Activity

Mon

Wed

Fri

Sun

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

GovconOS

9k members • Free

Searcher School

161 members • $99/month

Career Coaches Community

774 members • Free

Elevated Tech

541 members • Free

Remote Job Accelerator

699 members • Free

5 contributions to Remote Job Accelerator

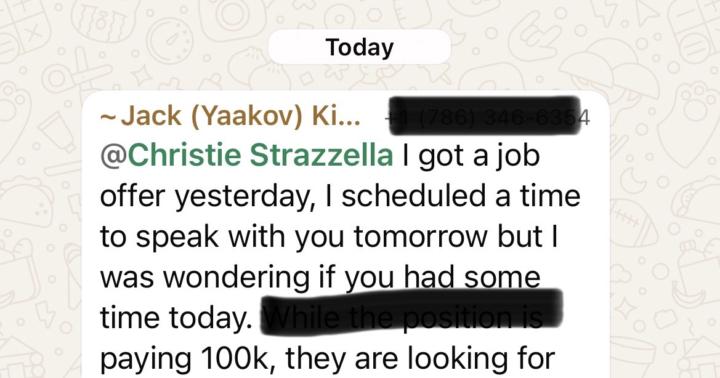

Jack Kimmel, Marketing Manager, getting a strong 100k offer!

Such a great win!

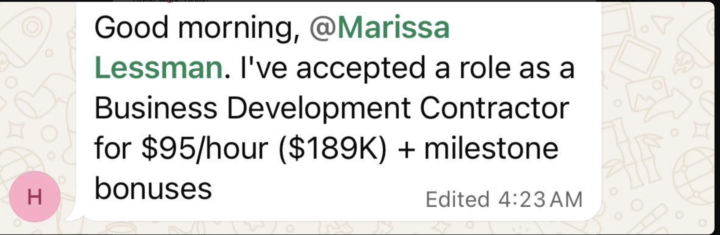

Holly, Director of Business Operations, landed a $189K role!

Great work, Holly!

Are we the next Argentina? top 5 economy --> 50% poverty

In 1913, Argentina was the place you moved to for opportunity. Top 10 GDP per capita. Massive immigration boom. Ahead of Germany and France. Nearly toe-to-toe with the U.S.¹ Today? Over half their kids live in poverty. The currency’s a meme. And 9 sovereign defaults later, investors treat it like their toxic ex who keeps saying “they’ve changed”²⁻⁴. Argentina isn’t an outlier, it’s what happens when a country ignores compounding debt, prints to delay the pain, and convinces itself there’s always more time. And if you zoom out, you’ll realize: America is on the same curve. Just further to the left. T his isn’t some far-off hypothetical. If we look at the math & the data, it’s the logical outcome of policies we’ve already put in motion. In the next 5 minutes, we’re going to unpack: - What really broke Argentina - Where the U.S. sits in that same cycle (spoiler: we’re on Step 4 of 7) - What happens next if nothing changes - And the only playbook that actually puts you ahead, not just afloat Let’s get surgical. The Debt-Inflation Spiral, in Plain English Here’s the loop Argentina couldn’t escape: 1. Spend more than you make 2. Borrow to fill the gap 3. Hit the borrowing wall 4. Start printing 5. Spark inflation 6. Elect populists who promise to “fix it” with more spending 7. Collapse confidence Sound familiar? We’re already at #4. - **U.S. debt-to-GDP: 123%**⁵ - **Annual deficit: $2T+**⁶ - Interest payments now > Medicare or Defense⁷ - And most people still think buying more ETFs will fix it If you’ve ever heard the phrase “slowly, then all at once,” This is the “slowly” part. Inflation: The Slow Leak That Sinks the Boat The U.S. isn’t going to announce a default. We’ll just do what we’re doing now: print to stay solvent. And that means the default happens through your wallet. The numbers: - At 3% inflation → You lose 25% of your dollar’s value in 10 years - At 5% → You lose 62% in 20 years⁸ - At 7–13% (1970s levels) → You’re cooked

Want a referral to Google?

I have a recruiter friend at Google, they're hiring for all the positions on the link below. https://www.google.com/about/careers/applications/jobs/results#!t=jo&jid=127025001& If you'd like a referral at any of these, all you need to do is be a member of our Scale Your Salary program

1-5 of 5

@nathan-platter-8810

High-Performing Data Analyst ||

Podcast Author + Maker ||

Giving "Lightbulb Moments" ||

Life-Simplifier → get stuff done with pronto results

Active 16d ago

Joined Jun 19, 2025

ENFP

Chanhassen, MN

Powered by