Write something

Pinned

Welcome To The Credit Cicle 🔥

(Take 1 Min to Skim This Entire Welcome Post or You May Miss Out On Live Credit Meetup With Dave & Mike) We specialize in helping people knock the credit bureaus out 🥊 so you can leverage your credit to invest into income producing assets So to get the most out of this society & learn the secrets the credit bureaus and banks don’t want you to know - follow these 3 quick steps below now: Step 1.) Get Access To A Your Secret Credit Report: SmartCredit.com/CreditTeam Step 2:) Please Introduce Yourself & Tell us Your Goals We Are Tired of Our People Lacking Financial Education Soooooo we made a vow to change this "ITS OUR TURN"

Pinned

Results :)

So by sheer luck, I came across Dave in a scroll in April of 23. I was interested but was for sure it wouldn’t help me. I immediately was skeptical. The next day, I watched some more and printed out my reports. It was terrible. I had 10 bads and 9 collections all together. It seemed overwhelming to me. I decided the next year or so would come and go no matter what so I tried it. There’s so much more to be said it’s a lot but… In fifteen months I went from 512 to 779. It takes time and patience but if you hang on, it can happen. It isn’t magic, it isn’t overnight. Patience was key and now I’m nearing an 800 credit score. I messaged Dave last night to thank him for all he does for others and wanted to share here. It can be done. Take it one account at a time on your report and you can get there!!

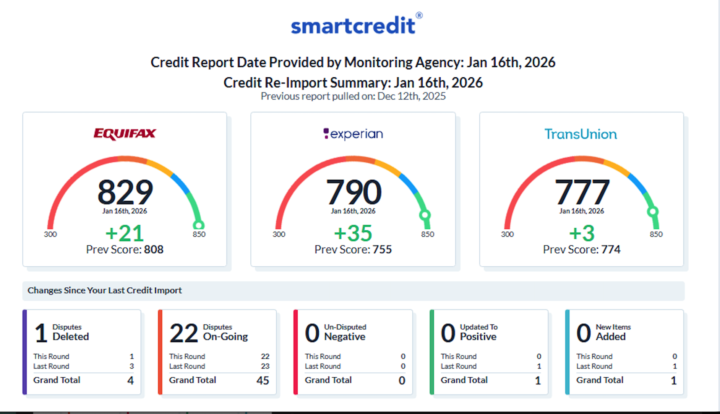

829 Credit Score 😱

Another member leverage the information to continue to get success

Chime is ruining my credit

I opened a Chime Credit Builder account, which is supposed to be a secured card that only uses the money I deposit. It should never go negative. But because of a system error on Chime’s end, my card went negative even though it wasn’t supposed to. After that, Chime started reporting late payments and delinquencies that were not real. As soon as I saw the issue, I tried to pay the balance immediately, but every time I contacted Chime, they refused to take the payment. They wouldn’t let me pay through the app or over the phone, and instead they told me to “dispute it with the bureaus.” Not long after, Chime charged off the account, closed it, and started reporting multiple derogatory marks — 30-day lates, 90-day lates, a charge-off, and a $117 balance owed — all of which were caused by their own error. Since Chime blocked me from paying electronically, I went out of my way to send an official Citizens Bank cashier’s check for $117 by USPS Certified Mail, which Chime received. After that, Chime emailed me confirming that my account was fully paid, settled with a $0 balance, and that they would update all the credit bureaus within 30 days. Even with that confirmation and proof of payment, Experian, Equifax, and TransUnion are still reporting the account as a charge-off with derogatory marks, late payments, and a balance owed. NOW WHAT DO I DO?

Credit Repair

I’m so ready to start attacking and fixing my credit. I just need to know where do I start at? What do I need to do first? Anyone have any suggestions? Let me know! Thanks in advance

1-30 of 241

powered by

skool.com/virtual-millionaire-9513

Learn How To Repair, Build, and eventually Leverage Your Credit The Right Way!

Suggested communities

Powered by