Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Owned by Domenico

Impara ad automatizzare il tuo Business 🚀 con l’Intelligenza Artificiale. Crea Offerte Irresistibili e Virali, Milioni di Views e Trova Clienti! 💰

Memberships

YouTube BUSINESS Roadmap

21 members • Free

Come Vendere Meglio

28 members • Free

Speaker Perfetto

102 members • Free

Free Skool Course

46.6k members • Free

51 contributions to 100M Money Models & AI Mastery

Why you’re not sending a Dead Lead Recovery campaign that could add $15K to your quarter

It’s not because you don’t have dead leads. It’s not because you don’t know how to follow up. It’s because sending the message forces emotional risk. Hitting send means facing three uncomfortable possibilities: They reply yes. They reply no. Or they confirm what you’ve been avoiding — silence. So most people delay. They call it timing. They call it not wanting to spam. But what they’re really avoiding is resolution. Alex Hormozi says the person who wins is the one who cares most about the end user. Not the one who wants the sale most. The one who wants the outcome most. That distinction matters in outreach. If you reach out to help someone finish a decision they already started, you’re aligned with them. If you reach out because you want their money, they feel it instantly. Same message. Different intent. Very different result. This is where most “dead lead follow-up” breaks. Helping sounds like: “I was reviewing old conversations to see which ones still deserved attention. On ours, did you decide to move forward, pause, or drop it?” Selling sounds like: “Hey, just checking back in — wanted to see if you’re still interested.” One helps them resolve an open loop. The other tries to manufacture urgency. People don’t ghost help. They ghost neediness. The quiet truth is this: Recovery works when you care more about their clarity than your conversion. That’s not moral advice. It’s a sales advantage. And it’s why restraint beats scripts every time. If closing old dead leads in the next 60 days actually matters to you, comment “60.” I’ll share the 3 Step Dead Lead Formula.

Meet the $100M Ads Guy — and No, He’s Not Alex.

Hi Guys, Most people don't know my Partner Wayne - He is the $100M Ads Guy. The $100M spent on ads. The billion-dollar revenue impact. The companies call him when nothing else works. But before all that, he had one unfair advantage: He didn’t guess.He paid for every mistake with his own money. When you’ve spent $100M of your own cash on paid media, you stop hoping something works and start knowing what does. No ego. No fluff. Just math, patterns, and truth. That’s why he’s dangerous. While others debate tactics, Wayne talks in levers.He can look at a funnel for 30 seconds and say: “Here. Fix this. Your revenue jumps.” And he’s almost never wrong. I’ve watched founders stuck for months get clarity from him in minutes. Because when you’ve broken every funnel and rebuilt it at scale…you see what others can’t. Tomorrow, for the first time, you get to sit in the same room. No paywall. No pitch. Just raw clarity — live. If you want to see what $100M of paid-media experience looks like when it diagnoses a real business… Comment OPEN DAY and we can discuss the an invite.

Inside the Builders Club: Why the Founders Who Show Up Grow Faster

Most founders don’t fail because they’re lazy. They fail because they spend months working on the wrong problem. Inside the Builders Club, we fix that in minutes. This Thursday, for the first time, we’re opening the doors and letting you join the call live. In the first month, members 6x-ed and 12x-ed their investment — not from hacks, but from a single moment of clarity that changed their direction overnight. No theory. No hype. Just real bottlenecks, real businesses, and real momentum. If you want to experience the room that produces results like this, this is your one chance to get in without being a member. Comment OPEN DAY and we can discuss an invite. Invites are limited.

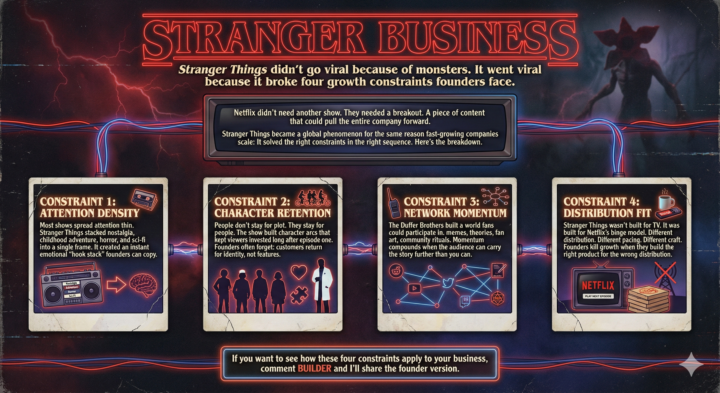

“Stranger Things didn’t go viral because of monsters.

It went viral because it broke four growth constraints founders face.” Stranger Things didn’t go viral because of monsters. It went viral because it broke four growth constraints that every founder faces. Netflix didn’t need another show. They needed a breakout. A piece of content that could pull the entire company forward. Stranger Things became a global phenomenon for the same reason fast-growing companies scale: It solved the right constraints in the right sequence. Here’s the breakdown. Constraint 1: Attention Density Most shows spread attention thin. Stranger Things stacked nostalgia, childhood adventure, horror, and sci-fi into a single frame. It created an instant emotional “hook stack” founders can copy. Constraint 2: Character Retention People don’t stay for plot. They stay for people. The show built character arcs that kept viewers invested long after episode one. Founders often forget: customers return for identity, not features. Constraint 3: Network Momentum The Duffer Brothers built a world fans could participate in memes theories fan art community rituals Momentum compounds when the audience can carry the story further than you can. Constraint 4: Distribution Fit Stranger Things wasn’t built for TV. It was built for Netflix’s binge model. Different distribution. Different pacing. Different craft. Founders kill growth when they build the right product for the wrong distribution. If you want to see how these four constraints apply to your business, comment BUILDER and I’ll share the founder version.

@everyone is using AI tools to save time. I built MoziBuilder to save clarity.⬇️

Hey Guys, Starting is easy now. All you need is a Canva logo, a LinkedIn headline, and a few AI tools. But building? Building means systems. Consistency. Focus. It means running toward the unsexy parts: process, math, and feedback loops. The difference between the 95% and the 5% isn’t talent — it’s clarity. That’s why I built MoziBuilder.Not to give you more data, but to show you what actually moves the needle. Because “starting” feels exciting. “Building” feels like work. But work is what wins. Like and Comment CLARITY, and I’ll send you the free MoziBuilder diagnostic to see if you’re part of the 5%.

1-10 of 51

@domenico-bisceglia-5996

Guadagna con il Marketing e l’Intelligenza Artificiale.Ho creato oltre 1987 Post Social, 1 Milione di Visualizzazioni ed aumentato il Fatturato! 🚀

Active 5h ago

Joined Oct 2, 2025

Italy 🇮🇹