Activity

Mon

Wed

Fri

Sun

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Owned by Delaney

Land your next 6-figure remote role in 90 days with an AI-driven job search strategy.

Group for all active members of the Scale Your Salary program.

Memberships

Elevated Sales Training

24 members • Free

AI Automation Made Easy

13.1k members • Free

Anxiety Recovery Blueprint

3.7k members • Free

Ads For Coaches

8k members • Free

AI Automation Agency Hub

297.8k members • Free

Skoolers

190.4k members • Free

YouTube Growth Engine

435 members • Free

OSA ELITE Group

35 members • Free

51 contributions to Remote Job Accelerator

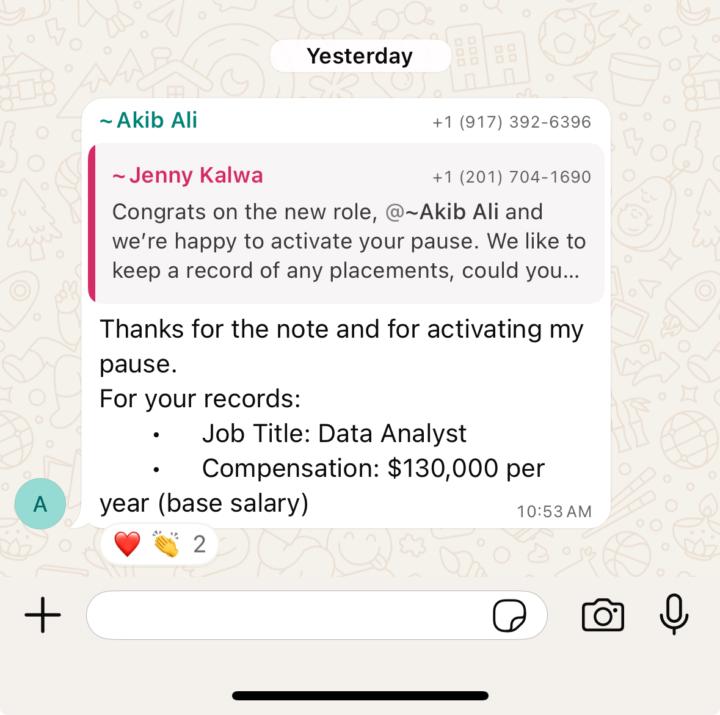

Congratulations to Michelle Bippus for accepting a Senior FinTech Consultant position!

Great work landing a ~$100k position!

Welcome to the Remote Job Accelerator 😎

Welcome to the Remote Job Accelerator😎 We are pumped to have everyone here in one place to either land your dream job, revamp your resume, get a raise, or stack multiple corporate jobs. As a brand new member of the RIL, I want to go over a bit of housekeeping real quick… Rule #1: Before asking ANY questions in the group make sure to use the search bar at the top of Skool for posts, comments, or classroom videos. Rule #2: Have fun and be respectful to our team and ALL members! This is an obvious one to point out but I want to make it super clear that this is a place where everyone is supported no matter where you are in your career. Now I need everyone to introduce yourself down below on this post in the comments section. Tell everyone where you are from, your current career situation, and what your goal is for being in the DJM! 👇GO COMMENT NOW 👇

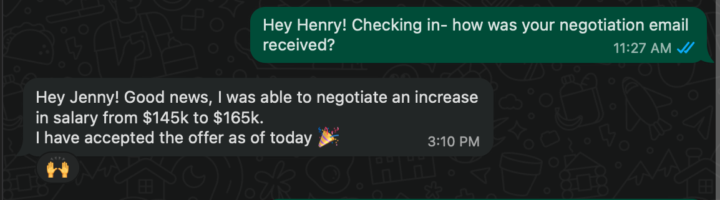

Congrats to Henry, with a $165k Senior Product Manager offer!

Way to tactfully negotiate a 10%+ increase- rock star! 🚀

(Lesson 5 Help) Questions on the lesson above?

Drop them in the questions below to get support from your coaches.

0 likes • Sep '25

@Blake Rutherford Hey Blake, apologies about that. We used to be able to provide that for free, but now with the scale of how many people access this course the account has broken and we are no longer able to provide it to everyone for free. You will have to get that service for yourself.

1-10 of 51

Active 1d ago

Joined Aug 17, 2024

Powered by