Write something

Small Gains 💰

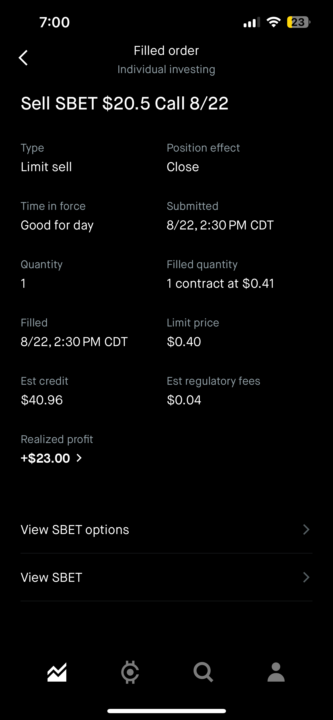

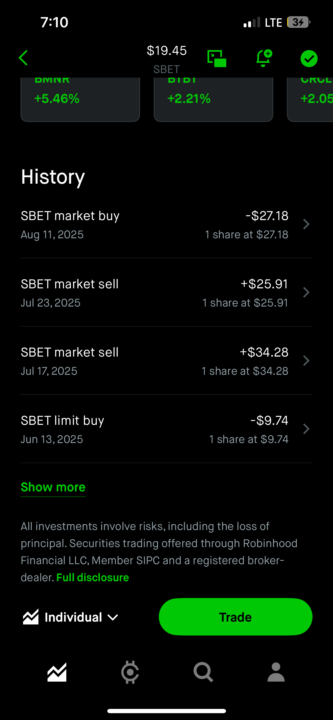

Learning options isn’t 100% skill, even when you’ve mastered it, it’s still not 100 skill. It’s hours of research and market analyzing. Heres another example of someone just starting out with less than 100 invested into one stock.

0

0

Stocks 📈📉

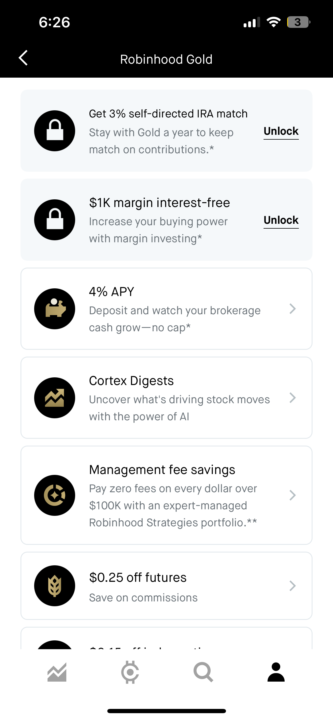

❌ When investing in stocks for the first time, it’s best to have a managed account that you pay a monthly fee for and you only deposit money into, and after that rest is up to the firm, I have tried multiple platforms and I have found out “Robinhood” works best for my investment goals. 4% Apy for ROBINHOOD ❌

0

0

Tips and tricks⁉️

🧠 1. Start with a Plan - Define your goals: Are you investing for retirement, a house, or passive income? - Time horizon: How long can you leave your money invested? - Risk tolerance: Know how much volatility you're comfortable with. 💸 2. Invest Consistently - Use dollar-cost averaging: Invest a set amount at regular intervals (e.g., monthly), regardless of market conditions. - Helps reduce the impact of market timing and emotional decisions. 📚 3. Educate Yourself Continuously - Read books like The Intelligent Investor by Benjamin Graham or Common Stocks and Uncommon Profits by Philip Fisher. - Follow reliable financial news and thought leaders. 📊 4. Diversify - Don’t put all your money into one stock, sector, or asset class. - Diversification helps manage risk across different markets (e.g., stocks, bonds, real estate, ETFs). 🕰️ 5. Think Long-Term - Time in the market beats timing the market. - Compound interest works best when you let your investments grow untouched. 🧾 6. Understand What You’re Investing In - Never invest in something you don’t understand. - Research the fundamentals: revenue, profit margins, debt, industry trends. 🛑 7. Avoid Emotional Investing - Don’t panic sell in a downturn or chase hype in a bull market. - Stick to your plan unless fundamentals change. 🛠️ 8. Use Tax-Advantaged Accounts (If Available) - IRAs, 401(k)s, or other tax-sheltered accounts can help you grow wealth more efficiently. - Know your local tax rules and strategies. 💼 9. Rebalance Periodically - Over time, your asset allocation may drift. Rebalancing keeps your portfolio aligned with your goals and risk tolerance. 📉 10. Learn from Mistakes - Losses are inevitable — what matters is learning from them. - Keep a journal of your investment decisions and revisit them regularly.

What is an IRA⁉️

Traditional IRA - Contributions may be tax-deductible, depending on your income and whether you have a retirement plan through your employer. - Investments grow tax-deferred, meaning you don’t pay taxes on gains until you withdraw. - Withdrawals in retirement are taxed as ordinary income. - Required Minimum Distributions (RMDs) must begin at age 73 (as of 2025). - Early withdrawals before age 59½ may be subject to a 10% penalty, plus income tax. 2. Roth IRA - Contributions are made with after-tax dollars (not tax-deductible). - Qualified withdrawals are tax-free (both contributions and earnings) if: - No RMDs during your lifetime. - You can withdraw contributions (not earnings) at any time, tax- and penalty-free. Other Types of IRAs: - SEP IRA: For self-employed individuals or small business owners. - SIMPLE IRA: For small businesses with fewer than 100 employees. - Rollover IRA: Used to move funds from a workplace retirement plan (like a 401(k)) into an IRA.

0

0

1-10 of 10

skool.com/motivated-and-successful-7400

Want to secure a great financial future ⁉️

Join a growing community of new and experienced investors who help one another strive for the best results.

Powered by