Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

What is this?

Less

More

Owned by Hassan

Global experts helping you enter the world's most elite finance careers. Highest salary @ 21 $180,000 | HF, PE, VC, MBB

Learn the frameworks that win offers: PEAL-X™ • PEAL-3™ • STAR-3® (Law) and IB fundamentals (e.g., DCF). Lessons, drills, and replays.

Memberships

378 contributions to Elite Careers Strategy Gateway

Our frameworks generate outcomes at elite US firms

Free ECS content has already helped some people go from rejection to offers at top firms. If that’s what free can do, imagine what happens when we: – set your exact targets, – tear down and rebuild your answers, – and drill you on mocks until you sound like someone they actually hire. Free = frameworks. Paid = getting pushed to offer level.

0

0

2,500+ Members from McKinsey, Oxford, Stanford, and LSE! [Introduce Yourself]

Welcome all! You’re now part of a global community with students from the world’s most elite universities. We're in beta stage, and already have members here from These include the University of Oxford, the London School of Economics, and Stanford Business School 💪 This community has been up for only 4 months and we've passed 1000 members Reply to this post with a brief intro to you Who are you? Where are you studying? What career would you like to pursue? And also what content would you like to see added?? (as we're still in beta at the moment) To re-introduce myself I'm Hassan, an ex-corporate recruiter, I'm here to help you enter elite careers like Investment Banking, Corporate Law, Venture Capital, Private Equity amongst many others. Any questions? Please make a post here and ask! If you'd like to enquire about the 1-1 waiting list please DM me or one of our admins and they'll provide you with the details 😁

![2,500+ Members from McKinsey, Oxford, Stanford, and LSE! [Introduce Yourself]](https://assets.skool.com/f/1ee54dc8e72e49c5ba2306da5924981a/9a6764a3f9cd49728415a23fea297a2686a16292a1a44fcbba161a520e96c725)

If I wanted a Training Contract at Paul, Weiss London, starting from zero, here’s exactly what I’d do.

1️⃣ Decide if Paul, Weiss is really my game. I’d study their London growth story and ask if I want a career built around private equity, public M&A, restructuring and high-stakes litigation, not mid-market generalist work. 2️⃣ Treat the vacation scheme as the only door. I’d plan backwards from the vac scheme, because it is the pathway to the Training Contract, with assessment primarily during those two weeks. 3️⃣ Build a PE-first commercial awareness plan. Every week I’d track at least three PE-backed or public-company deals where Paul, Weiss or its direct competitors are on the ticket, then break them down using PEAL-3® so I can talk valuation, capital structure and exit routes, not headlines. 4️⃣ Rewrite my CV using VTMR™. Every line would be Verb–Task–Metric–Result, with bullets that look like junior-associate work: fund modelling, credit analysis, transactions, advocacy. That is how you get taken seriously by a team built around Europe’s leading PE partners. 5️⃣ Build a Paul, Weiss-only PEAL-X® bank. I’d write at least four PEAL-X® answers where every sentence has a Paul, Weiss fact: London trainee intake size, NQ salary c. £180k, core seats (Antitrust, Finance, Funds, M&A, Restructuring), and their recent lateral hires from Kirkland, Magic Circle and A&O Shearman. 6️⃣ Engineer my story with STAR-3®. I’d script ten STAR-3® answers that prove I can operate in lean, high-pressure teams: decisions made, risks taken, quantified results, and reflection on how that transfers into cross-border PE work. 7️⃣ Reverse-engineer the recruitment funnel. I’d map every step: online form → interview → vac scheme → partner interview, numeracy test and presentation. Then I’d rehearse those three vac-scheme assessments under timed conditions until they feel routine. 8️⃣ Lean into the “entrepreneurial mindset” filter. Because Paul, Weiss explicitly wants self-starters in a differentiated, fast-growing London office, I’d choose examples where I built something from scratch, not just followed instructions.

What most students at elite universities get wrong about elite law applications.

They treat their university brand as the strategy. Firms don’t. Here’s the reality (and what you should actually do): 1. Firms recruit for outcomes, not optics. Slaughter and May hires from 70+ universities . White & Case says 80% of its trainees come via vacation schemes — not brand-name CVs . Your task is to prove you can deliver under pressure. Action: Show proof of outcome — quantify your achievements using the VTMR™ Formula (Verb–Task–Metric–Result). 2. Generic answers kill applications. Recruiters at Linklaters and White & Case openly reject cover letters that could be copy-pasted to another firm . Action: Apply the PEAL-X™ Framework. Every sentence must contain a firm-specific fact — a deal, client, ranking, or sector. 3. Commercial fluency beats academic polish. Clifford Chance explicitly values intellectual agility and the ability to discuss commercial issues, not just legal theory . Action: Train with STAR-3™ — structure competency answers around Situation, Task, Action, and 3 Results (deal, client, and personal outcome). 💡 At City Careers Coach, this approach has delivered a 95% offer benchmark across flagship clients — including White & Case, Ropes & Gray, and Sidley Austin. University prestige may open the inbox. Framework-based execution secures the offer.

0 likes • 13d

@Wendyl Luna Hi Wendyl, we only focus on Big Law within London or New York. Which geography are you seeking? Please see our past clients there (all under NDA, consent granted): https://www.citycareerscoach.com/post/case-study-ropes-gray-from-non-russell-group-ccd-to-vacation-scheme-tc. Thanks, Online Team

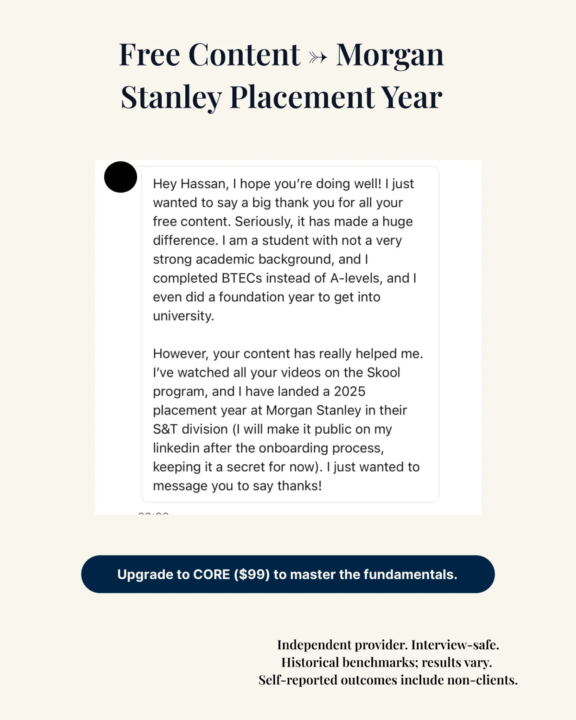

Free Content → Morgan Stanley Placement Year (S&T Division)

Proof that access isn’t the issue — structure is. PROOF: • Secured a Morgan Stanley S&T Placement Year (2025) using free ECS content alone. • Candidate had BTECs + Foundation Year, no A-levels or traditional finance background. • Learned to structure motivation and delivery using PEAL-3™ and STAR-3™ frameworks. METHOD: We train candidates to think and write like future analysts — not applicants. Every framework breaks complex recruiter logic into replicable steps: motivation, delivery, and evidence. — Elite Career Strategy™ — training-only; public facts; no guarantees; interview-safe. This candidate came from a non-traditional academic path — BTECs, foundation year, and no early exposure to finance. After applying the principles taught in ECS free content — structuring answers through PEAL-3™ and building story precision with STAR-3™ — they secured a 2025 Placement Year at Morgan Stanley in Sales & Trading. Proof: When you apply the right method, background stops mattering.

1

0

1-10 of 378

@hassan-akram-7877

Ex-IB/PE/VC & corp-law recruiter • (95 % offers, 15 countries) • Harvard/MIT/Yale speaker • Times of India columnist

Active 18h ago

Joined Mar 7, 2024

London

Powered by