Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

What is this?

Less

More

Memberships

The River of Wealth

15 members • $250/month

STR Secrets 7 Figure Boardroom

58 members • Free

Boutique Hotel Secrets

79 members • Free

STR Secrets Mastermind

376 members • Free

26 contributions to The River of Wealth

*UPDATE* First real (closed) trades!

I placed my first trades with real money a couple of days ago! Both are bull put spreads, I opened one contract with TSLA and three with AAPL. Why these companies? I'd done a bit of paper trading and both performed well with high return on risk. Tesla is generally volatile and therefore trades often close pretty quickly, so I get to recycle the money faster - but the volatility also increases risk, so I kept my position small. Apple has also been moving enough to close out trades pretty quickly, and I feel overall it's less volatile than Tesla, so I like the slightly lower ROR while maintaining the churn with increased stability. There's only a few thousand dollars at risk for potentially a few hundred dollars of gain, but projected ROI is about 9% if I'm closing at 50% so that's awesome. I plan to hone in on a few companies I like to trade spreads on and gradually increase my number of contracts (perhaps over a couple of different positions) to start generating some meaningful profits. UPDATE 12/5: After 3 days in the trade, my Tesla position closed for a profit of $210 🎉

Spreadsheet tracker for BPS

Here's the spreadsheet I (with the help of ChatGPT) put together to track my Bull Put Spreads. Eventually I'm sure I'll build out something more robust to track all my trading with different strategies, but wanted to keep it relatively simple to start. I originally built it out with my paper trading, then this morning created new tabs for real trading but kept the trades in there as examples - just delete those rows once you don't need them anymore. Once a trade fills, just cut/paste the row into the Closed Trades tab and everything should update automatically. :) Something I found out the hard way: Microsoft is a bitch about auto-save now (you have to store the file in OneDrive for auto-save to work, which is the rankest BS I've ever heard) so look into that if you've lost the habit of reflexively saving your work like I have. I probably should have built this in Google Sheets but I like Excel better.

0 likes • 3d

I want to note the DTE and CDTE columns... I didn't provide any explanation for them. CDTE is Current Days To Expiration and it calculates automatically based on the expiration date and today's date. However I also wanted to track how many days to expiration (DTE) there were when I placed the trade, which is a fixed number, hence the separate DTE column. None of the formulas in there should be too crazy so it should be easy to play around with and make into your own!

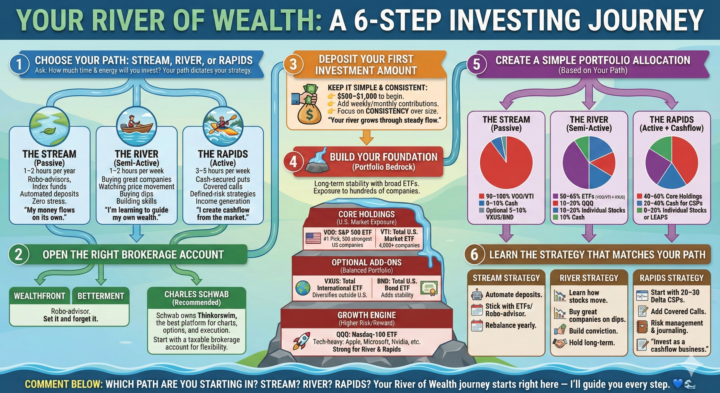

Getting Started: 🌊 6 Steps to Investing in the Stock Market + Infographic

🌊 The 6 Steps to Start Investing — The River of Wealth Pathway Before you buy a stock… Before you place a trade… Before you choose a strategy… You need clarity on the type of investor you want to be. Inside River of Wealth, we use the Stream → River → Rapids framework to match your investment style to your lifestyle. These are the 6 steps every beginner should follow. Let’s dive in. 🌊 🟦 Step 1: Choose Your Path — Stream, River, or Rapids Ask yourself: How much time and energy do I want to spend investing? The Stream — Passive (1–2 hrs/year) “My money flows on its own.” - Robo-advisors - Index funds - Automated deposits - Zero stress The River — Semi-Active (1–2 hrs/week) “I’m learning to guide my wealth.” - Buy great companies - Watch price movement - Buy dips - Build skills The Rapids — Active (3–5 hrs/week) “I create cashflow from the market.” - Cash-secured puts - Covered calls - Defined-risk strategies - Monthly income Your path determines your entire approach. 🟩 Step 2: Open the Right Brokerage Account If you’re in The Stream (Passive): Use a robo-advisor: - ✔️ Wealthfront - ✔️ Betterment If you’re in The River or Rapids: Open an account at: ✔️ Charles Schwab (Schwab owns Thinkorswim — the best charting & trading platform.) Start with a taxable brokerage account. 🟧 Step 3: Deposit Your First Investment Amount Start simple and consistent: 👉 $500–$1,000 to begin👉 Add weekly or monthly deposits👉 Focus on consistency over size Your wealth builds from steady flow. 🟥 Step 4: Build Your Foundation (Your Portfolio Bedrock) Begin with broad, diversified ETFs. These give you instant exposure to hundreds or thousands of companies. 🇺🇸 Core Holdings (U.S. Exposure) - VOO – S&P 500 ETF (my #1 pick) - VTI – Total U.S. Stock Market ETF 🌍 Balanced Add-On ETFs - VXUS – International stocks - BND – U.S. bond market 🚀 Growth Add-On ETF - QQQ – Tech-heavy Nasdaq-100 This becomes your long-term riverbed.

Bull put spreads

My latest late night conversation with ChatGPT had me asking "are there additional strategies I should be considering to meet my goals of conservative income generation with capped risk?" and ChatGPT suggested (amongst other things) bull put spreads. @Jeffrey Cowan I remember you referencing bear call spreads in one of my earlier posts - at the time I had no concept of what that was, but now I feel like I've got a decent grasp of the strategy. :) So, I am now playing around with bull put spreads. Given the high ROI potential with much more limited capital collateral/risk, why doesn't everybody do these 😂 What am I missing? Is it mainly because the numbers are SO small that it's just not sexy enough? Commissions eat too much of the return? Is there a risk I'm not perceiving? 'Cause yeah a single contract's dollar value is pretty minimal, but at scale...

1 like • 15d

First BPSs closed! After only 3 days open - woot! I know this is the result of IV crush after Nvidia earnings, but still a super cool look at how quickly things can cycle in options trading. Interesting fact: these two spreads were in Tesla and Apple. I actually got the same credit for each of them ($110) and exited at the same debit ($55) so the net profit was identical. BUT The Return on Risk and ROI is WILDLY different. I entered these (paper) trades before I had my spreadsheet built out with ROR and ROI calculations. Looking at these calculations, the ROR for Apple was 12.36% (with my ROI exactly half that - 6.18% - since I exited at 50% profit). The ROR for Tesla was a whopping 28.21% (ROI at 14.1%). This is super interesting for a few reasons that I see at a glance. And this is just a function of the math, but I think it's helpful to draw out these concepts. - The capital I had at risk in Tesla per contract was only $390 - The capital at risk in Apple was $890 - The high ROR on the Tesla trade highlights that while my INITIAL CREDIT and NET PROFIT (50%) on these two trades was the same, I had MUCH LESS capital at risk in the Tesla trade. My biggest takeaway is that I'm NEVER doing a spread again without looking at ROR 😂 @Jeffrey Cowan is this something that TOS will tell us, or do we need to calculate it on our own? And general reminder: since I'm looking to exit at 50% profit, my target ROI is half of the ROR. And the ~6% ROI on the Apple trade is still awesome when you consider it only took three days - BUT with much more capital at risk, I'll think more carefully about entering those types of trades again. Attaching a screenshot of my spreadsheet, you'll note that the spread width on Apple was bigger than what I had on Tesla, but I don't think that impacts the fundamentals of what was discussed above (correct me if I'm wrong).

🧠 Nov 18 Community Call Recap: Bull Put Spreads, Backtesting & “Am I Ready To Go Live?”

Huge shoutout to everyone who joined today and for the great questions and reflections. This was basically a masterclass in thinking like a professional options trader while still designing a life you actually want to live. Here is the full recording: VIEW RECORDING - 61 mins Here’s a quick recap + some action steps. 1️⃣ ChatGPT as Your Co-Pilot (Not Your Pilot) We started by talking about how Julie’s been using ChatGPT: - ✅ Great for brainstorming strategies, asking “what am I missing?” and turning dense textbook concepts into plain English. - ❌ Not great at real-time data or math – always double-check numbers, deltas, and risk with your broker’s platform. Key idea: Use ChatGPT to accelerate your understanding, not to outsource your thinking. 2️⃣ Bull Put Spreads vs Cash-Secured Puts We dug into why bull put spreads can be so attractive, especially if you’re not on margin yet. Cash-Secured Puts (CSPs): - Tie up a lot of capital (full notional of 100 shares per contract). - Unlimited downside until zero on the stock. - Simple, clean, great if: Bull Put Spreads: - Sell a put (e.g. 20 delta), buy a lower strike put (e.g. 10 delta). - Pros: - Cons / Fine print: 👉 Rule of thumb:If you’re trading in a smaller account without margin, bull put spreads can be a powerful way to get started and keep risk defined — as long as you stick to very liquid options. 3️⃣ Backtesting with Tastytrade – What We Learned We did a live demo using Tastytrade’s backtester: - Tested 30–45 DTE, ~20 delta CSPs on NVDA over ~12 months. - Compared: Takeaways: - On NVDA, the options strategy significantly outperformed simple buy-and-hold in that period, with a lower max drawdown. - On SPY with the same rules: - Bull put spreads on NVDA: Key idea:Backtesting helps you see how a strategy actually behaved through real volatility, instead of just trusting vibes or isolated trades. 4️⃣ Designing a Trading Life You Actually Want

1-10 of 26

@julie-mccoy-8166

STR investor with 9 properties in the TN Smokies and Destin; moving into the wedding/events and mini-resort space

Active 2h ago

Joined Oct 18, 2025

Powered by