Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Memberships

Checkmate The Matrix

542 members • $25/month

63 contributions to Checkmate The Matrix

PRA passing to Resolvecall

Hi All, I have a debt that PRA Group allegedly purchased from Halifax, now I have set up a payment plan with them, as I only want to deal with one of these parasites at a time, currently waiting for a court date with Link Financial, I fell behind with the payments to PRA, only 1 month as far as I remember. I received a letter the other day which I only just read this morning, they said "They have given me many opportunities to engage with the on the matter of my outstanding account, but my balance remains unpaid, as a result of this on 13/01/2026 my account will be transferred to Resolvecall Now nowhere on the letter or the online portal I pay through shows any arrears amount, they do no mention an amount, just say outstanding account This has now pissed me off, I certainly don't want to deal with Resolvecall. and I will now look to send PRA the first SAR, I was going to wait, but now they can do one, I have made the payment that I belive I was behind with and I was going to contact them to stop them passing my account to Resolvecall as I just don't want to deal with them, any advice on my best course of action, I did think I could tell PRA they do not have my consent to pass my personal data to Resolvecall, but according to ChatGPT they can do this

0 likes • 3d

So an update, I sent an email to Resolvecall as per @Ant Phoenix suggestion above and after received an email from them, so I sent the same message in reply to their email, yesterday I received the following from them after telling them to cease processing my data. They must think I am stupid and will give them my personal data, meanwhile PRA has raised my dispute with them so if the account is in dispute, why are they still trying to pass to resolvecall, especially as I do not belive I am in arrears Hello, Thank you for taking the time to contact us. We have a duty of care to all our customers, to ensure that no personal or sensitive information is provided to any unauthorised third party. Before we can assist you further via email, we require that the following information be confirmed: - Your full name. - Your date of birth (DD/MM/YYYY). - Your full address including post code. If you would prefer to contact us by phone, you can call us on 0141 212 8500. Our customer service team will be happy to assist and is available 8:00am–7:30pm Monday to Thursday, 8:00am–6.30pm on Friday, and 9:00am–2:00pm on Saturday. You can also view and manage your account online at https://www.myresolvecall.co.uk. Yours sincerely, Matthew Customer Relations Agent CorrespondenceCorrespondence Department 0800 092 0081 www.resolvecall.co.uk | Resolvecall Limited 3rd Floor • 1 Smithhills Street • Paisley • PA1 1EB

1 like • 3d

@Peter Wilson apart from emailing them to cease processing my data I've not made any communication with Resolvcall and not replied to their emails or messages with links to contact them, I'm just about to start with PRA with SAR No1 as said I was going to wait until I had the court case with Link Financial to see how that turned out before moving on to PRA, but they have pissed me off now

Why?

I have a question about my current position with PRA, which is in another post. Why do companies like PRA, who are a DCA, then pass the debt to firms such as Resolvecall to collect? It makes me feel like there’s some kind of scam going on. The same thing happened with Link Financial, who also passed the account to Resolvecall, but that case is now waiting for a court date and nothing has come of their involvement so far. On a related point, I know we’re looking at using GDPR to challenge the involvement of DCAs, but my concern is more basic. They claim to have bought a debt – say a £10,000 balance – yet we all know they haven’t paid £10,000 for it. I know this from experience: Lowell offered me a 70% discount if I paid within three months. That makes it obvious they bought the account for a fraction of the face value. So how can it be legal that a DCA might buy a £10,000 debt for, say, £300 and then pursue you for the full £10,000, claiming that’s what you now owe them? In a fair justice system this just doesn’t feel right, and I’m struggling to understand how it is allowed.

Responses

Hi All I'm getting responses from original company's ie American express, santander, after sending sar to wescot & zinc ,zinc acting on behalf of American express. The replys are basically saying I want to let you know that your complaint has been investigated. The content of this email sets out the details of the complaint as I understand it, my final decision and the rationale for that decision. Based on my investigation and available evidence, I am sorry to advise that I am not upholding your complaint. Whilst I appreciate this may not be the outcome you were looking for, below you will find my explanation. Not sure what i do at this point? Sar 2? Can anyone advise please reply appropriate this group and all the input. I now know a lot more but not enough. I only get an hour or 2 to study this as I'm working full time and my free time i run a boxing club, sorry to be a pain. Mark 👍

Court Bundle

Hi all. Does your court bundle have to reflect what you have put in your N1. if so how strict are they?

1 like • 26d

During the phone mediation when they told the mediator that they do not own the debt and are acting as an agent, my reply to the court mediator was, "so they are a 3rd party Interloper and so have no right to contact me", surely this would of been noted and the court would be aware of this as the mediation was conducted by the court, or does the mediation have no impact on the court case

1 like • 26d

My main claim is Link Financial did not produce the deed of assignment as requested by the SAR's and so they can not prove they own the debt, so that is the GDPR breach, however during the mediation they admitted they do not have the deed of assignment as they are not the holder of the debt, so its still a breach of GDPR but in a slightly different way as far as I can see, but I want to clear the alleged debt from been chased again, so I don't just want to get rid of Link, I want to ensure LC Asset cannot chase the debt after, when I read the letters it does state that Link are joint holders of my data along with LC Assets,

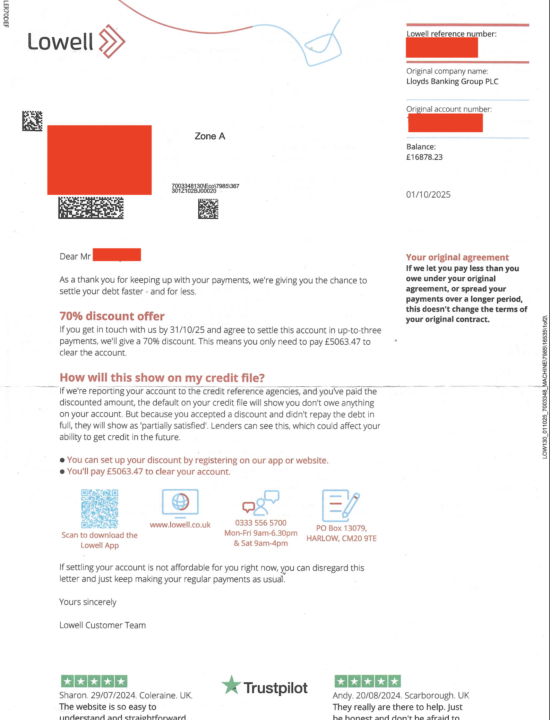

The Con of DCA's

Hi All, I know this group is knowledgeable on the subject of DCA's but I was going through paperwork and came across a letter I received from Lowell, which is an alleged loan debt that was passed to them from Lloyds Banking Group for £16,878.47, I agreed a payment plan with them as I want to deal with these leeches one at a time, I couldn't deal with multiple court cases, still waiting for a court date with Link Financial, anyway I set up at the minimum amount possible £50 per month, this obviously frustrates them, as it will likely never get fully paid, the letter attached is offering me a 70% discount on the alleged amount owed, so if as they claim the bought the £16,878.47 debt, why would they be prepared to allow me to pay £5063.47 to clear the alleged debt, what business would ever offer something where they would lose £11,815.00 this just proves they do not buy a debt for the actual amount, it's all a con

1 like • 26d

I know that they don't own the debt, LC Asset own the alleged debt, I found this out in the mediation call via the court, so that makes them a 3rd party interloper and so they have even less right to chase me for an alleged debt, so the have definitely broken GDPR, I'm still waiting for a court date, so my argument in court will be that they could not produce the deed of assignment when requested and then they admit they don't have the deed of assignment as they are not the owner of the debt, to me that should be game over, but i think it all depends on the judge you get on the day, I need to look at putting together my court bundle, as I have not looked into what this requires and I want to ensure I am ready when the date comes through

1-10 of 63

@christopher-flaherty-6511

Hi, My name is Chris from South East England

Active 3d ago

Joined Mar 2, 2025

Powered by