Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Memberships

WavyWorld

43.7k members • Free

Crypto Banking System

305 members • $10/month

Amplify Views

27.9k members • Free

The Crypto Sabbatical

4 members • Free

Synthesizer

34.2k members • Free

DeFi University

215 members • Free

5 contributions to The Crypto Sabbatical

4DSKY DePIN New Project

Hey guys, Came across this new depin project yesterday 4DSKY providing edge-native flight tracking for real-time airspace awareness, supporting drone operations, airports, and traffic management. This is definitely in a field that interests me, having spent 26 yrs in the commercial flying world. Huge upside potential for this one, but early days and ideally suited for a busy suburban environment where low level high flight traffic density will be operating. Think Amazon deliveries or Uber eats by drone ! 🤯 I'll post this in to the classroom articles for all members and if you did want to buy a hardware device like the Jetvision Airsquitter from helium deploy you can get 10% off at checkout using code "CryptoforKiwis"

Turning NVDAx Bags Into a Passive Yield Engine with PiggyBank.fi

Came across this tokenised RWA (real world asset) play today. Tokenised stocks (stocks on steroids is their hook) looped for you 😎. Be aware it is a new platform, so test with small amounts and please DYOR but it could be one to watch 👍. Full breakdown and walk through will be available in the Premium section later today. Most of us treat NVDAx as a simple “synthetic stock” hold, but PiggyBank.fi lets you turn that position into a yield‑bearing asset without manually juggling leverage or farms. You deposit NVDAx into the xStocks Vault and receive pbNVDAx, a token that automatically tracks your share of an under‑the‑hood strategy using Kamino‑style lending, stablecoin borrowing, and low‑risk stablecoin farms to generate extra yield. Instead of trying to loop collateral yourself, the vault does it for you and auto‑compounds the returns: over time, each pbNVDAx becomes redeemable for more NVDAx than you initially deposited, assuming markets behave and the strategy performs. The trade‑off is accepting DeFi risk—liquidations if NVDAx dumps hard, smart‑contract and integration risk, plus 48–96h epoch‑based withdrawals—but in return you potentially capture a higher long‑term return on an asset you were planning to hold anyway. If you’re already bullish NVDAx and comfortable with DeFi risk, PiggyBank.fi is a tool worth watching as part of a broader “yield‑on‑synthetics” stack, rather than just letting your tokens sit idle

Happy Thanks Giving Gifts 😁

Happy thanks giving guys, I really hope you get to spend some quality time with friends and family and just in case you were thinking of treating yourselves too, Tangem cold storage wallets have a Black Friday special until the 28th with an extra 20% off + $10 in BTC use code BF2025 at checkout 😉 Fun numbers game : that $10 in BTC you'd receive today would be worth about $109 in the future, if BTC reaches that $1m mark in the next 5 yrs 😁. So basically the Tangem wallet pays for itself 😝 you just need to give it time while Hodling your crypto on to it.👍

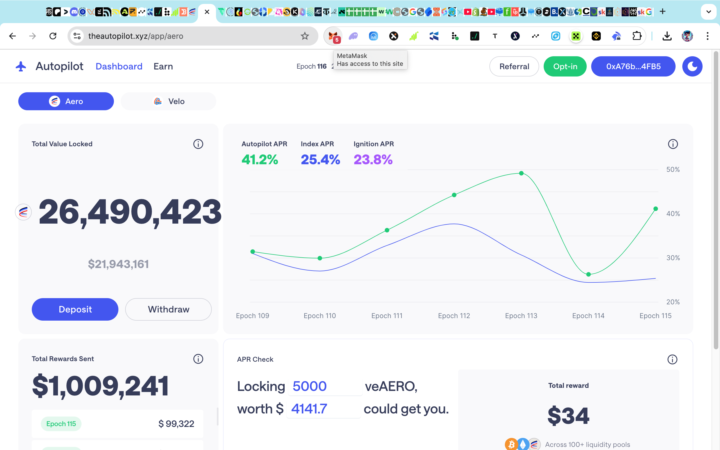

Questions on the VeAero voting process using TheAutopilot.xyz

I've been playing with the autopilot voting system https://theautopilot.xyz/r/deYC and discussing with a moderator on their Discord to understand the non custody side a bit more as it made me nervous signing over the voting rights to them. I have to say that the support was fantastic and they jumped straight on to a voicecall over discord to explain it in detail for me. The summary is that you always retain control of the NFT (your VeAero lock) and can check this in debank that it's linked to autopilot for voting rights. If needed you can go to basescan and force a hard withdrawal of the NFT back to you. Be aware that when you deposit the lock with them to do so on the deposit tab not the 'opt in' green one in the top right, as this opts you in to only the auto ignition for any new token launches on aero and can be a bit hit and miss in my opinion. Also when you deposit it takes the lock back to max lock to optimise voting rights so you'll go back to 4 yrs. The mod said that the system was designed for a group of guys doing voting they realised there was a need and market for it and pushed it to the public about 6 months ago. They take 5% of any fees generated but the algorithm usually produces 10% more than voting manually. There seems to be some exciting developments happening with the launch of Aero Dex and that auto voting will be a feature, possibly a buy out of autopilot by aerodrome or some kind of merger, he stopped short of being able to tell me that but sounds all very bullish. Hope this helps if you are on the fence about trying it out. I'll post a couple of screenshots to show potential returns and the deposit vs. opt in green button I mentioned above. 😁

Welcome to The Crypto Sabbatical: Our Journey Begins

I’m excited to have you join me on this unique journey as I explore what it truly means to live fully on crypto. Over the coming months and beyond, I’ll be sharing my real experiences, challenges, wins, and lessons learned while stepping away from the traditional 9-to-5 grind to build a sustainable life powered by digital assets. This community is for anyone curious about breaking free from the desk and seeking genuine, practical insights into how crypto can support a different lifestyle. Whether you’re just starting or already deep in the space, my aim is to inspire and inform with transparency—sharing the investments I’m in, the results as they unfold, and the strategies behind them. Let’s discover together if this new path is not only possible but rewarding. Thank you for being here. Feel free to introduce yourself, share your goals, and ask questions. The conversation starts now!

1-5 of 5

@davis-n-9927

Founder @DeFiOrbit.xyz | Professional Portfolio Manager for Liquidity Providers (Uniswap, Orca, Aerodrome, vFat, Revert & Aave)

Active 7d ago

Joined Nov 4, 2025