Write something

Season 2 Grass.io Airdrop

Don't forget guys you still have time to qualify for the second airdrop from Grass.io The second airdrop (Season 2) reserves 170 million $GRASS tokens, potentially worth $50-60 million USD at the current price of approximately $0.30-$0.96 per token. User estimates suggest $800-$1,000 USD for high-point farmers (e.g., 24M points), varying by points-to-tokens ratio from Season 1 (roughly 1 token per 20,000 points). Check out the existing full Grass article in the classroom and I've added the airdrop details expected in Q1 2026 💪.

0

0

Compound Weekly to $50k/Year: DeFi Bluechips with Minimal Capital

Is it possible to turn $77k into a $50k annual income (US median salary) by compounding weekly in relatively stable WETH/USDC or BTC/USDC pools— A recent $1k test, shows how it may well be possible and now needs to be scaled exponentially with lowish risk to find out. hey everyone 👋, just adding a new article in to the classroom area that looks at the power of weekly compounding to help achieve a median salary with perhaps a lot less then you thought was needed. Let me know your experiences and thoughts with this strategy.

Happy Bitcoin Genesis Day 🎉

Did you know that January 3rd 2009 was the day Satoshi Nakamoto mined the very first block 'the genesis block, making the Bitcoin network operational? 🙃 Good excuse for a party and to buy some more sats 🥳

2

0

🎶 Can you earn passive income... from your favourite songs? 🤔

Ever wished you could actually own a slice of your favourite track — not just stream it? Well, that’s pretty much what SongBits lets you do. They’re turning music royalties into bite-sized digital shares (or “bits”) so regular people can invest in songs and get paid when they’re streamed, played, or used commercially. It’s like joining the behind-the-scenes of the music industry — without needing a record deal or a guitar solo. 🎸 I’m diving into how it works, what it costs, and whether it’s actually worth it in my next premium post... 👀 But for now, here’s the question:👉 Would you invest in a song if it could pay you every time someone hits play?

Poll

1 member has voted

2

0

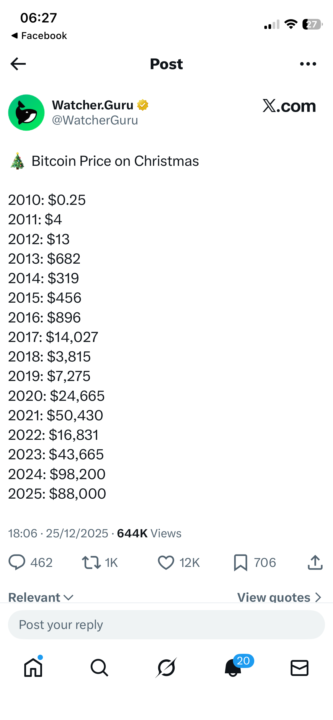

From 25 Cents to $88K: Bitcoin’s Christmas Story

This caught my eye today and illustrates well, the long term gains for those who can be patient enough to wait it out - Merry Christmas 🎄 everyone. Bitcoin’s Christmas price has climbed from $0.25 in 2010 to $88,000 in 2025, showcasing huge long‑term growth despite several brutal drawdowns along the way. Across the years, big spikes like $14,027 in 2017, the drop to $3,815 in 2018, and the rebound to $50,430 in 2021 highlight Bitcoin’s boom‑and‑bust, but still upward, trajectory. Given the current cycle and recent high near $98,200 in 2024 before cooling to $88,000 in 2025, a rough, speculative band for Christmas 2026 could sit somewhere around $90K–$120K, while still being highly volatile either way. Data and inspiration credit: @WatcherGuru on X for the Christmas price list.

1-21 of 21

powered by

skool.com/the-crypto-sabbatical-5837

Can you really escape the 9-to-5 and live on crypto? Join The Crypto Sabbatical and discover the possibilities firsthand.

Suggested communities

Powered by