Pinned

Start Here: NAV or Career + how AIS Hub works

Welcome to AIS Hub 👋 Choose your track below (NAV / Career / Both). ➡️ Comment: Name + Country + Track + #1 challenge — and I’ll point you to the right resources. Welcome to AIS Hub 👋 I’m Anna — 20 years in fund accounting (NAV production, controls, error resolution) + hiring/interview support. This hub has two tracks. Pick one (or do both): ✅ Track 1: NAV Skool | Skills + Controls Use this if you want to improve NAV production, resolve errors faster, and build daily controls.➡️ Go to NAV Skool (Skills + Controls) and post your #1 NAV challenge. ✅ Track 2: Career Launch | CV + Interview Use this if you want a clearer job-search system + stronger CV/LinkedIn + interview confidence.➡️ Go to Career Launch (CV + Interview) and post: role + location + timeline. Need help fast? Post in Q&A – Ask Anna (include context so I can answer properly). Premium (optional) $7/month or $69/year includes: 2 live Q&A calls/month (NAV + Career) + NAV Errors Playbook + priority Q&A + certificate.

0

0

Pinned

NAV Track: Start Here + how to ask NAV questions

Follow this order (save this post): 1. NAV Foundations → 2) NAV Errors Playbook → 3) Daily Controls ✅ To get the best help, include: fund type + asset type + what changed + figures/screenshots + what you tried. - Fund type (UCITS / AIF / HF / PE) - Asset type (equities/bonds/derivatives/etc.) - What changed today vs yesterday - Screenshot/figures (if possible) - What you already tried

0

0

Pinned

Career Track: Start Here + 14-day system + feedback format

Start here (14 days, 30 min/day): Reply with: Target role + country + timeline + your #1 blocker. ✅ Post here for feedback using: - Your target role + location - Your experience level (0–2 yrs / 3–5 yrs / 5+ yrs) - Your CV/LinkedIn (remove personal data if you want) - The 3 jobs you’re applying to

0

0

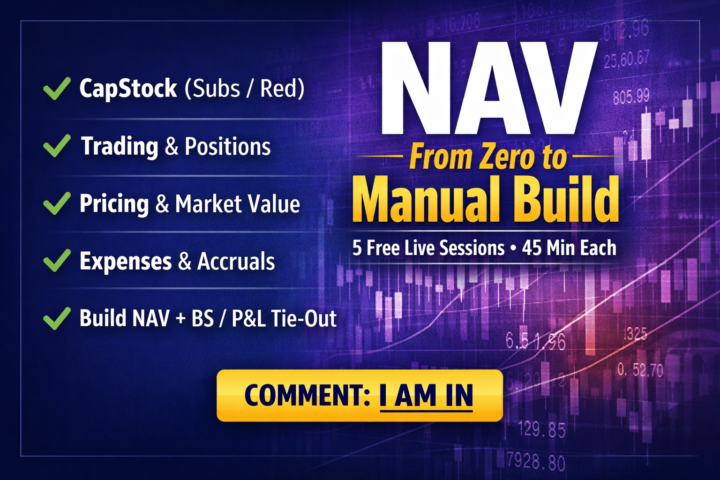

🎓 5 FREE LIVE NAV LESSONS — starting soon

I’m opening a small group for a practical NAV training series: 5 × 45-minute live sessions. What we’ll do:We’ll use one workbook and one dataset across all lessons (fund + 3 share classes + 5 assets).By Lesson 5 you will manually build the NAV, and you’ll understand how it ties to Balance Sheet + P&L (double-entry). ✅ You get the workbook✅ You get the live walkthrough✅ You get a clean method you can repeat at work To join: comment I AM IN (or DM me), and I’ll send the session link + details.

0

0

🚀 FREE NAV Lessons for Flexible Workers (Fund Accounting / NAV Production)

If you’re a flexible worker / contractor / returning-to-work professional and you want to break into (or level up in) Fund Accounting & NAV, I’m opening a set of FREE lessons inside NAV Skool. These are short, practical, and built for real-life schedules — 15–25 minutes per lesson with checklists + examples. What you’ll get (FREE): ✅ NAV Basics (without the fluff) — what actually moves NAV day-to-day✅ Core controls that stop errors (the things seniors check first)✅ Recons & breaks — how to think, investigate, and document✅ Pricing + corporate actions — where juniors get caught out✅ Mini “daily tips” playbook you can copy into your workflow Who it’s for: - Entry-level / career switchers into fund accounting - People re-entering work after a break - Flexible workers who want structured learning without long courses - Juniors who want to sound confident in interviews

1-30 of 32