Write something

Forget Revenue: 5 Hard Truths About Cash Flow That Will Save Your Business

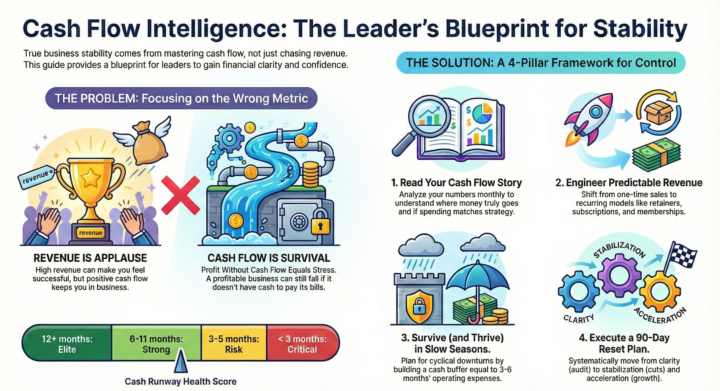

We’ve been conditioned to celebrate revenue. But revenue is applause. Cash flow is survival. A lot of businesses look “successful”… right up until they can’t breathe financially. If you want real peace, power and sustainability, here are 5 uncomfortable but freeing truths: 1- Revenue Is Applause. Cash Flow Is Oxygen. Profit doesn’t keep the lights on — cash does. Know your runway: - 12+ months = Elite - 6–11 months = Strong - 3–5 months = Risk - <3 months = 🚨 Crisis 2- Your Numbers Are Telling a Story. Start Listening. Do a 90-Day Lookback: - Total In vs Total Out - Identify leaks - Categorize spending: Must Spend | Should Spend | Nice To Have | Waste Your financial truth brings your next level of clarity. 3- Predictable Revenue Is Engineered, Not Discovered. Stability comes from: - Recurring revenue - Consistent pipeline - Strict collection discipline (Hope is not a strategy.) 4- Slow Seasons Aren’t Surprises. They’re Patterns. Smart leaders: - Study historical slow periods - Build cash buffers - Create evergreen + seasonal strategies Slow season panic is optional. 5- Financial Clarity Isn’t a Dream. It’s a 90-Day Plan. Clarity → Stabilization → Acceleration → Expansion With: - A 4-account banking system (1-Clarity, 2-Stabilization, 3-Acceleration & 4-Acceleration) - A weekly CFO ritual (1 hour, non-negotiable) Control is built, not wished for. Bottom Line Revenue impresses people. Cash flow protects leaders. Your business doesn’t need applause… it needs oxygen. 👇🏾 What is your cash flow currently telling you that revenue isn’t?

[NEW TRAINING ALERT] The Story of The Shade Room

I have an infatuation with studying how successful entrepreneurs rose to the height of their success. I think you will enjoy this one as much as I did. I'd like to introduce to some, maybe reintroduce to others Angelica "Angie" Wandu, the CEO and founder of The Shade Room, where she discusses the origins and tumultuous growth of her multi-million dollar black media empire. Wandu had a difficult childhood in Los Angeles, including the murder of her mother by her father and subsequent years in foster care, which instilled a fierce sense of hustle and resilience that she attributes partly to her Nigerian heritage. This is business case study was so compelling and powerful, I created a course for you... "FROM EVICTED TO MEDIA EMPIRE". Available NOW in CLASSROOM! Share your comments 👇🏽

![[NEW TRAINING ALERT] The Story of The Shade Room](https://assets.skool.com/f/c0c8bd9068c24effaa137c7e0afcac4f/7c6b52661b7a4fcf9a0217740a3891e4d2a296970a074f06b966197c997b0b0e-md.png)

How the Wealthy Actually Build Wealth (Not What School Taught You)

Most people are taught to chase income. Wealthy people chase ownership. That difference changes everything. Here’s the real game: 1. Income ≠ Wealth High income can still mean broke. Wealth = assets + cash flow + time. 2. Ownership is the cheat code Jobs pay once. Assets pay repeatedly. Businesses, equity, real estate, IP → that’s the focus. 3. Assets vs Liabilities Ask this before spending: 👉🏽 Does this put money in my pocket or take it out? If it only takes… it’s not helping you build wealth. 4. Debt isn’t bad — ignorance is Wealthy people use debt to buy income-producing assets. Average people use debt to buy stuff. 5. Taxes are planned, not reacted to The wealthy structure income before it’s earned. Most people just hope for a refund. 6. School trained employees, not owners Wealth education comes from: - Mentors - Experience - Books - Networks Not classrooms. 🔥 Action Steps (Start Today) => Track your net worth, not just income => Redirect ONE expense toward an asset => Study ONE asset class for the next 90 days => Invest before you spend => Ask better questions: “How can I structure this?” Community Question: What’s the first asset you’re focused on building or buying? Drop it below 👇🏽

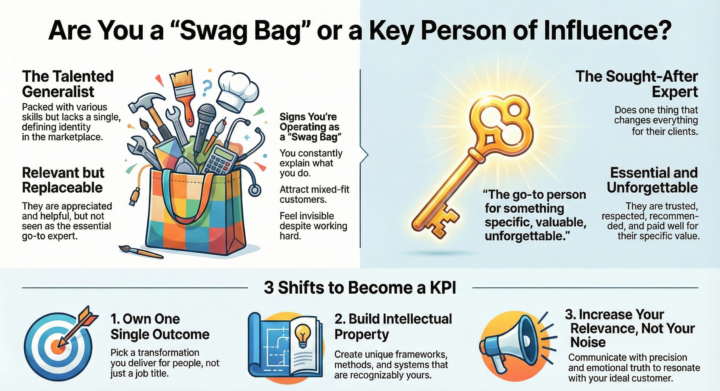

Are You a “Swag Bag”… or a Key Person of Influence?

4 Mindset Shifts Every High-Performer Must Make (in my opinion) A hard truth Dr. Fraser recently highlighted: Some people are planning for three generations…while others are planning for Saturday night. And that’s the same gap I see when I coach leaders. Many talented people are busy, helpful, skilled — and still invisible. Because they haven’t decided what they want to be known for. That’s the difference between a Swag Bag and a Key Person of Influence (KPI). A swag bag is full of random goodies. A KPI is the one essential solution. Which one are you acting like? Here are the 4 mindset shifts that move you from “busy but invisible” → “sought-after and essential”: 1. Being Helpful Isn’t Enough The “Swag Bag” does everything: Many lanes. Many talents. Many directions. But no identity. No core outcome. No message the marketplace can repeat. If you can’t explain what you do in one sentence… the marketplace won’t remember it in one minute. 2. Your Growth Is Your Ceiling Your business, brand, or career cannot outgrow you. No strategy or technique can compensate for a leader who isn’t developing. I shared this previously and I'll say it again: “The only way to maximize your profits is to maximize yourself.” Experts invest — in their mind, their clarity, their skills and their systems. 3. Focus Creates Influence Becoming a KPI requires deciding: “I’m the one for this.” Caesar, the boxing coach with 19 certifications, grew only after choosing his one idea. One class. One system. One offer. Result? Forty active members on day one. Ideas don’t change your future. Decisions do. 4. Build Systems, Not Just Skill A KPI turns their expertise into: Frameworks. Methods. Language. Solutions that are uncopiable. When your system has a name — your name — you become a category of one. The goal is not more noise. The goal is more relevance. You’re already talented. Already valuable. Already capable. Now the question is: What is the ONE transformational outcome you’re choosing to be known for?

Future Proofing- Opportunity And Access

This week, I had the honor of attending Hope Global Forum, this year’s theme Future Proofing! Jennifer Hudson moderated a dynamic panel. Personal credit is essential to business success. How do you know, if you don’t grow. Budgeting support and trust worthy guidance is more important today than ever. Let’s grow together! #FutureProofing

1-7 of 7

powered by

skool.com/leadership-on-demand-6981

Leadership On Demand is the premier community for faith-driven, visionary entrepreneurs seeking clarity, confidence, and purpose-led business growth.

Suggested communities

Powered by