Utilizing the Zombie Death Clock Information

Hi John, I am interested in your portfolio you've built and have talked about. I have a couple of questions and please bear with me as I'm still new to stock investing. It seems with the Zombie Death Clock tool, you evaluate stocks based on their cash runway among other factors. In which way do you use this information? Are you using this to short these stocks or buying put options? Or are you using this information to know which companies to stay away from? I'd imagine if shorting, this would be a small piece of your portfolio as it is high risk. If this is accurate, what percentage of your portfolio do you put towards these shorts and what is your risk tolerance? Are you strictly using options to mitigate risks? Reviewing your gains and very few yearly losses you have put on your website, it doesn't seem as high risk as I'd imagine. I'm looking for a clear picture of how you use the Zombie Death Clock information and how we can use it to build our portfolios.

Just added the intro video for the community.

We will start having weekly meetups to discuss any questions you may have and add features to my backlog that will help you continue to build your wealth. I had put a standing meeting on the calendar, but we can change it. If there are no questions this week, I hope to see you next week. Also, I would like to thank @NateHerk and his AIS+ community for giving me a jumpstart using n8n.

0

0

Are you ready to take control of your wealth?

We Don't Follow the Crowd. We Follow the Cash. Most investors drown in financial noise — thousands of SEC filings, complex GAAP tags, and misleading headlines. Our automated Signal Sentinel cuts through the complexity to find the few direct truths that actually matter. To get things started with our community, please introduce yourself and share the last investment-related book that you found to be valuable.

1-3 of 3

powered by

skool.com/occams-investing-5373

Occam’s Investing

💰 We follow the CASH

🚀 Real-Time Forensic Alerts:

🔍 The "Sentiment Razor" Feed:

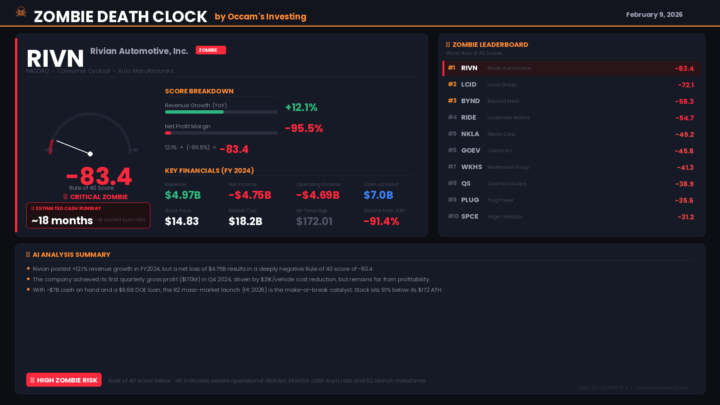

🧟♂️ Avoid Zombies

🤝 High-Signal Community:

Suggested communities

Powered by