Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Memberships

Bikimbawdar

1.2k members • Free

مجتمع ن8ن بالعربي

2.7k members • Free

AI for Non-Techies

1.6k members • Free

Master Talent Academy

9 members • Free

مجتمع الثراء الرقمي المجاني

30.3k members • Free

MB USA Academy

748 members • Free

41 contributions to MB USA Academy

Task#4 - تصميم داشبورد سوق العمل في الخليج (للوافدين)

اليوم أحب أشارككم تجربتي في بناء داشبورد تفاعلي احترافي لتحليل سوق العمل في دول الخليج، باستخدام أدوات الذكاء الاصطناعي 👇 🔧 الأدوات المستخدمة Gemini Deep Research في جمع البيانات وتحليل الاتجاهات Gemini Canvas في بناء الداشبورد والهيكلة تحليل بيانات منهجي لتجهيز الجداول، المؤشرات، والـ KPIs تصميم بصري لعرض الأرقام بطريقة سهلة الفهم 📊 خطوات التحليل التي اتّبعتها 1. جمع بيانات حديثة وموثوقة: الرواتب، تكلفة المعيشة، تكاليف السكن، الفيزا، القطاعات المطلوبة… 2. تنظيف وتوحيد البيانات لتصبح جاهزة للعرض. 3. تحليل المقارنات بين الدول (السعودية، الإمارات، عمان، قطر، الكويت، البحرين). 4. إنشاء KPIs أساسية: متوسط راتب الوافد تكلفة المعيشة سهولة الفيزا العائد على الهجرة (ROI) 5. إعداد لوحة معلومات تفاعلية تساعد أي شخص يفكّر بالسفر على اتخاذ قرار واضح قبل خطوات الهجرة أو التقديم على وظائف. 📁 ما الذي يحتويه الداشبورد؟ مقارنة فورية بين دول الخليج أهم القطاعات المطلوبة في كل دولة المهارات الأعلى طلبًا تكلفة المعيشة والسكن والنقل تقييم سهولة السفر والفيزا العائد المتوقع من الانتقال (ROI) نقاط توضيحية مختصرة بدل الرسوم البيانية غير المتاحة 🎯 الفائدة هذا الداشبورد يعتبر مرجع عملي لأي وافد يفكر بالعمل في الخليج، لأنه يجمع أهم معلومات السوق في مكان واحد ويساعد على اتخاذ القرار بثقة وبصورة واضحة جدًا. 🔗 رابط الداشبورد: https://gemini.google.com/share/e2bc50417d22 #AI_Analysis #GulfJobMarket #DataDashboard

MINDRA ADVANCED AI 4th Task Full Analysis For Investing in AI at Google

Evening everyone I wanted to share a quick analysis for anyone interested in investing in AI at Google. I used a 4-step framework: Descriptive, Diagnostic, Predictive, and Prescriptive. 1️⃣ Descriptive (What’s happening now?) - Alphabet’s Q3 2025 revenue: $102.3B ✅ - Google Cloud is growing fast due to enterprise AI demand - Gemini 3 launched across Search, Workspace, and enterprise tools - Capex increased to scale AI infrastructure 2️⃣ Diagnostic (Why is this happening?) - Enterprise AI contracts are driving Cloud growth - AI in products boosts user engagement and revenue - Heavy investment now for future profit - Competition and pricing pressure exist 3️⃣ Predictive (What could happen next?) - Base Case: Cloud grows 25–30%, margins improve gradually - Bull Case: Cloud grows 35–45%, strong AI adoption - Bear Case: Cloud grows 10–15%, margins may compress 4️⃣ Prescriptive (What should an investor do?) - Track Cloud revenue, backlog, Gemini usage, and capex - Conservative: 3–6% allocation, hold long-term - Balanced: 6–12% allocation, dollar-cost average - Aggressive: 12–20% allocation, tactical positions ✅ Key takeaway: Google’s AI strategy is a long-term growth opportunity, especially in Cloud and AI products. Investors should monitor KPIs closely and make data-driven decisions. For the dashboard, I've created 2 dashboards :gemini https://gemini.google.com/share/5dd8cb131c09 and Z ai Please follow this link :Z.ai Code Scaffold - AI-Powered Development, and you can read the full report attached Many thanks 🌸

MINDRA ADVANCED AI 3rd Task prt.2

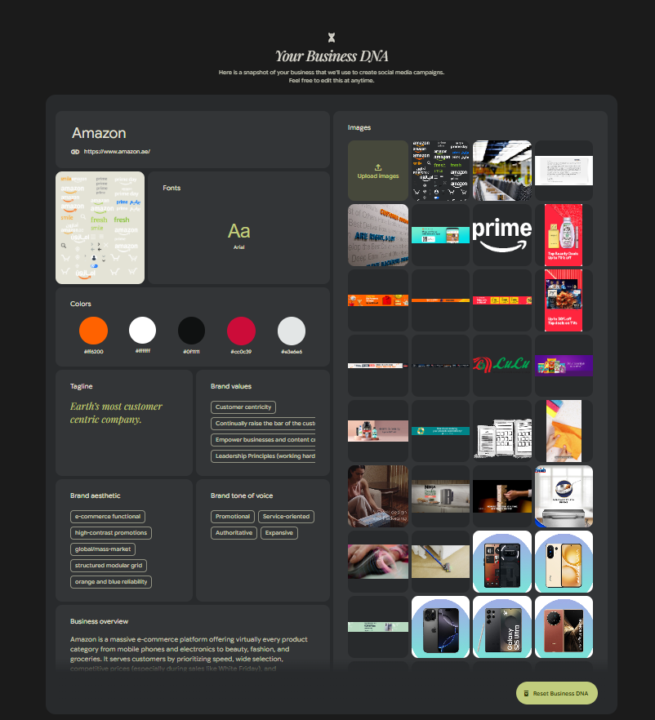

Using Google Pomelli to Analyze Amazon.ae Pomelli is an AI tool from Google Labs. It scans any website and creates a “Business DNA” profile, including brand colors, fonts, tone, and key messaging. What Pomelli Found for Amazon.ae - Colors: Orange, black, white - Font style: Simple and clean - Tagline/Tone: Customer-centric, global, reliable - Assets created: Why Pomelli Is Useful - Turns any website into a full marketing identity - Saves time on design and copywriting - Helpful for both big brands and new businesses - Easy to edit or regenerate designs Use Pomelli to create promotions, product launch posts, and marketing materials quickly without needing design tools. Try it: https://labs.google.com/pomelli Many thanks for your time🌸

MINDRA ADVANCED AI 3rd Task prt.1

Using Google NotebookLM to Easily Compare 3 Powerful AI Models (DeepSeek-V2, GPT-5.1, and Google Gemini). - DeepSeek-V2 — What It Does - GPT-5.1 — What It Offers - Google Gemini — Why It’s Special I used NotebookLM https://notebooklm.google.com/ to Study Them and create a Summary by Mind Map, Video, or Podcast Perfect for Students, Teachers, and Creators

MINDRA ADVANCED AI - SECOND TASK

Evening everyone I just built a new chatbot workflow using n8n — a powerful tool for automation and connecting apps without coding This chatbot can automate messages, save data, and connect with apps like Google Sheets or Telegram — all in one smart flow. 💡 Why it’s cool: It saves time, reduces manual work, and shows how AI + automation can make our tasks faster and smarter. 🔗 Check it out: https://fatimahassan025.app.n8n.cloud/webhook/e4ba4910-a27b-4237-bb69-a5e84d7b052c/chat

1-10 of 41

@fatima-hassan-4856

A Specialist in Artificial Intelligence & E-Commerce | Empowering Innovation and Online Success

Active 1d ago

Joined Feb 18, 2025

UAE