Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Memberships

Checkmate The Matrix

541 members • $25/month

50 contributions to Checkmate The Matrix

PIP - help!

In February 2025 I had a review letter saying I'm getting the standard rate of PIP until 2029. However. I did a mandatory reconsideration because I should be on the higher rate. today I received a letter from the Health Assessment Advisory Service. They have booked a PIP assessment for me for 28th January - so not much time! Their reasoning: ' One of our health professionals has looked at the information you sent to DWP, as well as further information they asked for from the people involved in your treatment or care. After doing this, we have decided we need to arrange an assessment with you. this is to help us better understand the impact of your disability, illness or health condition.' So obviously they want to throw me off. However, since they've already confirmed I'm getting PIP until 2029, can they do an assessment AFTER saying I've got it? Last time I had one of these assessments, I went through hell, so struggling to stay calm with this one. The extra info I sent them is things like occupational therapy report, letters from the mental health nurse, etc, solid evidence, so this should not have triggered an assessment. If anyone has been through this same situation, what did you do? Many thanks.

0 likes • 4d

It's about points and wording, they've turned it into a game of chess, have you looked into the descriptors and points? If you fall short you won't get it! Ask Grok for the point and descriptors, outline your condition/disability and instruct it to find you the best points to fit your abilities, they don't actually award it on disability, it's about how your disability affects your day to day life, good luck 👍

Council Tax

Hi Guys Ive been disputing paying my council tax since I moved into my house back in 2022 and I am now following Peters guidance to take the Council to court. I am slightly daunted but determined to keep going! After sending the first letter : Final Legal Review of Equity-Based SARs. I receieved the following response which I am unsure if to respond to this? or to just send the next letter. I would really apprecate any advice particualy if youve been through a similar situation. Thanks in advance. This is the respons:Thank you for your Subject Access Request (attached) that was received on 15 January 2026. Clarification Required We are unable to consider your request in its current form. In order to consider your request under the Subject Access regime, we need you to narrow and redefine your request so that it relates to your personal information. The SAR process provides a right of access to an individual's own personal information; it is not a dispute resolution process nor is it a process for discussing speculative questions relating to determining whether council tax debt collection relies on legally defective liability orders. Please read the information below: Information and assistance on how to pay council tax is published on our website for information and this may be of help to you: Council Tax - Durham County Council Support to help you pay your Council Tax - Durham County Council Please note that the council does not require consent to process your personal data. There are six lawful basis we can use. Depending on the statutory process involved, we rely on 'processing is necessary for the performance of a task carried out in the public interest or in the exercise of official authority vested in the controller.' See Article 6 (e) of the GDPR. You can find the applicable privacy notice on our website here: https://www.durham.gov.uk/dataprivacy

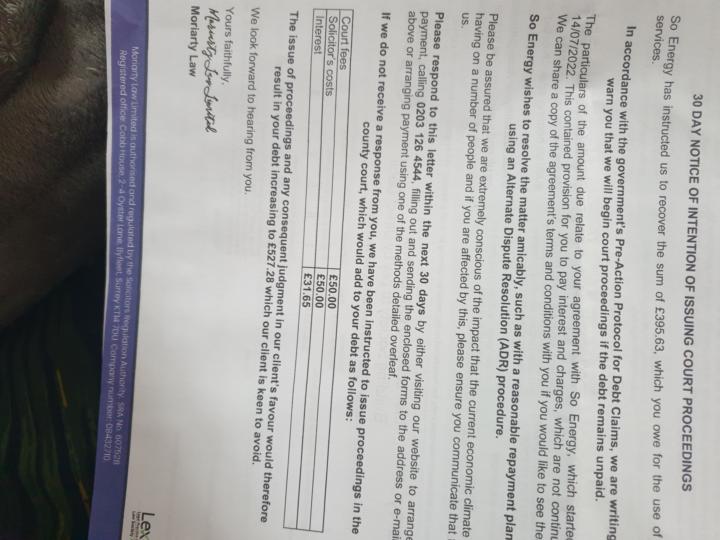

Moriarty law

This company are threatening to raise the cost of my debt to £527.28 if I don't respond! I'm a carer and vulnerable, I'm giving them everything I can afford! We're cold most of the time, Im paying £400 a month to reduce the debt 😭 from other family members, can they do this? They're registered with the solicitors regulatory, I've practically almost to the point of paying it off and they do this

0 likes • 23d

@Dave DimeBar who advised me to do a SAR? Have I missed something 🤔 I have anxiety and ADD and now you're saying you don't have a bot for a breach of contract whilst saying a SAR all the way 🦧 I know you don't give legal advice and it's my fault for going along with it, but I actually went with the advice a few comments on here suggested! Now you're asking why would I do it

1 like • 9d

@Nick Waughman I messed up sending SAR when it wasn't appropriate thing to do 😕 my head's messed up, so I paid it! Other family chipped in, I developed severe anxiety recently to do with other family stuff 😞 I can't cope with the agg not when I'm not feeling grounded! It was a long outstanding amount, I've got enough on my plate atm, thanks for asking

1 like • 10d

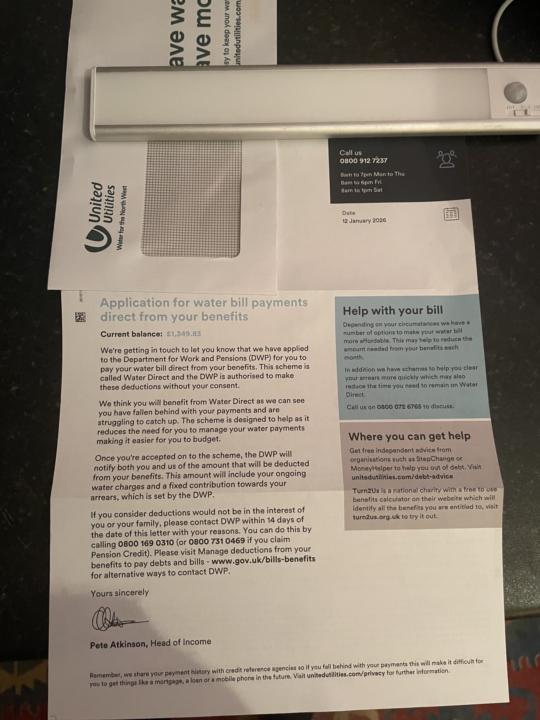

What Grok said... 😞 The letter from United Utilities you received (dated 12 January 2026) is a standard notification about their application to set up Water Direct (also known as third-party deductions) for your water bill arrears and ongoing charges. This is a legal scheme in the UK, and while the wording can feel intimidating or "threatening" (e.g., mentioning deductions without consent, credit reference sharing, or potential future impacts on credit), it is not unlawful or a scam—it's how the system is designed and operates under government rules. Why This Is Legal Water Direct is a formal third-party deduction scheme run by the Department for Work and Pensions (DWP). Water companies (like United Utilities) can apply to the DWP to have fixed amounts deducted directly from certain benefits (e.g., Universal Credit, Pension Credit, Income Support, etc.) to cover water bill arrears and ongoing usage. This helps prevent bigger debt buildup and protects vulnerable people on benefits from disconnection or court action. For water bills specifically, the DWP does not require your explicit consent to set this up in most cases. The company can request it if you've fallen behind, and the DWP can approve and start deductions (up to a maximum of about 25% of your benefit, often less for water). This differs from some other utilities (like gas/electricity ongoing costs on Universal Credit, where consent is now often needed after legal changes). The letter is required to inform you: it tells you the current balance (£1,349.83 in your case), explains the scheme, gives you 14 days to contact the DWP if you object (e.g., if deductions aren't in your/family's interest), and provides contact numbers (0800 169 0310 or others for Pension Credit). This notification step is part of the legal process. Deductions are set by the DWP (a fixed amount for arrears + ongoing charges), not the water company alone, to make payments "affordable" and easier to manage. What Feels "Threatening" But Is Standard

This is why I get utterly confused

The bot on here advised SARS on credit related debt even though I copied the letter, for utility debt 😔 it's proving the wrong direction! I ran the advice off this group, through grok and this is the response - No, this dispute letter is not fully valid or effective under UK law, particularly for a debt from an energy supplier like So Energy, and some demands exceed what debt collectors (even those posing as or being a law firm like Moriarty Law Limited) must legally provide. Key Issues with the Letter Request for "original signed credit agreement" under Consumer Credit Act 1974 (sections 60-65): UK law entitles you to a true copy (often reconstituted) of a regulated credit agreement under sections 77-79 of the CCA 1974, along with a statement of account (for a £1 fee). Creditors need not provide the original signed document, and the copy does not have to be signed or perfectly match the original form (per Carey v HSBC, 2009). Energy debts like unpaid bills from So Energy are not regulated credit agreements under the CCA 1974—they are simple contractual debts for supplied services. The CCA request does not apply here, so this demand is invalid and unlikely to be fulfilled. Request for "valid, unredacted deed of assignment" under Law of Property Act 1925 (section 136): If the debt has been legally assigned (sold/transferred) to Moriarty Law or another party, a valid assignment requires written notice to you, but not necessarily providing the full deed. You can reasonably request proof of assignment (e.g., a copy of the notice or deed) to verify their right to collect, and collectors often provide this in disputes. However, they are not strictly required to provide an "unredacted" version upfront unless pursuing court action. This request is common in dispute templates but not a statutory entitlement in the way phrased. Detailed breakdown of charges and interest: This is reasonable and often provided, especially if you dispute the amount. Under general FCA rules (CONC guidelines), collectors should provide clarity on the debt makeup if requested.

1 like • 25d

@Melanie Lambert I sent what the bot created after it read the letter, there are no discrepancies anyway 🤔 it's a bill I basically can't afford to keep on top of, they know I'm vulnerable 😞 i don't see how a SAR is going to help, I sent one anyway, they're trying to rope me into entering details just to read a response, which I'm not doing obviously! I don't even know what I expected!

1-10 of 50

Active 3d ago

Joined May 2, 2025

Powered by