Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

What is this?

Less

More

Owned by Jeffrey

Stocks. Options. Abundance. A community where mindset meets mastery and multiple streams flow into one river of wealth.

Memberships

Skoolers

182k members • Free

Boutique Hotel Secrets

79 members • Free

STR Secrets Mastermind

376 members • Free

AI Mastermind

3k members • $49/m

STR Secrets 7 Figure Boardroom

58 members • Free

High Vibe Tribe

78.1k members • Free

HOST Launch

179 members • Free

[Archived] DT Market Masters

9.3k members • Free

35 contributions to The River of Wealth

*UPDATE* First real (closed) trades!

I placed my first trades with real money a couple of days ago! Both are bull put spreads, I opened one contract with TSLA and three with AAPL. Why these companies? I'd done a bit of paper trading and both performed well with high return on risk. Tesla is generally volatile and therefore trades often close pretty quickly, so I get to recycle the money faster - but the volatility also increases risk, so I kept my position small. Apple has also been moving enough to close out trades pretty quickly, and I feel overall it's less volatile than Tesla, so I like the slightly lower ROR while maintaining the churn with increased stability. There's only a few thousand dollars at risk for potentially a few hundred dollars of gain, but projected ROI is about 9% if I'm closing at 50% so that's awesome. I plan to hone in on a few companies I like to trade spreads on and gradually increase my number of contracts (perhaps over a couple of different positions) to start generating some meaningful profits. UPDATE 12/5: After 3 days in the trade, my Tesla position closed for a profit of $210 🎉

0 likes • 24h

@Julie McCoy this is so awesome, huge congratulations on your first real trades! 🎉🙌 I love how intentional your approach is already: keeping position size small, choosing high-liquidity names, thinking through volatility vs. ROR, and focusing on closing early at 50%. That’s exactly the mindset that wins long-term. Tesla + Apple are great tickers to trade on because they give you movement, liquidity, and consistent opportunities to recycle capital, and you’re already thinking in terms of process, not outcome. That’s the whole game. Keep compounding these reps. As you hone in on your core tickers and slowly scale contracts, you’re going to build a really consistent income engine. Proud of you, this is how it starts 🚀🌊

River of Wealth Stocks + Options Call – Dec 2 Recap 🌊📈

Huge shoutout to Julie and Tony — this call was packed with real wins and super actionable strategy. 🚀 Big Wins from the Call Julie - Placed her first real-money bull put spreads on AAPL and TSLA (Congrats @Julie McCoy!) - Used her spreadsheet to compare return on risk, adjust long strikes, and size positions smartly - Picked Apple for stability and Tesla for volatility and opportunity Tony - Ran multiple cash-secured puts on NVIDIA (Congrats @Tony Li!) - Already hit ~30%+ annualized returns - Dialed in the framework: 30–45 DTE, ~20–25 delta, tight spreads, 50% take-profit Please share these wins in the community so we can all celebrate them 🙌 🧠 Key Concepts We Covered Bull Put Spreads & CSPs How to filter out low-quality trades, why high-quality names matter, and how to build an options income layer on top of stocks you already believe in. Macro Tailwinds & Timing We talked about market strength into December, regaining moving averages, and how to wait for the right pitch instead of forcing trades. Narrative & “Forever Companies ”Narratives flip fast, but companies that consistently execute (AAPL, NVDA, TSLA) tend to win over time. We discussed pairing long-term holdings with options income for a powerful two-engine strategy. Avoiding Over-Diversification: It’s often better to focus on a few A+ names you understand well rather than scattering across 10–15 tickers. 📊 Technical Analysis: Moving Averages We added 20, 50, 100, and 200-day simple moving averages in Thinkorswim. Use them to: - Gauge market strength - Decide when to throttle risk - Find better strike placement - Identify support and resistance Broad market (QQQ, SPY) + individual names (NVDA, AAPL, TSLA) all follow these rules. ⏳ Theta: “Selling Time” Tony put it perfectly: We are selling time.Even on weekends and holidays, time decay works in your favor.This is a strategy you can run without staring at the screen all day.

2

0

Spreadsheet tracker for BPS

Here's the spreadsheet I (with the help of ChatGPT) put together to track my Bull Put Spreads. Eventually I'm sure I'll build out something more robust to track all my trading with different strategies, but wanted to keep it relatively simple to start. I originally built it out with my paper trading, then this morning created new tabs for real trading but kept the trades in there as examples - just delete those rows once you don't need them anymore. Once a trade fills, just cut/paste the row into the Closed Trades tab and everything should update automatically. :) Something I found out the hard way: Microsoft is a bitch about auto-save now (you have to store the file in OneDrive for auto-save to work, which is the rankest BS I've ever heard) so look into that if you've lost the habit of reflexively saving your work like I have. I probably should have built this in Google Sheets but I like Excel better.

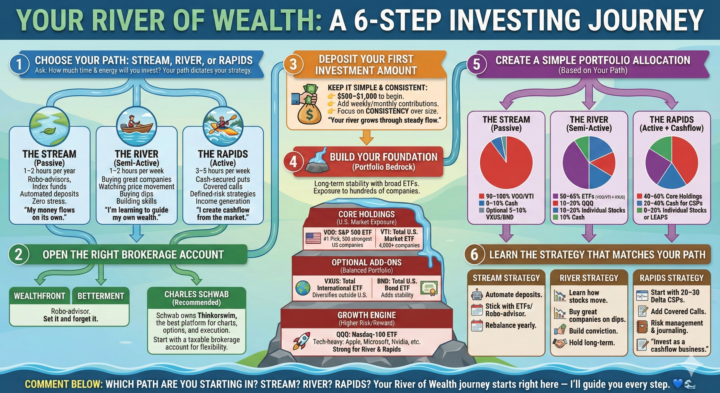

Community Call - November 25: From Stream to River to Rapids

VIEW RECORDING - 76 mins Huge thank you to Danni and Julie for an amazing call today. This one was such a perfect example of how we can go from totally passive to active cashflow in a really intentional way. On this call we walked through: 🔹 The River of Wealth 6-Step Investing Journey - 🏞 Stream – Truly set-and-forget investing (index funds + robo-advisors like Wealthfront/Betterment). - 🌊 River – Core ETF holdings + a handful of individual stocks. - ⚡️ Rapids – Options as a cashflow engine once your foundation is solid. 🔹 How to think about: - Core holdings (VOO, QQQ, etc.) - Optional add-ons (tilts + a few favorite names) - Growth engine (income strategies like cash-secured puts and bull put spreads) 🔹 Turning a monthly cashflow goal into a planWe used Danni’s goal of $2K–$5K/month as a live example and talked about: - Why a realistic target for options is 1–3% per month - What kind of portfolio size and structure can get you there over time - Why we still build on top of solid core holdings instead of “all rapids, all the time” 🔹 Live options + Thinkorswim walkthroughWith Julie’s help we walked through: - A bull put spread built step-by-step (including how we sized it to target ~$2K profit) - Why we close at 50% profit instead of waiting until expiration - How to place and close a vertical spread quickly in Thinkorswim - Key columns like P/L Open, P/L Day, Buying Power Effect, Delta, Theta, Net Liq, and what they actually mean in practice I love how much real progress you’re all making – especially seeing people move from paper trading → confidence → eventually, real-money positions with clear rules and risk management. If you were on the call (or watching the replay), drop this in the comments: 1. Are you currently mostly in the Stream, River, or Rapids? 2. What’s your monthly cashflow goal from options over the next 12 months? 3. What’s one concrete action you’ll take this week?

0

0

Getting Started: 🌊 6 Steps to Investing in the Stock Market + Infographic

🌊 The 6 Steps to Start Investing — The River of Wealth Pathway Before you buy a stock… Before you place a trade… Before you choose a strategy… You need clarity on the type of investor you want to be. Inside River of Wealth, we use the Stream → River → Rapids framework to match your investment style to your lifestyle. These are the 6 steps every beginner should follow. Let’s dive in. 🌊 🟦 Step 1: Choose Your Path — Stream, River, or Rapids Ask yourself: How much time and energy do I want to spend investing? The Stream — Passive (1–2 hrs/year) “My money flows on its own.” - Robo-advisors - Index funds - Automated deposits - Zero stress The River — Semi-Active (1–2 hrs/week) “I’m learning to guide my wealth.” - Buy great companies - Watch price movement - Buy dips - Build skills The Rapids — Active (3–5 hrs/week) “I create cashflow from the market.” - Cash-secured puts - Covered calls - Defined-risk strategies - Monthly income Your path determines your entire approach. 🟩 Step 2: Open the Right Brokerage Account If you’re in The Stream (Passive): Use a robo-advisor: - ✔️ Wealthfront - ✔️ Betterment If you’re in The River or Rapids: Open an account at: ✔️ Charles Schwab (Schwab owns Thinkorswim — the best charting & trading platform.) Start with a taxable brokerage account. 🟧 Step 3: Deposit Your First Investment Amount Start simple and consistent: 👉 $500–$1,000 to begin👉 Add weekly or monthly deposits👉 Focus on consistency over size Your wealth builds from steady flow. 🟥 Step 4: Build Your Foundation (Your Portfolio Bedrock) Begin with broad, diversified ETFs. These give you instant exposure to hundreds or thousands of companies. 🇺🇸 Core Holdings (U.S. Exposure) - VOO – S&P 500 ETF (my #1 pick) - VTI – Total U.S. Stock Market ETF 🌍 Balanced Add-On ETFs - VXUS – International stocks - BND – U.S. bond market 🚀 Growth Add-On ETF - QQQ – Tech-heavy Nasdaq-100 This becomes your long-term riverbed.

1-10 of 35

@jeffrey-cowan-9566

Living in Newport Beach, CA, investing in Stocks + Options and developing Hotels and Resorts into Wellness Destinations 🌴

Active 57m ago

Joined Sep 15, 2025

Powered by