Spreadsheet tracker for BPS

Here's the spreadsheet I (with the help of ChatGPT) put together to track my Bull Put Spreads. Eventually I'm sure I'll build out something more robust to track all my trading with different strategies, but wanted to keep it relatively simple to start. I originally built it out with my paper trading, then this morning created new tabs for real trading but kept the trades in there as examples - just delete those rows once you don't need them anymore. Once a trade fills, just cut/paste the row into the Closed Trades tab and everything should update automatically. :) Something I found out the hard way: Microsoft is a bitch about auto-save now (you have to store the file in OneDrive for auto-save to work, which is the rankest BS I've ever heard) so look into that if you've lost the habit of reflexively saving your work like I have. I probably should have built this in Google Sheets but I like Excel better.

Bull put spreads

My latest late night conversation with ChatGPT had me asking "are there additional strategies I should be considering to meet my goals of conservative income generation with capped risk?" and ChatGPT suggested (amongst other things) bull put spreads. @Jeffrey Cowan I remember you referencing bear call spreads in one of my earlier posts - at the time I had no concept of what that was, but now I feel like I've got a decent grasp of the strategy. :) So, I am now playing around with bull put spreads. Given the high ROI potential with much more limited capital collateral/risk, why doesn't everybody do these 😂 What am I missing? Is it mainly because the numbers are SO small that it's just not sexy enough? Commissions eat too much of the return? Is there a risk I'm not perceiving? 'Cause yeah a single contract's dollar value is pretty minimal, but at scale...

🎯 How to Generate Income with a Bull Put Spread on NVIDIA Earnings (Step-By-Step Guide)

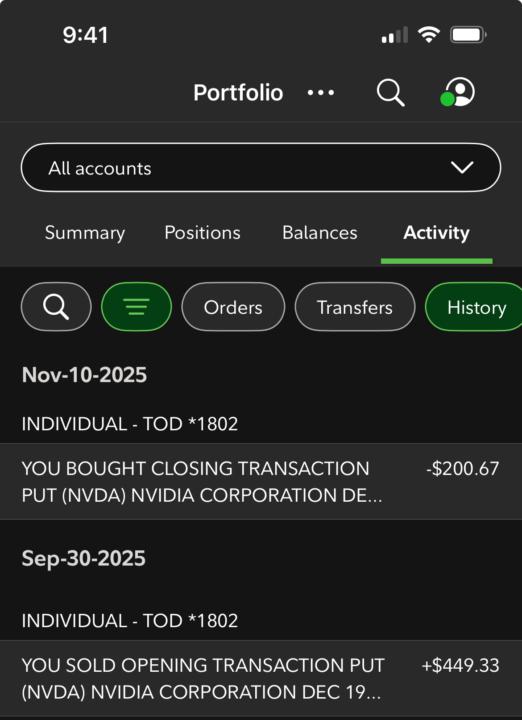

Hey everyone! Today I recorded a full walk-through showing one of my favorite income strategies — the Bull Put Spread — using NVIDIA earnings as the example. NVIDIA reports after the bell today, so implied volatility is elevated and option premiums are richer than usual. Perfect time to break down how I personally think through a spread like this. Below is a quick summary of what you’ll see in the video ⬇️ 💡 What Is a Bull Put Spread? A bull put spread is an options income strategy where you: 1. Sell a put at a strike you’d be happy owning the stock 2. Buy a further OTM put to cap your downside You collect a credit up front, and your max loss is defined — no surprise blowups. This is one of my favorite income streams inside the River of Wealth because it allows smaller accounts (or accounts without margin) to generate consistent returns with limited risk. 🔧 The NVIDIA Setup I Walk Through At the time of recording: - NVDA price: ~$185 - Earnings: After the bell - DTE: I prefer the 30–45 day window - Delta targets: Sell ~20 delta, buy ~10 delta In the example, I show how to set up: - Sell the 165 put (~20 delta) - Buy the 155 put (~10 delta) - $177 credit received - $823 max risk - Breakeven at ~$163 This is a defined-risk, high-probability setup, especially with elevated IV before earnings. I also walk through: - Why I prefer strikes with higher open interest - Why I often lean toward the $5 and $10 increments - How IV crush works after earnings - How to set the order up in Thinkorswim step-by-step 🧠 Closing the Trade: My 50% Rule Inside the video, I show exactly how I set the GTC closing order at 50% profit. For the example: - Entry: $1.76 - Target: $0.88 - I show how to highlight both legs → “Create closing order” → Set limit → Make GTC. This is one of my core River of Wealth principles:automate your exits so your emotions don’t get involved. 📈 Scaling the Position I also show how this looks when you size up:

ChatGPT + options strategy

I'm LOVING ChatGPT as a tool to quickly analyze potential strategies or trades. Still definitely need to dummy-check it! But it's very useful to talk through ideas. Today's discussion centered around Micron - I love the long term upside potential there, but not ready to run out and buy 100 shares of it at ~$250 a pop. So I went exploring possibilities that could expose me to the unlimited upside while limiting my downside. Interested in your take @Jeffrey Cowan . Basic thesis: Micron goes substantially up in value over the next 3-5 years, based on the fundamentals as I understand them. I want to own it without owning it. Theory: buy a LEAP call to provide that long term upside exposure, while only risking the premium. In the meantime, sell cash secured puts or possibly "poor man's covered calls" to generate income (I'm biased much more towards CSPs given this is a stock I prob want to own long term anyway). ChatGPT's advice: buy a deep ITM call for a far out date (January '28 is the furthest one currently available), optimizing for high delta, lower capital investment, better breakeven, and better leverage. Its opinion is the 100 strike fits my needs best - currently trading at $147, the breakeven is about $247 (today's stock price) but I only need ~60% of the capital to secure that position, and limit my downside exposure. Pair this with writing CSPs just as Jeff does, to generate income. Highest risk is having double exposure to the stock if it falls dramatically, but I also maintain the uncapped upside potential. Note: there's two legs here, if you want to call them that, but they are not dependent on each other; I can buy the LEAP without selling CSPs and I can sell CSPs without buying the LEAP. Each serves a different purpose, but both take a bullish view on the stock.

1st successful trade

It’s been almost 25 years since I did my first options trade, covered call on Legato Systems on 11/14/2000. In 2003, I stopped trading all together and just invested in the SP500. I started trading stocks a few months ago and at the boardroom event, @Jeffrey Cowan awakened my passion to look into options again. Sold a cash-secured put and it closed out today for a 1.55% return in 41 days! Would have closed out last week had I learned about just going for a 50% profit which I picked up from joining this community.

1-9 of 9

skool.com/riverofwealth

Stocks. Options. Abundance. A community where mindset meets mastery and multiple streams flow into one river of wealth.

Powered by