Pinned

Secrets of Retirement Accounts 2/25

📅 Wednesday, Feb 25 | 8PM Eastern — Live Training I’m hosting a live event on self-directed retirement accounts paired with advanced note investing strategies. Here’s why I’m doing it: Register here https://us02web.zoom.us/webinar/register/WN_589lAwcVQMuCeFnCf-6EVA Starting a tax-free retirement account was the single most important thing I did. Not because it was “exciting”… but because it made me pay attention. It made me stop outsourcing my future to whatever was inside a typical retirement plan… and start learning how real wealth is built. In this training, I’ll walk you through:✅ The self-directed setup (without the confusion)✅ How note investing works in the real world✅ The strategies I use to turn non-performers into performers✅ How this can create retirement income that’s not tied to the market 👉 Register here: https://us02web.zoom.us/webinar/register/WN_589lAwcVQMuCeFnCf-6EVA ⚠️ Pre-registration required. No registration = no access. Comment “I’M IN” if you’re coming.

Pinned

Welcome New Members! Please introduce yourself Drop your "My Story" Below

New users WELCOME! Please let us know what you have been doing and what you want for your future! Also go to the "Classroom" and enter Start Here Course

Who gets the 💲💲 call?

We love when title companies call our 800 number! You look at your phone..who the F$^% is calling me from Michigan? "Hi, this is Paul from Chicago Title in Muskegon, Michigan.I'm calling about a property at XXX East XXXX Avenue.We are looking to get a payoff of the mortgage that she has on the property. Can you please call me back, so I can get a payoff, please?Thank you." SWEET!

Who pays attention to the boring things?

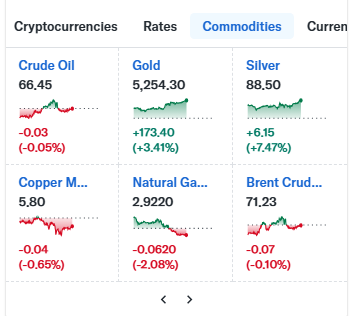

Silver is in my focus One day move! 7.47% I bought in last month at $60 which was twice the normal price for many years I felt like the sucker at the poker table! HA! Silver is a very rare essential manufacturing mineral. The most conductive element known. Needed in data centers worldwide. Electro vehicle battery material. Solar panel material. Will we see $40 or $150 first? Let's hear it!

Raise capital for your deals, help friends and Family!

What could be better? Join me This Wed 8PM EST for a Seminar: Learn how to : 💵1) raise unlimited capital for your deals 💵2) invest your own capital📈Tax Free Growth 💵3) help Family and friends get good solid safe returns on your deals 💵4) have a pipeline of unlimited cash flowing into your deals. Turn it on and off when you want Register with this link https://us02web.zoom.us/webinar/register/WN_589lAwcVQMuCeFnCf-6EVA Add this event to your calendar

1-30 of 299

skool.com/retirement-cash-flow-

Retire wealthy with multiple streams of income! Build these streams one by one. Get one going then work on the next. NO: stocks bonds mutual funds!

Powered by