Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Owned by Strata

A futures day trading community focused on market structure, price levels, and why moves happen – not signals or trade calls.

Memberships

4 contributions to Strata Market Structure Lab

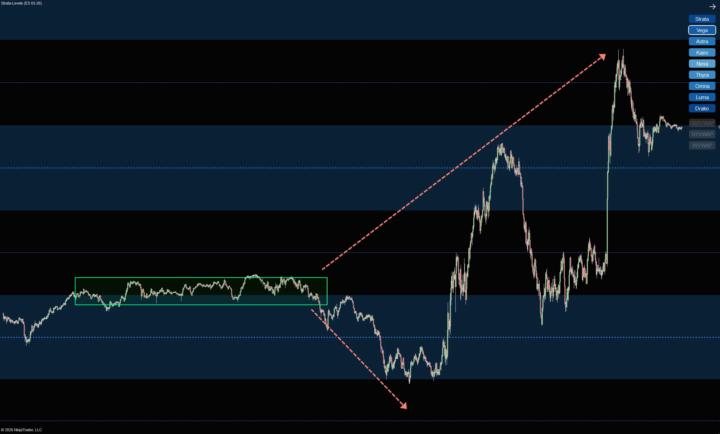

Compression → Expansion Example

This sequence starts with tight compression. Price spent time coiling into a narrow range, overlapping candles, and reduced follow-through. That’s usually a sign the market is storing energy, not going dormant. When structure finally gave way, price expanded quickly out of the range. The initial break moved down, accelerating as stops were triggered and liquidity was taken. But the key wasn’t the direction — it was the expansion itself. Once that downside expansion ran out of fuel, price reversed and expanded even harder in the opposite direction. That secondary move was the real release of energy, not the first push. This is a common pattern in day trading: compression builds energy, the first break clears liquidity, and the true expansion comes after structure resets. Learning to recognize this sequence is more important than predicting which side breaks first. No signals. Just structure and context.

Why This Breakout Failed

At first glance, this looked like a clean break of the prior day’s low. Price pushed below the level, momentum picked up briefly, and it looked like continuation was underway. But structurally, this was a low-quality breakout. The prior day’s low was sitting inside a broader area of balance, not at the edge of expansion. When price broke below it without strong follow-through, sellers quickly ran out of fuel. As selling pressure stalled, late shorts were forced to cover and price rotated back into range. This is a common day trading trap, especially around prior session levels. A break alone isn’t enough — context matters. Without expansion away from structure, breaks often fail. This type of behavior is visible ahead of time when structure is mapped and understood. The goal isn’t to predict the move, but to recognize when a breakout is vulnerable. No signals. Just structure and context.

Why Price Stalled Here

Price didn’t stall here randomly. This area lined up with a predefined structural zone inside a higher-timeframe balance. As price approached it, momentum slowed, follow-through weakened, and rotation started to show up almost immediately. What’s important here isn’t the exact level — it’s the context. When price pushes into structure without expansion behind it, stalling is often the first sign that the move is running out of energy. This is a common behavior in day trading, especially when traders are chasing a move late and ignoring where price is relative to structure. Zones like this are mapped ahead of time in the Strata framework and plotted live in the StrataLevels tool. The value isn’t predicting the move — it’s knowing where reactions are likely before price gets there. No signals. Just structure and context.

📌 Start Here — Read This First

Welcome to Strata Market Structure Lab. This community exists for one reason: to help futures traders understand why price reacts where it does. Not signals. Not trade calls. Not hype. ✅ What this community is Inside here, I’ll share: - Annotated chart breakdowns (NinjaTrader) - Examples of failed breakouts, traps, and reactions - Explanations of market structure and price behavior - Weekly “why it reacted here” style posts Everything is focused on context and structure — how the market is actually moving under the surface. ✅ What this community is not You will not find: - Buy/sell signals - Entries or exits - Indicator downloads - Settings or scripts - “Just follow this trade” content That’s intentional. The goal here is to help you see the market more clearly, not to copy trades. ✅ About the indicators The charts and explanations shared here are derived from the same framework used in my indicators: - StrataLevels - Level-Force - Flux-Levels - VWAP Percentage Levels - Candle Countdown Flag Those tools are sold and supported on my website, not inside this community. 👉 https://StrataLevels.com This space is where I explain the why.The indicators are the how, plotted live in real time. ✅ How to use this community If you’re new: 1. Browse the chart breakdowns 2. Study the structure examples 3. Read the weekly reaction posts If you’re already a customer: - Feel free to ask questions - Chime in on structure discussions - Help keep this place grounded and practical No hype. No pressure.Just clean structure and real charts. Glad you’re here. Strata-Levels Team

1-4 of 4

@levels-strata-6992

I break down market structure so traders stop guessing.

NinjaTrader • structure-first 📈

Free market structure breakdowns 👇

Active 1h ago

Joined Feb 2, 2026