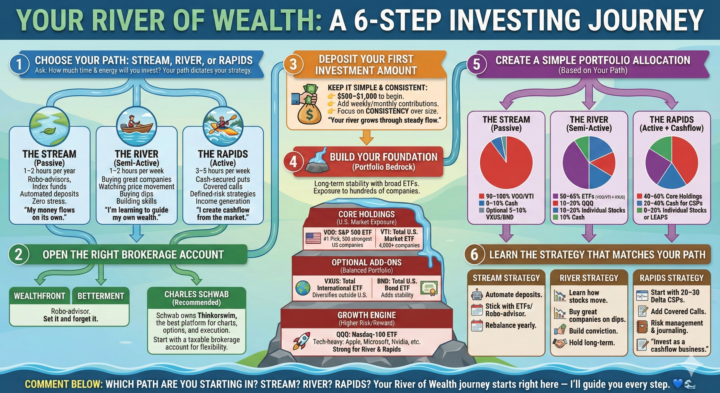

Getting Started: 🌊 6 Steps to Investing in the Stock Market + Infographic

🌊 The 6 Steps to Start Investing — The River of Wealth Pathway Before you buy a stock… Before you place a trade… Before you choose a strategy… You need clarity on the type of investor you want to be. Inside River of Wealth, we use the Stream → River → Rapids framework to match your investment style to your lifestyle. These are the 6 steps every beginner should follow. Let’s dive in. 🌊 🟦 Step 1: Choose Your Path — Stream, River, or Rapids Ask yourself: How much time and energy do I want to spend investing? The Stream — Passive (1–2 hrs/year) “My money flows on its own.” - Robo-advisors - Index funds - Automated deposits - Zero stress The River — Semi-Active (1–2 hrs/week) “I’m learning to guide my wealth.” - Buy great companies - Watch price movement - Buy dips - Build skills The Rapids — Active (3–5 hrs/week) “I create cashflow from the market.” - Cash-secured puts - Covered calls - Defined-risk strategies - Monthly income Your path determines your entire approach. 🟩 Step 2: Open the Right Brokerage Account If you’re in The Stream (Passive): Use a robo-advisor: - ✔️ Wealthfront - ✔️ Betterment If you’re in The River or Rapids: Open an account at: ✔️ Charles Schwab (Schwab owns Thinkorswim — the best charting & trading platform.) Start with a taxable brokerage account. 🟧 Step 3: Deposit Your First Investment Amount Start simple and consistent: 👉 $500–$1,000 to begin👉 Add weekly or monthly deposits👉 Focus on consistency over size Your wealth builds from steady flow. 🟥 Step 4: Build Your Foundation (Your Portfolio Bedrock) Begin with broad, diversified ETFs. These give you instant exposure to hundreds or thousands of companies. 🇺🇸 Core Holdings (U.S. Exposure) - VOO – S&P 500 ETF (my #1 pick) - VTI – Total U.S. Stock Market ETF 🌍 Balanced Add-On ETFs - VXUS – International stocks - BND – U.S. bond market 🚀 Growth Add-On ETF - QQQ – Tech-heavy Nasdaq-100 This becomes your long-term riverbed.

Questions before Friday's call

A few things I'd love to know the answers to @Jeffrey Cowan ! - In thinkorswim, how can I know when I have a closing order set for any open trades I have? I think I know but just want to confirm; so far I've placed most of my trades in the evening, so there's been a delay with opening my positions, I have to do some catch-up to make sure I set up the closings too. - How can I look at trade activity older than one day? I swear I was able to filter it before to "in the last 7 days" etc. but I cannot for the life of me find that option now. - How can I see how much of my cash is tied up in cash secured puts? My "Cash & Sweep Vehicle" amount in paper trading doesn't seem to reflect this (I'd love to learn exactly what that number is meant to reflect). So even in my paper trading I don't want to run around writing a bunch of cash secured puts without understanding how much cash I have that isn't already committed. Writing one put contract for Microsoft, for example, requires a substantial amount of cash on hand! - In charts, how do I zoom out? At one point I selected an area of a chart to zoom in on part of it, but I can't figure out how to get back out! ...nevermind I just figured it out. But I would also like to know how I can adjust the charts to show, say, weekly activity vs. daily, or change the timeframe between 5Y/1Y/3M/etc. - Also in charts, I see an icon for Trendline but can't see how to use it. In some of the books I'm reading certain trendlines are really important for chart interpretation, so I'd like to see how to view those and customize them if necessary.

Building a portfolio "from scratch"

I'm curious about your opinion @Jeffrey Cowan on coming into this without having any individual stocks held in a portfolio, and how to build something up to really play in the options space. For me, I do have a decent portfolio that's currently invested in index funds. - Do index funds have options, and if so, is there any prevailing opinion about pros/cons of trading them vs. individual stock options? (yeah I can check my specific ones on thinkorswim) - If I'm going to sell cash-secured puts, does the cash need to already be in actual cash, or would my existing holdings be able to work as collateral and I sell that only if the option is exercised? (I'm guessing the former, as the latter would be an instance of using margin, but you tell me) - When considering repositioning my portfolio with the intention of using it as a basis to trade options, beyond 1) buying stocks that generally have active options trading, and 2) being high quality stocks to own in general, are there other major factors I should consider? Certain sectors or cap size that tend to be better, or anything else? For anybody else reading this, now or in the future, I'm not planning to completely exit my index funds to go nuts in options... I have a larger part of my portfolio that's in index/mutual funds that I'm not touching anytime soon. I don't want to be interpreted as advocating for being at all reckless with a portfolio 😊

Best online resources?

What online resources do you like best for research, news, analysis, tools etc?

1-4 of 4

skool.com/riverofwealth

Stocks. Options. Abundance. A community where mindset meets mastery and multiple streams flow into one river of wealth.

Powered by