Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

What is this?

Less

More

Memberships

Bitcoin Entrepreneurs

49 members • Free

Bitcoin

1.3k members • Free

24 contributions to Bitcoin

Which way Bitcoin?

Are the 4 year halving cycle guys correct, and we are in for a year long bear market? Are we going to have a booming 2026, because Trump wants low interest rates, and lots of liquidity, so the economy is running hot heading into the midterm elections?

Poll

3 members have voted

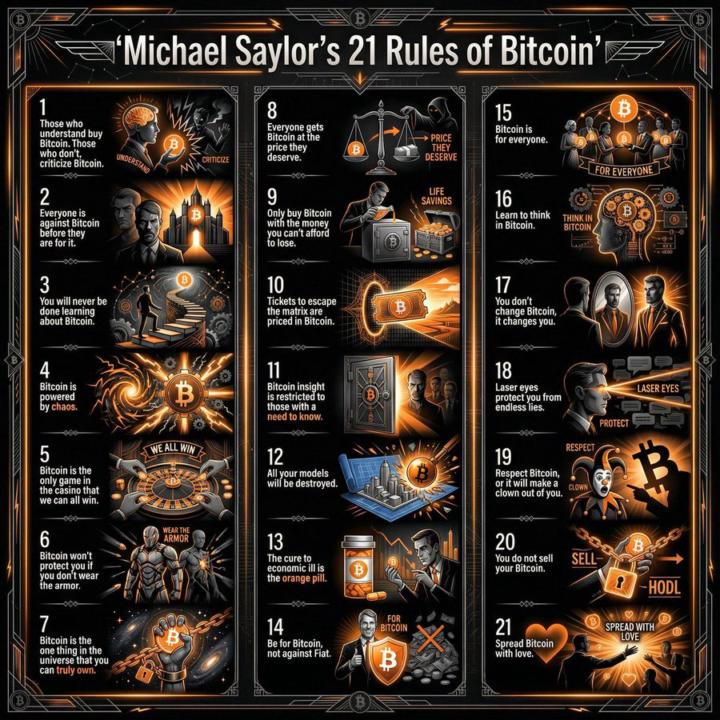

Saylor's 21 Rules of Bitcoin

Number 17 is damn true. Number 7 I sorta disagree with because how do u OWN 12 or 24 words? U don't. U just memorize them and they serve as your coordinates to your btc. Unless we wanna change the definition of ownership? :)

0 likes • 4d

#14 is wise words. Saylor is a strategic thinker, and that's why he pushes the store of value narrative. We do not want to position ourselves as a threat to fiat. There's a lot of powerful people and outright parasites who rely on fiat currency for the stealth taxation aspect of printing.

⚡Most BTC HODLers Only Compare “Buy Now” vs “Buy Later”

When people think about building their Bitcoin position, the conversation usually stops at: “Should I buy now?” “Should I wait for a dip?” But there’s another angle worth considering: using mining to accumulate BTC over time. Using the same $200,000 as an example (with BTC at $95k): Direct buy gives you 2.1 BTC instantly Mining grows that same allocation toward nearly 4 BTC over a few years And the math shows break-even at about 26 months — after that, the mining route continues building your stack regardless of market swings. This isn’t about trading or speculation. It’s about understanding that Bitcoin can be earned, not only bought. How do you see it? 💬 Do you treat mining as a meaningful part of long-term BTC accumulation?

1 like • 4d

I am definitely open to exploring mining as a way to stack long term. I will add that people should stop worrying about raising the fees for mining, IMO. There is no shortage of mining, if you look at the hash rate it's a hockey stick chart. What we don't want is crazy high fees on the Bitcoin blockchain. That drives new people away from Bitcoin. Also, the government is now allowing miners to depreciate their mining machines in year 1, this is significant. A lot of guys who are already rich get into mining, at scale, for the tax write offs, and apparently, as you have stated, you get more Bitcoin over time, as opposed to buying spot Bitcoin. It's my understanding the Bitcoin mining is a way that the rich (which I aspire to be) are using to layer their money, so they get richer off the money they already have. I don't know all the details, but I do know tax avoidance is a key feature. It's kinda like buying property for a tax write off, using the property for meetings, AIR BNB rental, or raising cattle, etc., so you have income from it, and really nice tax write offs, except possibly better.

What's coming

Thanks to AI coupled with robotics, we are likely at the dawn of a low scarcity civilization. In a world where most things are low cost, or no cost, the few things that do remain scarce are going to skyrocket in value. Bitcoin features engineered absolute scarcity that is verified every 10 minutes. With massive productivity gains and likely job losses ahead, there is probably going to be some form of UBI coming down the track. Bitcoin is where you want to be, so you don't end up in a bug pod high rise scraping by on UBI, because you don't have enough assets.

2

0

Consider.

The institutions are hoovering up the Bitcoin, and figuring out how to monetize it with financial products that they can skim profits off of. They're doing it with with products to serve the fixed income markets, lending, insurance, and other things that I'm not sophisticated enough to understand, and haven't been conceived of yet. We have 5 or 10 years of easy stacking opportunity left. You'll still be able to buy Bitcoin ten years from now, but nothing like how cheap and easy it is now. Those who stacked will be held in high regard by the generations to come.

1-10 of 24

@eric-bertrand-6845

First time I bought and held was in 2022. Now I am a hardcore Bitcoin fanatic.

Active 3d ago

Joined Nov 15, 2025

Powered by