Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Owned by Jackie

Financial literacy, How to repair your own credit

Memberships

Radikal Marketer (FREE GROUP)

412 members • Free

Radikal Mentorship

1k members • $1,497

Coffee Sometimes Tea Marketing

57 members • Free

Skoolers

190k members • Free

Credit Gems Community

718 members • Free

TS

Trucker School

26 members • Free

Credit Accelerator ⚡

205 members • Free

E-commerce For Beginners

1k members • Free

328 contributions to Credit connector

Chase Partners with Nova Credit...How it will affect Underwriting, Approvals & More! #JeffFormanRepost 🔥

Nova Credit Solutions to be Utilized by Chase | Nova Credit Chase Bank vs. FICO: LLC Owners Use This New Rule to Get Funding

Super Sound Credit Advice... #ListenUp🦻🏾

5 Things To Never Write On A Credit Card Application 9:51

Truist Personal Credit Soft Pull Tool

They do a soft pull from Equifax (keep TU/EX locked) to see if you qualify with no effects to your credit score. 💯🙏🏽 Creditcard Truist Bank is headquartered in Charlotte, North Carolina. The bank operates branches in the following states: - Alabama - Florida - Georgia - Indiana - Kentucky - Maryland - North Carolina - New Jersey - Ohio - Pennsylvania - South Carolina - Tennessee - Texas - Virginia - West Virginia They also have branches in Washington, D.C. 💯🙏🏽

Real Time Updates on Credit Data Points for Approval...as They Happen! 🔥

User Credit Card Results & Success Stories | Real Reviews - Help Me Build Credit

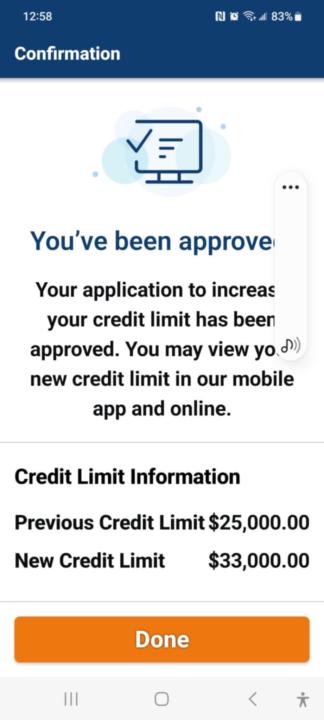

Navy Federal Credit Union CLI (Platinum Card)

NFCU had an app update on my phone, so I did it and went to see if I need to use my pin or fingerprint to access. Once in my account, I said let's see if they will increase my card limit (all CRAs are frozen). BAM...$8K increase in less than 2 minutes, went from $25K to $33K! In app, no hard pull. 🤑💯🙏🏽

1-10 of 328

@jacqueline-lavielle-8486

Hi, my name is Jackie I live in Miami. I am very excited to see where this mentorship takes me.

Active 94d ago

Joined Jan 5, 2024

Powered by