Aug '25 • General discussion

Collecting is fun - but is it a good investment?

1. What is Studio Pottery?

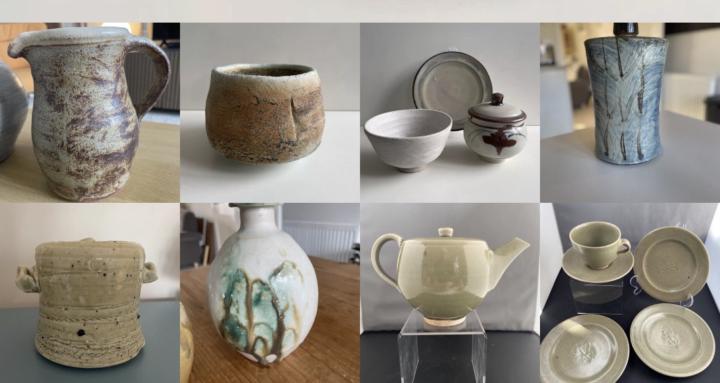

Studio pottery refers to ceramics produced by individual artists or small workshops, typically in limited quantities, with a focus on artistic expression rather than mass production. Each piece is often handmade, signed, and sometimes numbered.

2. Factors Affecting Value

Several key factors determine the investment potential of studio pottery:

a. Artist Reputation:

- Works by well-known or historically significant potters (e.g., Bernard Leach, Lucie Rie, Hans Coper) tend to appreciate over time.

- Emerging artists can be cheaper but carry higher risk.

b. Rarity and Uniqueness:

- Limited editions or one-of-a-kind pieces generally command higher prices.

- Pieces with distinctive glazes, forms, or techniques may be more desirable.

c. Condition:

- Chips, cracks, or repairs significantly reduce value.

- Original documentation, certificates, or signed pieces increase authenticity and value.

d. Provenance:

- Pieces with clear ownership history or exhibition records often attract collectors.

- Museum acquisitions or appearances in major galleries enhance credibility.

e. Aesthetic and Historical Appeal:

- Certain styles and periods (mid-century modern, Japanese-inspired work) have strong collector demand.

- Shifts in taste can affect future desirability.

3. Market Dynamics

- Studio pottery is a niche market with fluctuating demand.

- Auction results, gallery sales, and online marketplaces like 1stDibs or Artsy offer insight into pricing trends.

- Unlike stocks, there’s no standardised market index, so valuation can be subjective.

4. Advantages as an Investment

- Tangible Asset: Can be displayed and enjoyed while potentially appreciating.

- Cultural Value: Some collectors value historical and artistic significance, which can sustain long-term demand.

- Diversification: Adds a non-financial asset to an investment portfolio.

5. Risks and Challenges

- Illiquidity: Selling can be slow and dependent on finding the right buyer.

- Market Volatility: Taste, fashion, and collector interest can shift.

- Authenticity Risks: Forgeries exist, especially for high-value pieces.

- Storage and Handling: Fragile nature requires careful storage and insurance.

6. Investment Strategies

- Buy Renowned Artists: Focus on established names for more predictable appreciation.

- Support Emerging Talent: Can yield high returns if the artist gains prominence.

- Diversify by Style/Period: Spread risk across different regions, eras, and techniques.

- Documentation: Maintain purchase receipts, certificates, and provenance records.

- Auction Monitoring: Track sales history to understand market trends and potential resale value.

7. Summary

Studio pottery is a hybrid investment: part art, part collectible. It’s most suitable for investors who:

- Appreciate art beyond financial return.

- Can tolerate illiquidity and market subjectivity.

- Are willing to conduct research into artists, styles, and provenance.

While it can produce impressive returns - particularly for rare or historically significant pieces - its value is heavily dependent on taste, market trends, and condition, making it riskier and less predictable than conventional investments.

0

0 comments

powered by

skool.com/studio-pottery-identification-9240

All things studio pottery, discuss, identify, value & most of all enjoy our love of this fabulous art form. Potters introduce yourselves and your work

Suggested communities

Powered by