Write something

Pinned

Personal Hedge Fund

Boulder Partners is a personal hedge fund with the goal of testing strategies, identifying required metrics and applying these in a real world environment in an attempt to create economic freedom. In the general discussion see: 1. Current research 2. Trades 3. Q&A discussions 4. Discussions of my investing thoughts In the education section see: 1. Back testing 2. Investment perspectives 3. Trading records Please post any questions about what I am doing here.

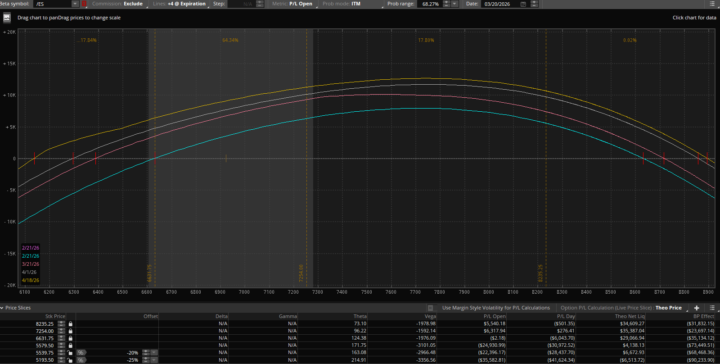

Weekly update 2/20/2026

No new trades this week. Current beta weighted risk is 2.92 against the SPX. Overall theta on futures is 90.67. SPX beta weighted risk ~$20,174. All else being equal, this represents $2,720.10 every 30 days due to theta decay-7.8% monthly. Of note, beta weighted portfolio value is remains close to the current futures balance ($22,336). The attached graph shows the current stress test with losses beginning at /ES price of $6,924.725 (which appears to increase with volatility). It has a 17.84% chance of loss over the next 30 days.

2

0

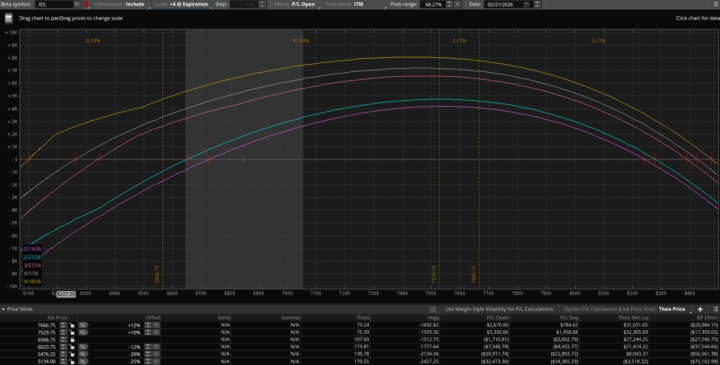

Weekly update 2/13/2026

No new trades this week. Current beta weighted risk is 2.61 against the SPX. Overall theta on futures is 82.34. SPX beta weighted risk ~$17,842. All else being equal, this represents $2,470.20 every 30 days due to theta decay-13.8% monthly. Of note, beta weighted portfolio value is remains close to the current futures balance ($19,807). The attached graph shows the current stress test with losses beginning at /ES price of $6,652.25 (which appears to increase with volatility). It has a 8.41% chance of loss over the next 30 days.

2

0

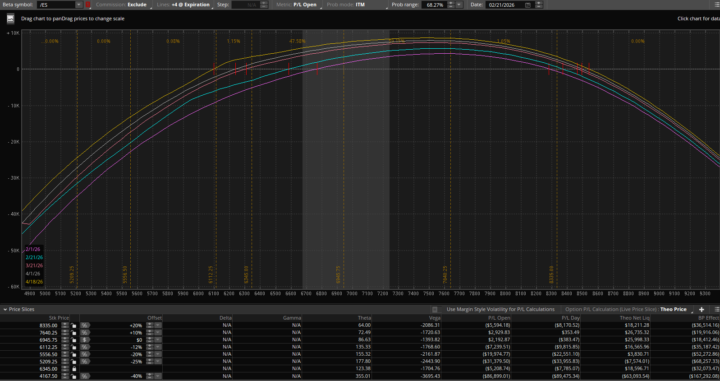

Weekly update 2/6/2026

Back ratio with entry price in PAYC at ~$113/shr. Current beta weighted risk is 2.57 against the SPX. Overall theta on futures is 74.85. SPX beta weighted risk ~$17,816. All else being equal, this represents $2,245.50 every 30 days due to theta decay-12.6% monthly. Of note, beta weighted portfolio value is remains close to the current futures balance. The attached graph shows the current stress test with losses beginning at /ES price of $6,771.50 (which appears to increase with volatility). It has a 14.62% chance of loss over the next 30 days.

1

0

1-26 of 26

powered by

skool.com/boulder-partners-2359

Join a group tracking the activity of an incubating investing partnership focused on bond, equity, options and futures.

Suggested communities

Powered by