Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

Imperium Academy™

50.1k members • Free

AI Automation Society

257.5k members • Free

Crypto Banking System

304 members • $10/month

🇺🇸 Biturai Trading Dojo

312 members • Free

UFW Invest

403 members • Free

The Options Academy

128 members • Free

Trading Growth Engine

763 members • Free

Self Inquiry Support Group

7k members • Free

Kickstarter Challenge

24.2k members • Free

17 contributions to Trading Growth Engine

What are you trading today?

Last trading day of 2025 what tickers are ya'll looking at Gextron for? the last one I checked was DIS for calls Jan 16 118

I'm swinging SPY calls

I like SPY a lot. 690 is very possible. just need to get above 685 I'm currently swinging SPY 690 Dec 15 calls Can SPY hit 690 this week?

SPY day trading strategy: When to stop?

It's the start of week 2 and we took two trades: - Trade #1: -14% - Trade #2: +45% Solid day. This whole phase is about gathering information, seeing how the strategy behaves in different conditions, and building something that's both profitable and sustainable. Inside our Zoom calls, we discuss about: When do we stop trading for the day? We took our morning trades, got stopped out on one, finished the second one strong...And after 12PM EST we were done. At 12:20PM , there was another opportunity, and I wasn't at my screen. I had already logged to go grab lunch and detach from the market. And honestly...that feels great. Because what we're aiming for here isn't a strategy that forces us to stare at the charts for 6 hours straight. We're aiming for a strategy that fits into a real life. One that gives clarity, structure, and freedom. Why We Stop Trading by 11:30 AM - 12 PM This isn't about overtrading or being afraid of losses. It's about protecting: - Our energy - Our mental clarity - Our long-term sustainability as a trader Trading is already difficult as is. And being glued to the screen all day is a slow path toward emotional burnout. And burned-out traders don't make good decisions. So after discussing it as a group, we're aligned: 11:30-12PM is the cutoff. If something sets up later, awesome. The market will still be here tomorrow. Life > Market Once the cutoff hits, go do something for yourself: - Gym - Walk your dog - Set up the Christmas tree - Church - Family time The strategy shouldn't own your entire day. The whole point is freedom. Not more screen time... What's Next We're going to keep refining the strategy every day: - Logging trades - Testing entries - Reviewing exits - Getting cleaner with targets But one rule is already locked in: If it's after 12 PM, we're done.

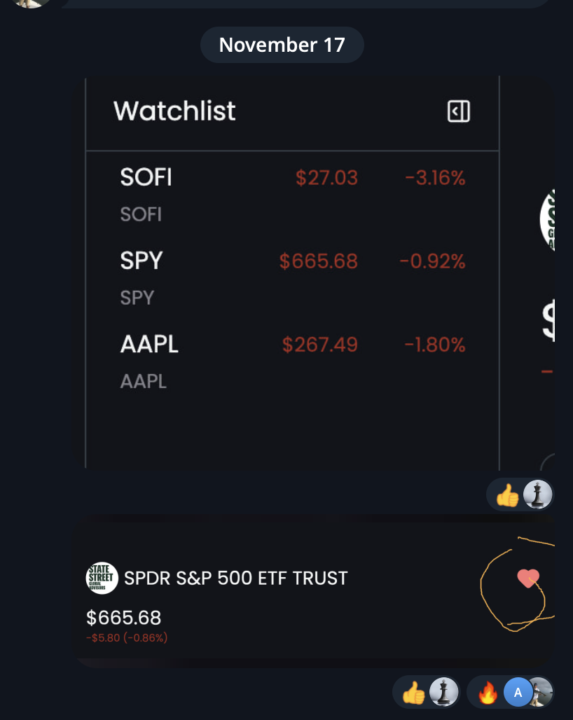

Gextron Update: Watchlists are coming...

One of the most-requested features is finally making its way into Gextron... 📌 Watchlists inside the Hero Dashboard. You'll soon be able to: - Save & track your favorite tickers - See price + %change at a glance - Instantly open into the full Gextron view

SPY day trading strategy: Sizing

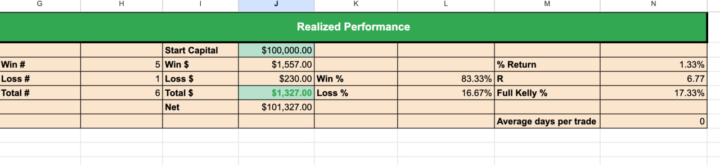

Quick update on the SPY strategy we're building together. Today we took one clean trade using Gextron. We went short from 665 → 662, and Gextron did exactly what it’s built to do: - It gave us the entry level - It projected an achievable price target - It helped us move from OTM → ITM with precision Inside our day trading group, one of the biggest topics we've been breaking down is position sizing. Because this is what determines whether your strategy grows or blows up. We've considered 3 main approaches: 1. Dynamic %-Based Sizing You risk a fixed % of your account, like 1%. As your account grows, your size grows. As it shrinks, your size shrinks. 2. Fixed Dollar Sizing If you start with $1,000 per trade, you stick to that $1,000 no matter what. 3. Conviction-Based Sizing High conviction → risk more Low conviction → risk less For the sake of consistency, we're sticking with fixed position sizing. Our paper account is $100,000. So we're trading $1,000 per trade. Wether the account hits $150k or dips to $90k we stay at $1,000 per trade. Why? - It makes our results predictable - It reduces P&L volatility - It protects the account during losing streaks - It gives us more control over the risk side of the strategy Right now we're sitting at 83% win rate over 6 trades – but we're excited to see our losing streak come. That's where we'll see the real durability of your strategy. We want controlled growth, small drawdowns, and avoiding high CVaR situations. What position sizing method works best for you? Drop your thoughts below!

1-10 of 17

@benson-osagie-1433

Is pays to be a good person in life and what so ever a man sowth that's what a man received.

Active 2h ago

Joined Nov 8, 2025

Powered by