Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Memberships

LetsGetFunded Starter (Free)

16.7k members • Free

Capital Connectors

2.7k members • $500/month

FI Investors

367 members • Free

Seller Underground

338 members • Free

One Rental at a Time

511 members • $20/m

Multifamily Strategy Community

2.5k members • Free

ClickUp Masters

241 members • Free

10 contributions to Multifamily Strategy Community

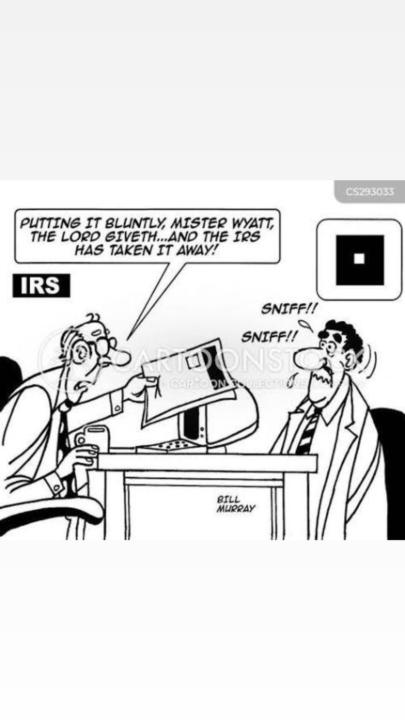

Anyone else feel like this?

If you are not yet a real estate professional, NOT paying the IRS 50% of what you make is a great reason to work towards that designation!!! Saves me hundreds of thousands of dollars a year.

Closed! 25 pad RV park

The life events keep coming! I’ve just closed on a 25 pad RV park deal, taking my most aggressive stride forward in real estate. A lot of firsts for me on this one - First time using a creative financing structure, first commercial property, first time doing anything with RVs. This deal explodes the size of my portfolio and builds out my knowledge and confidence. The park needs a lot of work, but that’s also the opportunity. Ask me how it’s going 6 months from now 🙃

Who would come if I did a MFS meet up in Dallas?

Curious how much interest would you all have in a monthly meet up in a MFS meet up in Dallas? If I booked a spot in Dallas who would want to make it down????

Beta Test of Osgood

Custom GPT has been in the works for a while. launching this for Y'all. Before we launch it i need your help top break it - Have it evaluate your deal, summarize an OM, write an LOI, create critical timelines based on your PSA, or just ask questions about creative finance. We have been training this thing for weeks to absorbs all of my content from the last 5 years. I want to see who can find the problems with it so we can make it better for launch. Until then I give you all free access to "Osgood" https://chatgpt.com/g/g-68b4c9d06f04819184c7fd8d8fc1e9a4-osgood

Major MFS upgrades with Regional groups

It's become a parent that we need to upgrade our community features in the multifamily strategy Mentorship. We are starting to work on regional groups. These groups will have community leads and will help with specialized market knowledge, as well as encouragement and guidance for the MFS Mentorship. Community leads will have been part of the mentorship program successfully purchased deals, and love teaching and building community. We hope to have these launched by year end. The 5 communities we are starting with are: 1. Northeast • States: ME, NH, VT, MA, RI, CT, NY, NJ, PA • Why: Dense urban markets (NYC, Boston, Philadelphia), older housing stock, heavy regulation, and strong rent demand. • Leader Focus: Navigating rent control, high competition, and redevelopment of older assets. ⸻ 2. Southeast • States: DE, MD, DC, VA, NC, SC, GA, FL, AL, MS, TN, KY, WV, AR, LA • Why: Rapid population growth, strong inbound migration, landlord-friendly laws, Sunbelt hotspots like Atlanta, Charlotte, Nashville, and Florida markets. • Leader Focus: Growth markets, new construction opportunities, and institutional capital flows. ⸻ 3. Midwest • States: OH, MI, IN, IL, WI, MN, IA, MO, KS, NE, ND, SD • Why: Affordable entry points, steady cash flow, lower volatility, legacy manufacturing cities seeing revitalization (Cleveland, Detroit, Kansas City). • Leader Focus: Value-add opportunities, stable workforce housing, and secondary/tertiary markets. ⸻ 4. Southwest • States: TX, OK, NM, AZ • Why: Explosive growth in Texas metros (DFW, Austin, Houston, San Antonio), energy-driven economies, landlord-friendly laws, and strong population inflows. • Leader Focus: Scaling portfolios quickly, development opportunities, and creative financing in competitive markets. ⸻ 5. West • States: WA, OR, CA, NV, CO, UT, ID, MT, WY, AK, HI • Why: Coastal powerhouses (Seattle, San Francisco, Los Angeles) mixed with high-growth inland states (Utah, Idaho, Colorado). Regulatory environments vary widely, but strong appreciation potential.

1-10 of 10

@rebecca-seaman-7520

The only think holding you back is knowledge and courage

Active 2d ago

Joined Jul 24, 2025

INTJ

Powered by