Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Owned by Maarten

Een community vol jongeren die gelukkig zijn door aan hun mentale en fysieke gezondheid te werken... kom eens dag zeggen.

Memberships

8 contributions to Bitcoin

🥈 Silver vs ₿ Bitcoin: Don't Fall Into The Switching Trap

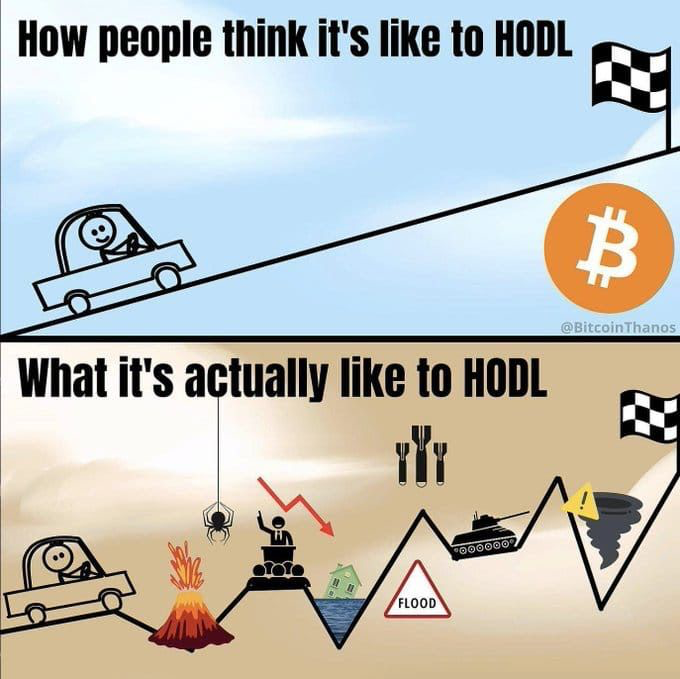

The Silver Opportunity ⚡ Silver can absolutely do well in the coming year. When fear rises and money gets debased, precious metals get a bid. I'm not here to trash silver – it has real utility and has protected wealth for thousands of years. But here's what you need to understand: Silver is not the end game. Bitcoin is. ⚠️ The Deadly Trap Most Investors Fall Into --------------------------------------------------------------------- Here's where people get wrecked. Jumping from one horse to another to chase short-term gains feels smart. You see silver pumping and think you're being tactical. You see Bitcoin dipping and think you're being disciplined. Until you fall off and get trampled. 🐎💥 Most people lose money not because they pick the wrong asset, but because they switch too often at exactly the worst time. They sell the bottom, chase the top, and end up with less than if they'd just stayed put. The wealth isn't made by those who jump around. It's made by those who ride the right horse all the way to the finish line. 💡 My Practical Take for 2025 ------------------------------------------------ If you want to put a small percentage of your emergency fund into silver? Fine. Do it smart: ✅ Physical bars only – no paper, no futures, no ETFs ✅ No leverage – own it outright ✅ No paper promises – if you can't hold it, you don't own it But make a rule right now: 📅 At the end of 2025, rotate back into Bitcoin. Promise yourself you will buy Bitcoin in November 2025 when it usually starts that slow grind higher and everyone is still asleep. Set a calendar reminder. Make it non-negotiable. Silver can be your trade. But don't let it become your prison. 🏆 Why Bitcoin Wins Long Term --------------------------------------------------- Let's get real about the fundamental difference: Silver's Limitations 🥈 - Requires third-party trust again - Storage costs and security risks - Verification requires expertise - Transport is expensive and risky - Settlement requires middlemen - You're back to trusting the same people who have lied time and time again

What Does “Progress” in Bitcoin Actually Look Like for You Right Now?

When you say you’re “working on Bitcoin,” what does that mean in practice right now? For some people it’s: - learning the basics - setting up wallets properly - mining or earning small daily amounts - just staying consistent instead of jumping around There’s no right answer — just different stages. Where are you currently focused, and why that stage right now? Would be interesting to see how different everyone’s paths look. 👇

Bitcoin is quantum-safe!

If you follow the rules that wallets already enforce. There’s a lot of noise around “quantum computers breaking Bitcoin.” The reality is more boring (and more reassuring): 👉 Bitcoin remains quantum-safe if you use it correctly. Most risk only appears when users ignore best practices. The two big rules 👇 -------------------------------- 1️⃣ Never reuse addresses after you spend from them - Once an address is spent from, its public key is revealed on-chain - Reusing that same address again could expose it to future quantum attacks - Modern wallets already generate a fresh address every time — let them Rule: ✅ Receive → Spend → Never reuse that address again 2️⃣ Never give out your xpub (extended public key) unless you fully understand why - An xpub allows someone to: - If someone asks for it casually, that’s a red flag 🚩 Best practice: ----------------------- - Only use xpubs for dedicated payment systems - Create a separate wallet with: - Never mix it with your long-term savings wallet If you don’t know what an xpub is — that’s fine. Just know there’s no reason to share it unless you’re intentionally running a payment setup. The takeaway 🧠 --------------------------- Bitcoin doesn’t fail because of quantum computers. Bitcoin fails when users reuse addresses, overshare keys, or mix wallets improperly. Follow wallet defaults. Segregate roles. Don’t leak information. That’s it. If you want to go deeper on this topic, check out davincij15.com for more. Stay safe. Stack smart. 🟠

The Tale of Two Savers: A 10-Year Journey

Meet two friends, both 30 years old, both sitting on $100,000 in savings. They're standing at a crossroads that will define the next decade of their financial lives. Sarah buys the dream home. ---------------------------------------------- She finds a $500,000 house. Perfect neighborhood, good schools nearby, everything she imagined. She puts down her $100,000, takes a $400,000 mortgage at 7%, and settles into homeownership. Her monthly reality becomes: - $2,661 mortgage payment - $417 property taxes - $150 insurance - $417 maintenance fund Every month, $3,645 leaves her account. She's building equity, she tells herself. This is the American Dream. Marcus takes a different path. ------------------------------------------------- He takes that same $100,000 and buys Bitcoin. He rents an apartment for $2,500 a month, but here's the key—he still has that $1,145 difference between what Sarah pays and what he pays. Every single month, that $1,145 goes into more Bitcoin. He's betting on 25% annual growth. Aggressive? Yes. Impossible? History says no. Fast forward 10 years. ------------------------------------ Sarah decides to sell. Her home appreciated 3% annually—solid, respectable growth. It's now worth $671,958. But there's still $343,250 left on that mortgage. After paying 6% in selling costs and settling the loan, she walks away with $288,391. Not bad, right? She more than doubled her initial investment. Marcus opens his Bitcoin wallet. ----------------------------------------------------- $1,785,077. He stares at the number. Six times what Sarah made. And unlike Sarah, he could have accessed that money at any point over the decade. No selling costs. No mortgage to settle. Pure liquidity. The brutal math nobody talks about: ----------------------------------------------------------- In Sarah's first five years, nearly all her mortgage payments went to interest. The bank got rich while her equity barely moved. She was trapped—not just in the house, but in the payment. One bad month at work? She's not just behind on rent, she's risking foreclosure.

1-8 of 8

Active 16h ago

Joined Jan 18, 2026

Powered by