Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Memberships

TGE

754 members • Free

47 contributions to TGE

RDW 18% on the day

S&P 500 is boring today. But $RDW is the real one. The current position is up 28%. Here's the catch. The monthly momentum is weakening on the sellside. This can truly be a great trade in the next 6-12 months.

Year-End Reset & 2026 Goals

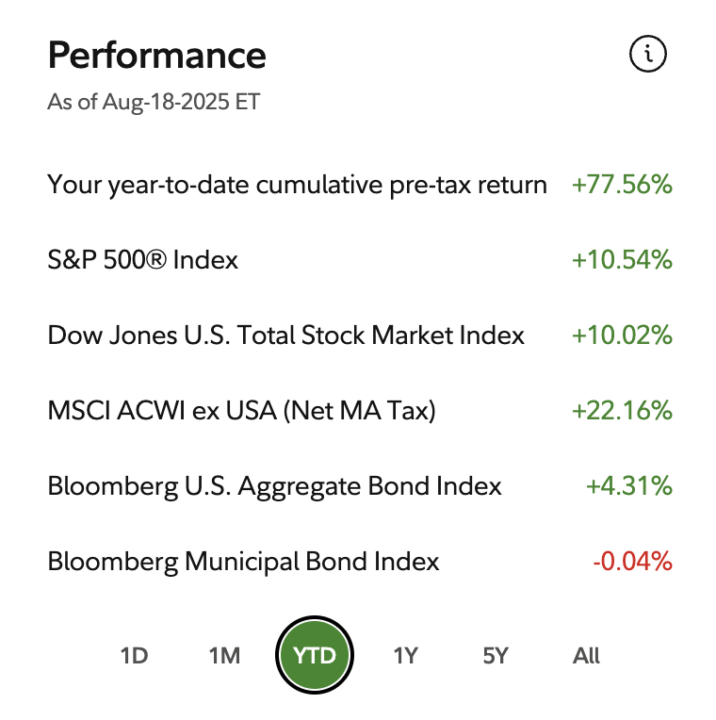

I'll be stepping away until after the New Year to reset and spend some time off. Before I do, just want say I hope everyone had a solid YTD performance and actually made money during this crazy year. Curious to hear from you all 👇 What are your trading goals for 2026? Enjoy the holidays and finish the year strong. 💪

7 fast steps to start option trading *Bonus in there*

Thousands of people are stuck in jobs they hate, daydreaming about trading options for freedom — but have no clue where to start. This post breaks down 7 real, practical steps to go from total beginner to confident options trader: ✅ Understand what actually drives option prices (not just indicators) ✅ Learn the Greeks, starting with delta ✅ Paper trade (but only for 30–90 days) ✅ Start small with real money to build emotional discipline ✅ Use tools that show where smart money is moving ✅ Pick one setup and master it If you’re serious about replacing your 9–5, give yourself 6–12 months to learn and build consistency.

2 winners // 2 small losses – Reducing exposure

• TTD calls @ -5% loss ❌ • CMG calls @ -7% loss ❌ • CELH shares sold half @ +54% Gains ☢️ • ZETA shares sold half @ +3.71% Gains 💸 These aren't random exits. They were pat of a bigger plan. Historically, September and October are pullback months of the year, and they tend to be drawdown-heavy periods for the market. Instead of being overexposed, I'm actively reducing risk by closing trades, trimming winners, and taking smaller gains. The goal isn't to avoid trades altogether, but to reduce exposure in certain sectors so I have buying power ready for better opportunities when volatility shakes out. This is the difference between trading a plan vs. just reacting – locking in profits, cutting small losses, and staying positioned to play offense when others are trapped.

AAPL $10.35 ➡️ $19.25 💸

Sold half of position 84% Gains ❤️🔥 When everyone was bearish on AAPL. I was bullish. AAPL around 205, Gextron gave us a buy signal. AAPL is now at 230. IV can helped us and can help you: - Gextron can let you know the next targets over the next 1-3 months. - Option market, where traders are putting real money into what they think will happen. - IV gives you a realistic target and date range for when it could happen AAPL next earning date is mid-October, and here's the kick – it hit the projected target 76 days early. That means IV didn't just give us a "maybe" target..it gave us an actionable, time-bound expectation. And the market delivered even sooner.

0 likes • Aug '25

I know. You guys have been laughing all the way to the bank for the past year while I’m picking up pennies in front of steamrollers. You inspired me to re-double my efforts and get serious about setting up trading view even though it is a subscription. I was watching the trading view video tonight; all stuff I know, but too lazy to implement. That’s a problem…

1-10 of 47

@gregory-fransen-3442

Christian, father, husband, skier, biker and novice trader.

Active 11d ago

Joined Dec 31, 2024

Powered by