Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Owned by Matthew

Welcome to Phoenix Homebuyer Launchpad! 🏡 This is your go-to community for all things related to home buying.

Memberships

Arizona Entrepreneurs

806 members • Free

One True Calling

53 members • Free

13 contributions to Phoenix Homebuyer Launchpad

Weekly recap

This week's recap! Rates had a pretty decent week, bounced up a little today. Let's focus on the real estate side of the market. Post Covid we saw about 5,000 sales per month. People are saying no one is buying homes, which is factually incorrect. In September there was a 10% increase with nearly 6,000 homes closing. Rates are slowly coming down, and for the first time we are seeing the number of transactions increase. It's just one month, but this may just be the start of that shift with rates improving. Feel free to leave a comment or a question.

0

0

They did it!

So excited for our buyers! We managed to close 9 days ahead of schedule and they walked away with $10,000 in incentives. This was THE home for them and we were beyond excited to make it happen for them! Running a special for November closings - free appraisal and home warranty. Inquire for full details!

0

0

Incentives

We want to help keep your expenses down when buying. Close in November & get a free appraisal and home warranty. Fine print below-

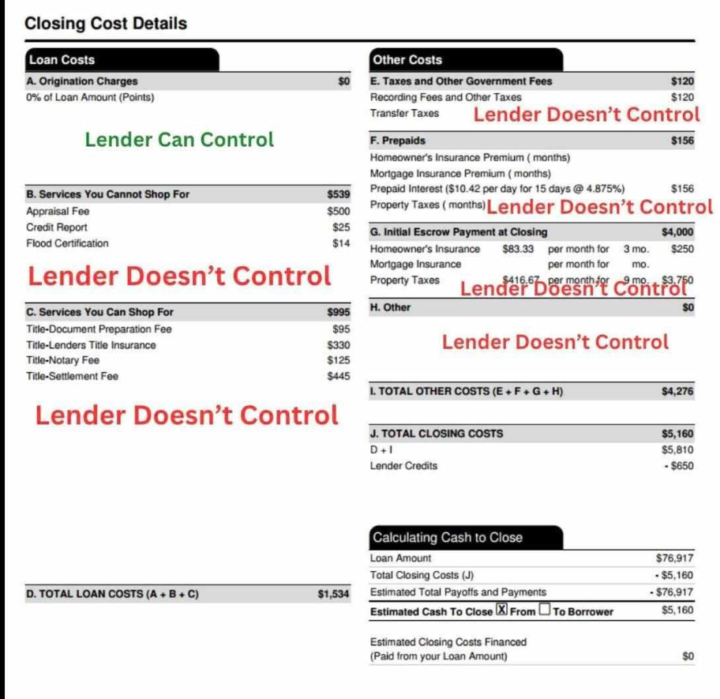

Loan Estimate

𝐋𝐞𝐭’𝐬 𝐓𝐚𝐥𝐤 𝐂𝐥𝐨𝐬𝐢𝐧𝐠 𝐂𝐨𝐬𝐭𝐬 Ever looked at a Loan Estimate and wondered: “What part of this does my loan officer actually control?” Here's the real deal: 𝐖𝐡𝐚𝐭 𝐈 𝐜𝐚𝐧 𝐜𝐨𝐧𝐭𝐫𝐨𝐥: → Origination fees (in this case, $0! ) As your loan pro, I fight to keep this cost LOW (or eliminate it when I can). 𝐖𝐡𝐚𝐭 𝐈 𝐜𝐚𝐧’𝐭 𝐜𝐨𝐧𝐭𝐫𝐨𝐥: → Appraisal, credit report, flood cert fees → Title company and attorney charges → Homeowner’s insurance → Taxes, prepaid interest, escrow set-up → Pretty much all the "other costs" 𝐖𝐡𝐲 𝐭𝐡𝐢𝐬 𝐦𝐚𝐭𝐭𝐞𝐫𝐬: You deserve transparency. Many of these numbers come from third parties, NOT the lender—but they still end up on your estimate. That’s why working with a loan officer who will break it down for you (like me ) makes all the difference. DM me if you want a second set of eyes on your Loan Estimate

0

0

Already a homeowner??

Refinancing coming back? You bet! Saved a client $530/month on their home loan today.

0

0

1-10 of 13

@matthew-coates-2844

Matthew Coates 💵• Creating Mortgage Solutions ✝️• Grounded in Faith 👨👩👦👦• Husband, Father & AZ Native 🎾•Tennis Enthusiast 🎭• Theatre Buff

Active 20d ago

Joined Jun 5, 2025

ISTJ

Phoenix, AZ

Powered by