Write something

Update On 1st Renovation- 74k Profit!

As I should have posted a long time go, we finished out first large remodel and sold the property in January of this year for full asking price! 212 S Elm was amazing learning project and allowed us to have the confidence to dive into a bigger project. Here were the final numbers on the deal. Purchase price: 41,800 Remodel: 41,500 Holding Cost: 1,650 Total Input Cost: 84,950 Sales Price: $170,000 Selling Cost: (11,050) NET Profit: $74,000 Tax Tip: We paid 0% in taxes on the profits from this sale because they are LTCG and in the 0% bracket based on our tax returns. Feel free to ask any questions!!

0

0

We bought 2 properties and got PAID to do it!

My partner and I sold one of our long term rentals which we owned for 2 years. It rented for 1,500/month in a college town with the details below: Purchase price: 85,000 (6k down) Rehab: 4,500 (cash) Sales Price: 125,000 Sales Cost: (2,596) NET Profit: $32,900 Profit & Equity: $45,700(what we recieved) Upon closing, the same day, we bought these two properties for a total combined purchase price of 164,000, we used the funds from the sale of our original property as the down payment for these two and had over 7k left over that was deposited in our bank account! These properties combined rent for 2,200/ month. Genius idea: When you purchase two properties from the same seller, put them under one loan. So when you sell one of the properties, you don’t have to pay the loan off because it’s still secured by the other property! Pretty neat we traded 1 house that rented for 1,500/month for 2 houses that rent for a total 2,200/ month and GOT PAID +7k to do it.

We made 42k profit on our flip!

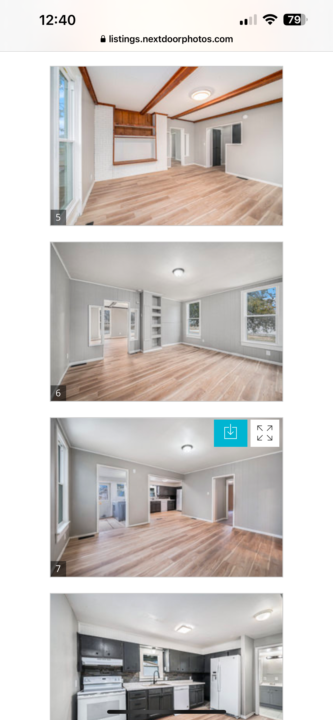

Last December, we bought 506 maple st. through direct mail marketing for 22,000. We remodeled the house completely for an additional 122,000, which we completed using our own cash. We turned it into a 3 bed 1 bath. We put it on the market and it went pending in just 3 days. Purchase price: 22,000 Rehab: 122,000 Holding cost: 0.00 Total Cost. 144,000 Sale price: 200,000 Selling cost (13,500) NET Profit: $42,500 Tax Benefit: We made sure to hold this property for a minimum of 1 year so it would be treated as LTCG, which means most of the profit will be taxed at 0% and a little at 15% for federal, and 0% for state. We are currently looking for a 1031 exchange property so we can defer all taxes! Reach out to learn more about the tax strategy, or ask us what things cost to complete a remodel!

🎉 Big News! We Closed on Another Property! 🏡✨

506 Maple St. Lathrop MO. We have big plans for this property, as we’ll be following the BRRRR strategy (Buy, Rehab, Rent, Refinance, Repeat). Our goal is to transform this house into a rent ready home that will be fully renovated by August 2025. 🛠️ Real estate isn’t just about properties...it’s allows you to build a vision & create value. We’re incredibly grateful for the opportunity to keep growing in this journey. Stay tuned for updates along the way! We can’t wait to show you the transformation of this property from start to finish. If you’ve ever considered investing in real estate or want to know more about how we do it, feel free to reach out

From Mailbox To Contract: Direct Mail WORKS

Here's a quick glance into the conversations I had, and how I secured a great deal. After sending a mail campaign, I received a phone call from the owner of a property in my desired market. She lived roughly 10 hours away from this property, and received the property as an inheritance. She was given the property roughly three years prior, which had tenants inside at the time of transfer. Since she has taken ownership, the tenants have never paid her rent! Now, they are considered squatters, and the owner has no intention, energy, or head ace to deal with the house. I asked her, "In terms of numbers, what would give you peace of mind to have this burden off you." She stated that she would feel comfortable selling the property for 22,000. I didn't bother to counter, and we now have it under contract. In this deal, both parties are walking away smiling! Super neat experience.

1-8 of 8

powered by

skool.com/nxt-gen-rentals-follow-grow-6400

Learn tips, tricks, and strategies from a Certified Public Accountant as I scale my own real estate portfolio. Gain access to a CPA who loves REI.

Suggested communities

Powered by