Activity

Mon

Wed

Fri

Sun

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

What is this?

Less

More

Owned by Steve

Turn your VA loan into a wealth-building tool. Mindset, strategy & support for military families ready to build generational wealth.

The premier financial ecosystem for pilots — integrated mortgage, energy, and wealth solutions for the aviation community.

Memberships

Growth Elite by Perspective

4.8k members • Free

Forward Content Accelerator

1k members • $1,997/y

Skoolers

190.2k members • Free

ACQ VANTAGE

647 members • $1,000/month

Root Collective

3.6k members • Free

Summit Scale

243 members • Free

21 contributions to The Pilot Wealth Hangar

✈️How will your finances look after you stop flying?

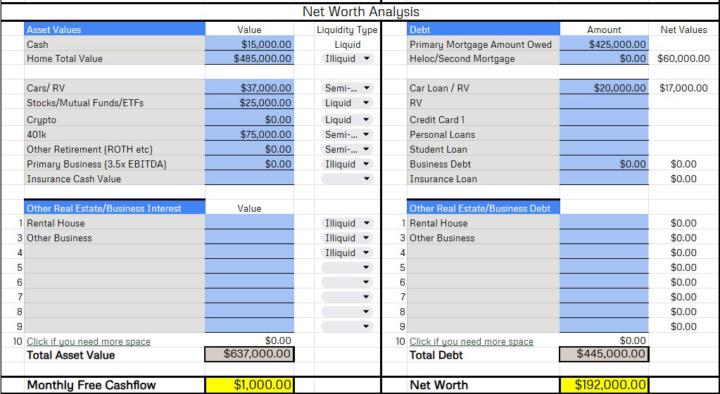

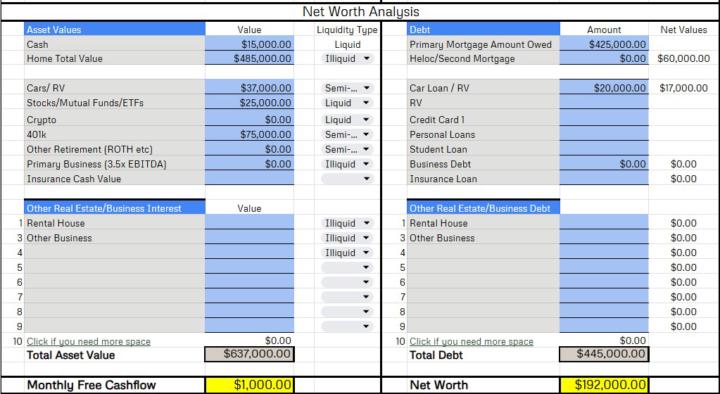

Most pilots focus on income and upgrades, but rarely on: - How retirement income is taxed - What happens if you can’t fly anymore - How quickly a spouse’s financial reality can change Flying income looks straightforward. Retirement income often isn’t. Without clarity: - Assumptions fill the gaps - “I’ll deal with it later” becomes the plan - Families are left reacting instead of choosing The difference comes from: - Understanding income, taxes, and assets over time - Knowing what your family would actually rely on - Making decisions early, while options are still open Some pilots assume it will all sort itself out. Others choose clarity early. The difference? Peace of mind. Take this completed version of The Pilot Wealth Snapshot, giving you a clear picture of what your own numbers might look like.

0

0

✈️ Why so many pilots get “approved” then denied?

- You’re told you’re “pre-approved” - You start writing offers thinking you’re good to go - Then the deal falls apart at the closing table - And you’re left wondering what you missed What usually comes up when we look closer: - Pre-qualification and pre-approval get used interchangeably - They’re not the same thing - Pre-qualification: -A few questions -Maybe a credit pull -Minimal document review - A real pre-approval: -Credit pulled -Income docs reviewed -Assets verified -An underwriter has actually reviewed your file Why this matters: - Your offer is taken more seriously - Earnest money is protected - Fewer last-minute surprises before closing If you want a fail-safe pilot pre-approval—the kind I’d trust with my own earnest money, take a look at the pre-approval checklist PDF attached to this post before writing offers.👇🏼

0

0

✈️ Is it possible to turn your 30-year mortgage into a 15-year mortgage?

Absolutely, it just doesn’t happen automatically. You turn a 30-year mortgage into a 15-year by paying it like a 15-year, even if the loan term itself doesn’t officially change. Why would a pilot consider it?Because paying it down faster means less interest, more equity, and faster financial flexibility (especially helpful with our irregular schedules, upgrade goals, or future base changes). Here’s what actually makes it work: ✅ 1. Make higher monthly payments (the biggest factor) To mimic a 15-year payoff, you must pay the 15-year equivalent monthly amount, which is typically 20–40% higher depending on your rate. You don’t need to refinance to do this — you can simply pay extra toward the principal every month. ✅ 2. Add principal-only payments Even if you can’t commit to the full 15-year payment every month, you can still shorten your payoff by: - Adding a fixed extra amount each month - Rounding up (e.g., $2,345 → $2,500) - Throwing in contract/bonus/per diem surplus money - Using extra flying months or premium trips as lump-sum payments These go directly toward principal, not interest — and that’s what accelerates the payoff. ✅ 3. Use windfalls that pilots actually get Pilots have unique opportunities for lump-sum payments: - Profit-sharing checks - Holiday incentive pay - Training pay differences - Per diem surpluses - Line bidding months with extra hours - Upgrades or seat changes Even one or two large annual principal payments can cut years off a 30-year mortgage. ✅ 4. Refinance into an actual 15-year mortgage (optional) This locks in the faster payoff with a lower rate, but it also locks you into the higher payment. Some pilots prefer flexibility — paying like a 15-year without the required commitment. If your income fluctuates due to reserve, bidding changes, or training months, the flexible approach may make more sense. ✈️ So, is it possible? Yes. Pilots routinely turn a 30-year mortgage into a 15-year payoff by: ✔ Adding extra principal each month

0

0

Wisdom From the Backseat: The Day My 11-Year-Old Reminded Me What Really Matters

About six months ago, I was driving with my 11-year-old son, talking through some opportunities I’m considering. I asked for his thoughts. Without hesitation he said: “Money is a great servant but a horrible master.” From the backseat, Eleven years old. And he meant it. It stopped me, not because the phrase was new, but because he understood it. I told him he was right. Then I shared something I rarely talk about: My company quietly sponsors veterans for mental-health treatment. No spotlight. No posts. Just the mission. We talked about impact, about doing meaningful work, and about how money can support the mission—but should never be the mission. And it reminded me of something every pilot knows: Your purpose is your heading. Your values are your instruments. You don’t have to wait to live that out. You lead with your values—right now. Even in the car. Even at 11 years old. Share your why with the people you love. Money is the tool. Mission is the goal. Supporting service members has always been my North Star.

0

0

Man, with what we make… I should be able to afford a whole lot more than I do

A few months ago, I was sitting in a crew room listening to two pilots talk about bases, upgrades, and pay bumps. Nothing unusual. But then one of them said: “Man, with what we make… I should be able to afford a whole lot more than I do.” That line stuck with me. Because honestly… I'd had the same thought before. Have you ever looked at your pay scale, your base, your schedule, and quietly wondered: Am I actually building wealth the way I SHOULD be at this stage of my career? If you’ve ever had that question — so did I. And I started noticing something interesting: Two pilots with the same paycheck can have completely different levels of affordability, savings, and long-term stability… depending on seat, base, and timing. When I started comparing real data across FO → Captain paths…The differences were honestly surprising. So I put together something special: A fully filled-out example of the tool The Pilot Wealth Snapshot so you can see EXACTLY what your own numbers could look like Zero Forms. Zero spreadsheets. Just clarity.

1

0

1-10 of 21

@steve-ton-7074

Mortgage Broker/ Owner. Aviator Home Loans.. Help Pilots buy homes.

Active 5h ago

Joined Sep 19, 2025

Powered by