Write something

MLK Day

We've decided to watch from the sidelines today, since cash markets are closed and liquidity is expected to be low. Wishing all a great day!

2

0

1-16-26

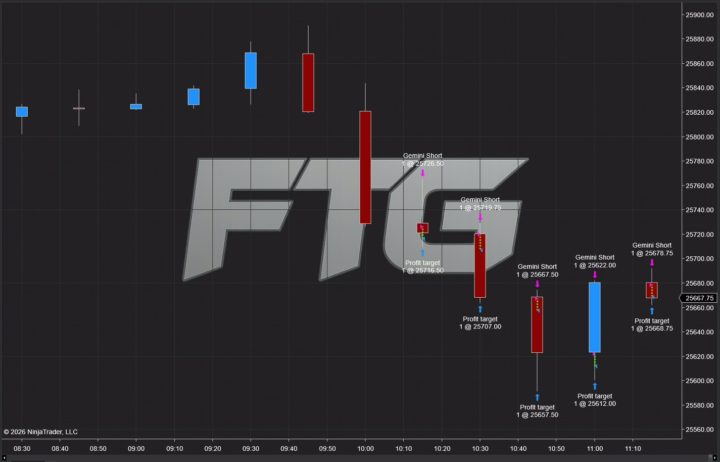

Volturon_v2 only took one trade, which lost, and then it stopped trading because we had our daily loss limit too low. Our AI-assisted hybrid algo, Gemini, hit our profit target by 11:00 on its first 5 trades. So, a mixed Friday, but a solid week, all in all. The markets are open half a day on Monday, but liquidity may be low. We may decide to sit out, but we'll keep you posted. In any case, enjoy your weekend!

Trades today so far

With default settings + VWAP FILTER on 15 min chart….Confirming, no trades so far today?

1

0

Free Trial - No Credit Card or Any Obligation - Just have fun...!!

For those who are just joining us: We are looking for traders to try our strategy with absolutely no obligation. Do you already use NinjaTrader? Download our NT8 approved algo, and give it a try. No credit card. No registration. Use it for 14 days and see if it works for you. There is zero downside to this offer. If you have questions, simply respond to this post or email support@volturon.com. In any event, download the algo without obligation here: https://drive.google.com/file/d/1tymVrx5GSnZz-DGgPPfmkZD_JKPrCldt/view?usp=sharing

1-22 of 22

powered by

skool.com/futures-trading-group-7221

Welcome to the Futures Trading Group, an exclusive community dedicated to the mastery and advancement of AI-driven automated futures trading.

Suggested communities

Powered by