Write something

🎥 millionaireME Minute | Lessons from a 92-Year-Old Guidance Counselor

“You think you have time.” That’s how she begins. At 92 years old, after decades of counseling young people about their futures, she turns the mirror back on us. And her advice isn’t about stock tips, résumé hacks, or productivity systems. It’s about the scoreboard that actually matters. Here are her ten most important lessons — and why they belong inside millionaireME’s definition of wealth: 1. Don’t neglect your health — especially strength. Muscle is independence. Strength is dignity. Lift now so you can lift yourself, unassisted, later. 2. Make more friends. Loneliness compounds faster than capital. Invest relationally. 3. Talk about death and money. Wills. Trusts. Durable powers. Accounts. Transfer on Death designations. Passwords. Personal property. Insurance policies. Avoidance is expensive. Clarity is love. 4. Retirement won’t save you. It will expose you.If work is your only identity, retirement feels like erasure. Build a life and purpose beyond your day job before you need one. 5. Enjoy your spouse while you may.Say yes to trips. Accept invitations. Don’t postpone joy. 6. Forgive everyone now. Pride and grudges are heavy baggage —too heavy!— for such a short trip. 7. Your adult kids don’t need your advice — they need your presence. Ask questions. Listen more. Trust them and that they’ll figure things out. 8. Write things down.Stories. Recipes. Pet names. Family lore.Memory fades. Written legacy compounds. 9. You will be scared. Of illness. Of loneliness. Of losing independence. But take heart: You are stronger than you think. Courage beats denial. Every. Single. Time. 10. The last 30 years go faster than the first 60. Decades collapse. PAY ATTENTION. You do not have unlimited time. This is millionaireME in its purest form: ✅ Health ✅ Relationships ✅ Preparation ✅ Purpose ✅ Attention You think you have time. But wealth isn’t just growing assets. It’s stewarding days. So here’s the question: If the next decade goes by in a blink… what would you regret not doing starting today?

3

0

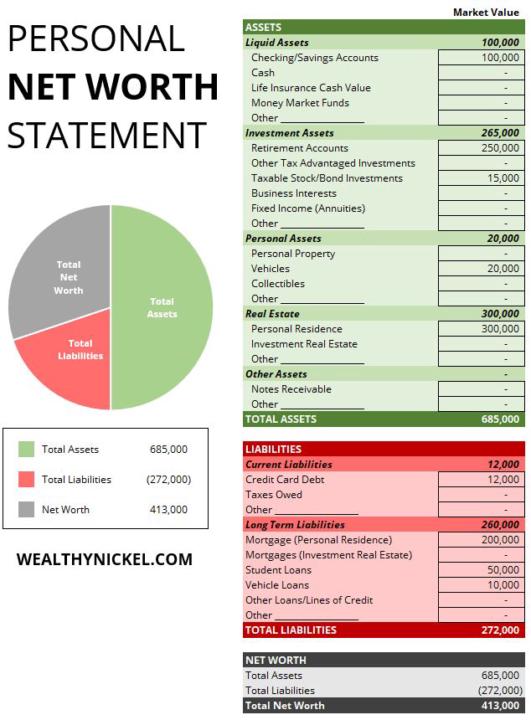

💸 millionaireME Minute: Your Net Worth Is Your Personal Balance Sheet

Quick question…Do you know your net worth? Not your income. Not your credit score. Your net worth. A net worth statement is a one-page snapshot of your financial life. On the left: what you own – cash – investments – home – business interests On the right: what you owe – mortgage – car loans – student loans – credit cards The difference? That’s your financial altitude. 👉 Net Worth = Assets − Liabilities Here’s the mindset shift most people miss: Paying off debt grows your net worth the same way investing does. Let me say that again: Paying off debt grows your net worth the same way investing does. And no—your net worth is not a moral judgment. It’s a baseline. A starting line. A GPS coordinate. If you don’t measure it, you can’t improve it. If you track it monthly, you start making better decisions automatically. Better question than “What’s my net worth?” What one decision—repeated monthly—would most improve this number over the next the month? The next quarter? The next year? That’s how wealth actually gets built. Measure it. Respect it. Move it—on purpose. Follow millionaireME for more wealth wisdom. #millionaireMEMinute #KnowYourNumber #WealthIsBuilt #UnleashYourInnerTBA

3

0

⏱️ millionaireME Minute | The Paramount Importance of Getting on the Right Bus 🚌

One of the simplest pieces of advice I’ve ever received is also the most enduring. For me, it came from the winningest college basketball coaches in history, Mike Krzyzewski, and it’s something he shares often, for good reason. It’s something his mother told him early in life back when he was a total unknown, just a Polish kid growing up in Chicago: “Get on the right bus. It’ll take you to all the places you want to go.” As he tells the story, it’s why he reluctantly climbed aboard the United States Military Academy, West Point, after high school. Not the fastest bus. Not the flashiest bus. The right bus. Last night was a reminder that being like Mike and subscribing to that truth still works. No one would’ve asked a guy drafted by the 2018 New York Jets if he’d become a Super Bowl champion—let alone one of the winningest players in the NFL over the past two seasons, including his time last year with the Minnesota Vikings. After stints with the Carolina Panthers and San Francisco 49ers (where he was a backup quarterback), Darnold finally became a free agent, and he chose well. And not just once. Twice. First, with his one year contract at Minnesota. Then his $100.5M contact with Seattle. Same Sam Darnold. Different environments. Different coaches. Different teammates. Different standards. The only real change? He consistently chose to run with winners. Until he won. 🏆 This isn’t just a sports lesson. It’s a life one. Your trajectory is shaped less by your raw talent and more by: • who you learn from • what you tolerate • what “normal” looks like around you Winning cultures don’t just raise performance—they rewrite belief. If you want better outcomes, ask a better question: 👉 Am I on the right bus? 👉 And, is so, where is it headed? Because, yes, of course, effort matters. And so does talent. But direction—and who you’re riding with—matters more than we like to admit. Choose wisely.

⏱️ millionaireME Minute | The Sword of Damocles (and Why So Many People Feel “Successful” but Unsafe) 🗡️

There’s an old Greek story about a man named Damocles. He admired the king’s life—power, wealth, luxury. From the outside, it looked perfect. So the king offered him a deal: “Sit in my seat for a day.” Damocles sat down to a feast…and then noticed a razor-sharp sword hanging inches above his head—held up by a single strand of hair. Suddenly, the food lost its flavor. The laughter stopped. The “dream life” felt terrifying. That sword? It’s become a metaphor for success without security. And today, many people are living right beneath it. • High income, but no margin • Nice lifestyle, but fragile cash flow • Big portfolio, but concentrated risk • Public wins, private anxiety • Applause on the outside, pressure on the inside Here’s the hard truth: 👉 If one unexpected event can ruin your peace, your system is brittle—even if it looks impressive. MillionaireME isn’t about avoiding ambition. It’s about removing the sword. That means: • Turning income into margin • Turning spending into ownership • Turning stress into systems • Turning “hoping it works” into knowing it holds Real wealth isn’t the size of the banquet. It’s whether you can enjoy the meal without checking the ceiling. So here’s your better question for today: What’s quietly hanging over your head—and what would it take to remove it? Because peace isn’t passive. It’s designed. And the goal isn’t more plates on the table. It’s fewer swords in the air. #millionaireMEMinute #WealthWithoutStress #MarginIsFreedom #UnleashYourInnerTBA 🐷🪽

2

0

⏱️ millionaireME Minute | Good News / Bad News… 📰

Let’s start with the bad news. If the current market were an airplane, the fasten seatbelt sign would be on. 👩✈️ Not because the plane is in trouble—but because the ride has gotten bumpier. Periods like this tend to test patience, conviction, and time horizons, especially for existing positions. 😑 Now the good news. Market turbulence often changes prices faster than it changes fundamentals. For those watching from the sidelines or steadily adding over time, i.e., dollar cost average practitioners like us, moments like this tend to create a wider spread between what things cost and what they may ultimately be worth. 😊 Historically, these environments have been less about prediction and more about perspective—distinguishing between assets that merely depreciate with use and those that compound value over time. No urgency. No calls to action. Just a reminder that volatility reshuffles opportunity in ways that calm markets rarely do. Fasten seatbelts. Stay curious. And fly. 🐷🪽

1

0

1-30 of 328

skool.com/millionaireme-marchforward

Encouraging and Celebrating One Another’s Success Journeys Toward Wealth and Wellness via Community, Coursework, and Collaborative Technology

Powered by