volatility spiked. The objective was simple: get paid for the panic. Today I've pulled a super-strategic move: just bought the 630 put for $1.11, and that single adjustment transformed the entire position into a risk-free butterfly 🦋 (!) with: - Zero downside risk - Zero upside risk - Max profit: $1,200 - Min profit: $195 - Probability of Profit (PoP): 100% This is what most traders miss in high-volatility regimes: you're not predicting direction; you're engineering a distribution. When fear is overpriced, you can sometimes lock structures where the market pays you first, then sells you the wing cheap enough to remove the tail. I do this setup on SPY all the time, but the framework works on any liquid ticker with tight markets: QQQ, IWM, and even selected single names.

1

0

My Personal 2026 Market Playbook as an Options Seller and Hedge Fund Manager

Hey! As we start 2026, I want to share a few very personal market views and investment ideas I'm going to actively explore this year. This is not a recommendation and not a directional forecast. It's simply how I currently see market structure, volatility, and opportunity from the perspective of an active options seller and short-volatility hedge fund advisor. 1) Metals: the parabolic move may be behind, but volatility lingers Gold and silver already had their most emotional, parabolic phase. The important nuance is that implied volatility rarely normalizes as fast as price action does, and that lag is where options sellers get paid. So, I'll be very active in GLD, SLV, PALL, and URA, both in my personal portfolio and in our hedge fund. The specific edge I'm watching is post-spike IV that stays sticky after the trend fades, especially when the surface flips into volatility backwardation. That's a perfect setup for short-dated and 0-DTE premium harvesting. 2) Crypto: stagnation is the edge My base case for crypto is not another explosive trend, but prolonged consolidation. That's exactly why IBIT, the iShares Bitcoin Trust ETF with liquid options, is so interesting. Implied volatility remains structurally rich, often well above realized volatility. I don't trade crypto directionally, but I sell premium strategically. Compared to the industry's obsession with upside narratives, this approach is far less exciting, but it creates a much more consistent income engine. 3) Rate cuts shift income opportunities If rate cuts continue, my famous "yield engineering" trades like SPX box spreads and risk-free butterflies become less attractive. At the same time, they open a different door. Lower rates support REITs (Realty Income - O - remains my personal favorite), utilities (XLU), healthcare (XLV, UNH), and dividend growth ETFs (SCHD). I consistently combine these with aggressive call writing, creating my Triple Income Strategy. This approach targets an additional 11-18% per annum, with extremely low volatility and zero vega risk!

1

0

1-30 of 82

powered by

skool.com/jcow-capital-6336

Define Risk - Manage Risk - Take Risk

Join for growth

- Strategic Updates

- Market Outlook

- Daily Reviews

Suggested communities

Powered by