Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Owned by Chris

An elite trading community powered by AI — learn, share, and grow with tools, strategies, and systems that give you an edge.

Memberships

Community Builders - Free

9k members • Free

Scale Your Coaching

20.9k members • Free

130 contributions to Jarvis AI

Market Sentiment with CeeLee January 20th 2026

Pre-market sentiment is cautious heading into the U.S. open. Macro and geopolitical headlines are driving a risk-off tone, futures are softer, and leadership remains selective. Today isn’t about guessing direction — it’s about waiting for confirmation, respecting key levels, and managing risk with discipline.

8

0

JARVIS A+ SETUPS — JANUARY 20TH 2026

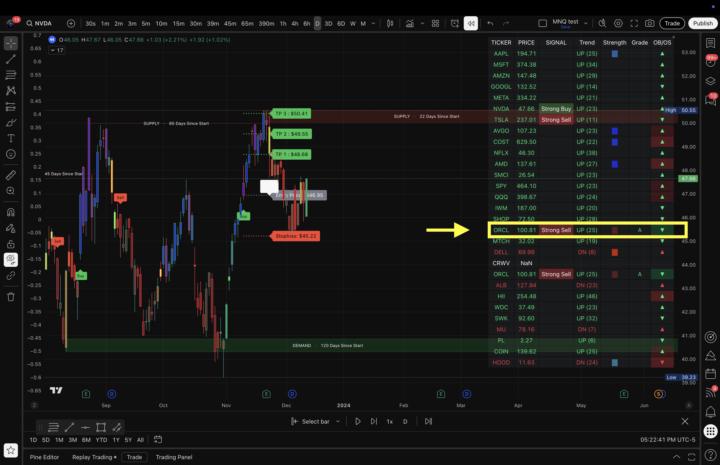

Date: Tuesday, January 20, 2026 Scope: Weekly intraday + short swing (quality > speed) 🚀 A+ CALL SETUPS (Bullish) 🤖 NVDA — Nvidia 📈 Setup: Leadership continuation 🎯 Breakout: Above 205 🛑 Invalidation: Below 192 ⏱️ Timeframe: Weekly intraday / short swing 📊 Why A+: • Still the primary market leader • Institutions defend pullbacks • Clean continuation structure above prior highs Preferred Strikes: Weekly 205 / 210 Calls 🧠 TSM — Taiwan Semiconductor 📈 Setup: Momentum continuation 🎯 Breakout: Above 146 🛑 Invalidation: Below 138 ⏱️ Timeframe: Short swing 📊 Why A+: • Semiconductor strength broadening beyond NVDA • Smooth trend, low headline noise • Better with time than speed Preferred Strikes: Weekly 145 / 150 Calls ⚙️ SMCI — Super Micro Computer 📈 Setup: Volatility-backed expansion 🎯 Breakout: Above 360 🛑 Invalidation: Below 330 ⏱️ Timeframe: Weekly intraday 📊 Why A+: • AI infrastructure demand • Explosive when range breaks • Clean continuation setup Preferred Strikes: Weekly 360 / 370 Calls 🧠 AMD — Advanced Micro Devices 📈 Setup: Momentum reclaim 🎯 Breakout: Above 178 🛑 Invalidation: Below 168 ⏱️ Timeframe: Weekly intraday 📊 Why A+: • Sympathy strength with semis • Liquid weeklies • Trend resumes above resistance Preferred Strikes: Weekly 175 / 180 Calls 🏦 XLF — Financials ETF 📈 Setup: Sector rotation 🎯 Breakout: Above 42.20 🛑 Invalidation: Below 41.20 ⏱️ Timeframe: Short swing 📊 Why A+: • Capital rotating into financials • Clean ETF structure • Lower noise, steady trend Preferred Strikes: Weekly 42 / 43 Calls 🩸 A+ PUT SETUPS (Bearish) ⚠️ GOOGL — Alphabet 📉 Setup: Relative weakness 🎯 Breakdown: Below 308 🛑 Invalidation: Above 325 ⏱️ Timeframe: Weekly intraday / short swing 📊 Why A+: • Lagging mega-cap peers • Failed bounce attempts • Clean downside structure Preferred Strikes: Weekly 300 / 295 Puts ⚠️ AAPL — Apple 📉 Setup: Distribution 🎯 Breakdown: Below 184 🛑 Invalidation: Above 191 ⏱️ Timeframe: Weekly intraday 📊 Why A+: • Losing leadership

Macro data 1.20.26

1. What are the key economic releases or central bank events today that could impact market sentiment? This sets the stage for the trading day and helps you anticipate volatility triggers. 2. How did the major global markets (Asia and Europe) perform overnight, and are there any notable moves in futures or forex that might influence the U.S. open? Understanding global sentiment gives you a broader context. 3. What is the pre-market movement of key stocks on my watchlist, like Tesla, and are there any notable gaps up or down? This helps you identify early opportunities or risks. 4. Are there any significant news headlines, earnings reports, or geopolitical developments that could affect my chosen assets? Being aware of news flow keeps you agile. 5. What are the key technical levels and indicators (like RSI, MACD) on the indices and stocks I’m trading today? This ensures you’re aware of potential entry or exit points. 6. Is there any unusual options activity or volume that might signal institutional interest or a potential big move? Tracking options flow can give you an edge. 7. What’s the overall market sentiment today—bullish, bearish, or neutral—and how are the VIX and other fear gauges behaving? Sentiment indicators help you align your strategy with the market mood. 8. Are there any notable sector rotations or shifts that could influence tech stocks like Tesla today? This helps you see if money is flowing into or out of specific sectors. 9. What risk management measures will I put in place to protect my capital today—stop-loss levels, position sizing adjustments, or hedges? This keeps your strategy disciplined and focused on capital protection. 10. Finally, what is my primary trading plan or thesis for the day, and how will I adapt if the market conditions shift? 11. Is trump speaking and If so about what and what time This ensures you start each day with a clear, adaptable game plan. 🧾 THE EXACT PROMPT TO GET THIS EVERY MORNING (Copy & Paste) Use this every morning before the bell — this will make me generate the same style, same format, updated with the top 5 A+ setups across the entire market:

JARVIS PRESENTATION & TRAINING

📢 COMMUNITY ANNOUNCEMENT — LIVE TRAINING TONIGHT 🚨 J.A.R.V.I.S Training (LIVE) 🚨🗓 Tonight⏰ 8:00 PM EST If you already have J.A.R.V.I.S, this is the session where we break down how to use it properly (signals, timing, alerts, execution, and daily workflow). ✅ If you’re still checking it out and want a live demonstration, pull up tonight and watch it in action. 👀🔥 🔗 Join here:https://livela.webinargeek.com/j-a-r-v-i-s-training-30 Drop a ✅ in the comments if you’re coming — see you at 8PM EST 💻🚀

7

0

OPTIONS 101

📢 ANNOUNCEMENT 🚨 J.A.R.V.I.S Training – LIVE Tonight 🚨 🗓 Tonight ⏰ 8:00 PM EST This is a live training session covering J.A.R.V.I.S and how to use the system properly. Don’t miss it. 🔗 Join here: https://livela.webinargeek.com/j-a-r-v-i-s-training-30 See you live at 8 PM EST 💻🔥

9

0

1-10 of 130

@chris-lee-3116

🤖 J.A.R.V.I.S AI | The world’s #1 trading indicator 🚀 Trade smarter, not harder | Real-time signals, automation & freedom

Active 4h ago

Joined Nov 5, 2025

Powered by